APPENDIX 4

MARKET STUDY SUMMARY

As part of the Orange Avenue Corridor Specific Plan effort (formerly called Downtown Specific Plan), a Market Study with a demographic overview and evaluation of current conditions for commercial, residential, and hotel land uses within and around the Specific Plan area was prepared by Keyser Marston Associates (June 2002.) The reader is encouraged to read the entire Market Demand Study on file in the Community Development Department at City Hall. The following is a summary of the Market Demand Study.

|

MARKET OVERVIEW |

Introduction

This section identifies Coronado’s demographic trends; provides an overview of market conditions for retail, residential, office, and lodging; and includes KMA’s key observations on real estate market conditions; the City’s assets and constraints; and main factors affecting various land uses. The conclusions were reached through a process of interaction with stakeholders, City staff, and Navy service providers as well as through research and analysis of market conditions and economic trends.

Demographic Overview

Coronado has approximately 24,500 residents -- one-third are military personnel (8,100 persons) and two-thirds are civilians (16,400 persons.) Coronado’s overall demographic characteristics reflect an affluent non-ethnic community with high proportions of seniors/retirees and youthful military personnel. The following bullet points summarize demographic characteristics of Coronado’s combined military and civilian population, unless otherwise indicated.

• Population and Income

|

• |

Population growth declined slightly between 1990 and 2002 (-0.61%). |

|

• |

Over the next five years, population growth is expected to be relatively static (0.76% annually), adding about 950 persons by 2007. |

|

• |

Household incomes are strong -- approximately 69% of households have yearly incomes more than $50,000 and roughly 51% have incomes more than $75,000. |

|

• |

Per capita income (PCI) in 2002 was estimated at approximately $40,000, which is much higher than City of San Diego ($27,500) or the County ($26,400). |

|

• |

Coronado’s median household income in Coronado ($76,900) far outpaces the City ($54,833) and County ($56,039.) |

|

• |

If looking only at civilian census tracts, Coronado’s PCI rises by more than $11,000 to approximately $51,300, equating to an annual spending potential of $842 million. Median household income increases to nearly $81,000. |

• Age

Coronado is a mature community with many Seniors, and for the most part, Coronado’s age distribution is similar to age distributions in the City of San Diego and the County of San Diego. Notable exceptions include:

|

• |

Coronado has a lesser share of residents in the Under 20 Years age group, 20.5%, as compared with the City and County of San Diego at 27.3% and 28.7%, respectively. |

|

• |

Coronado’s share of 20-24 Year olds is much higher than the City of San Diego’s share and nearly double that of the County of San Diego. This is attributable to the large proportion of the military population within this age category. |

|

• |

Coronado has a higher proportion of seniors, aged 60 and above. This age segment represents nearly 20% of the City’s population, at least 5% higher than metropolitan or regional geographies. |

• Ethnicity

The resident population in Coronado is less ethnically diverse than in the City/County of San Diego. Whites are the predominant ethnic group comprising 83.8% of the population. Other Ethnicities, 7.1%; African Americans, 5.2%; and Asians, 4.0%. Approximately 10.3% indicate Hispanic heritage.

Many of these statistics change dramatically when the military census tracts are removed, as detailed below:

|

• |

Coronado’s civilian population becomes more elderly and even less ethnically diverse. |

|

• |

The median age rises from 34 years to 46 years. |

|

• |

The proportion of residents aged 20 to 24 years falls from 15.9% to just 3.6%. |

|

• |

The proportion of residents aged 45 and over increases from 35.3% to 51.4%. |

|

• |

The 60 and Over age category jumps from 19.1% of the population to 28.4%. |

|

• |

The proportion of ethnic residents declines from 16.3% to 6.90% and the percentage of Whites rises from 83.8% to 93.2%. |

Retail Market Overview

This section describes Coronado’s Commercial Zone, identifies year 2000 trends in retail sales (the most recent year for which complete data is available), and provides key retail findings and recommendations.

• Retail Market Districts

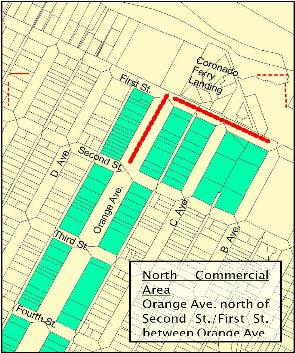

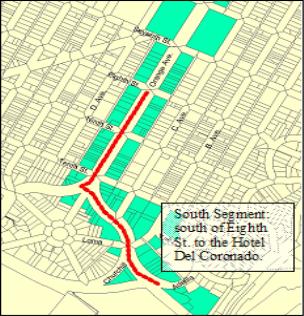

The retail concentration along the Orange Avenue Corridor is segmented into two main districts, north of Second Street and south of Eighth Street. The intervening blocks from Second Street to Eighth Street are dominated by dense rental housing, condominiums, and small hotels/motels.

North Commercial Area. The area north of Second St. is primarily restaurant anchored, including eating and drinking establishments and a grocery store. The north area’s retail mix includes approximately 39,000 SF of tourist-serving uses located at Coronado Ferry Landing, a tourist-oriented specialty retail center. Although the Ferry Landing is outside the Specific Plan boundary, its size and proximity influence the Specific Plan area.

Downtown Commercial Area. Most of the Plan area’s retail space is located along Orange Avenue, south of Eighth St. extending to the Hotel Del Coronado. The area is comprised of dense storefronts, generally narrow and deep in configuration, occupied by local-serving retail/commercial users. The Downtown retail segment is dominated by the following categories:

|

• |

Eating Places |

|

• |

Personal Services |

|

• |

Business Services |

|

• |

Tourist Serving |

The true core of the Coronado’s retail market lies in the area between Tenth St. and the Hotel Del Coronado. This area is characterized by a curving streetscape accented by unique architecture with historic character. A number of small retail centers, totaling more than 94,000 SF of retail space, are located on Orange Avenue between the southern terminus of C Avenue and the Hotel Del Coronado. The retail mix in the core is similar to that found throughout the remainder of the Orange Avenue corridor but introduces modest amounts of apparel, books, housewares, jewelry, and specialty retail shops.

The retail market is performing well at the current time. Lease rates are strong and vacancy is low throughout Downtown. However, the retail mix is slanted toward eating and drinking and business/personal service uses. Other retail categories are not well represented Downtown. Local residents appear willing to support business and personal service providers but exhibit price sensitivity on purchases of general merchandise and comparison goods, preferring to shop outside the City for these items.

• Retail Sales Trends

It is possible to estimate total retail sales for a given retail category based on the city’s population and the income characteristics and expenditure patterns in the region. Import of retail sales is assumed to occur when the actual level of retail sales in a given category exceeds potential retail expenditure. When potential retail expenditures exceed actual sales, export is evidenced. In such cases, it is assumed that Coronado residents are exporting a portion of their expenditure potential to other jurisdictions.

In 2000, Coronado’s retail sales potential amounted to approximately $269.5 million in the retail categories detailed below. Actual sales in 2000 were $95.6 million, leading to the conclusion that Coronado exported sales of approximately $173.9 million in 2000. Coronado exports sales in each retail category, excepting the Eating and Drinking category. Sales in the Eating and Drinking Category exceeded estimated expenditure in Coronado, totaling 135% of potential. This is due largely to the City’s strong tourism base.

The Specific Plan area should capitalize on its existing tourist base and strive to create a unique retail destination featuring upscale retailers and goods that appeals to both residents and visitors. The types of tenants representing the strongest potential to succeed in the Specific Plan area include restaurants; one-of-a-kind specialty retailers; upscale boutique retailers; and specialty food outlets such as Whole Foods or Trader Joes.

• Key Retail Findings and Recommendations

|

• |

Currently, Coronado’s economy is in equilibrium. The City’s actions to limit/restrict the introduction of chain retailers and national credit tenants and to forego active marketing campaigns in support of the tourist industry have not adversely affected the City’s economy or property values. |

|

• |

The City is exporting the vast majority of its retail sales potential out of the City. The most recent figures available indicate that Coronado is retaining only 35% of its sales potential. This is due in large part to the presence of the Navy Exchange at North Island Naval Air Station (NASNI) and an abundance of established discount retailers and super-regional malls on the mainland. |

|

• |

The City’s potential for attracting a large national discount retailer or general merchandise powerhouse is limited by: (a) small population base, (b) lack of available sites, (c) lack of access/visibility to freeway arterial, and (d) strong competition from Navy Exchange. |

|

• |

The Orange Avenue retail corridor should not attempt to compete with the Navy Exchange at North Island Naval Air Station (NASNI) to recapture General Merchandise sales. The scale of the Exchange and the deep discounts offered to active-duty and retired military personnel residing in Coronado cannot be overcome by the local business district. |

|

• |

The City should encourage businesses that contribute to create a unique retail environment oriented to one-of-a-kind upscale retail. An objective should be to retain local merchants and attract new merchants whose uniqueness will: (a) add to downtown’s ability to offer both merchandise and ambiance that is difficult to duplicate in most shopping centers and other downtowns, (b) help to establish and maintain Downtown Coronado as a significant destination retail location, and (c) serve the retail needs of local residents. |

|

• |

Service uses (e.g. plumbers, electricians, automotive, etc.) are not appropriate for Orange Avenue. Moreover, commercial lease rates in Downtown are unattractively high for such users. The City should seek to establish suitable locations elsewhere in the City. |

|

• |

The Village Theater should be revived to serve as an anchor for Downtown. It is thought that the single-screen theater can be supported by the local non-military population despite the presence of first-run movies at NASNI. However, finding an operator for a single screen movie theater may be difficult and expensive. |

Office Market

Coronado’s approximately 60,000 SF of office space is concentrated in the extreme southern portion of the Plan area, south of 10th Street. Slightly over 56,000 SF of office space is concentrated in three primary locations: California Plaza (33,000 SF), Eldorado Square (13,800 SF), and Coronado Plaza (9,500 SF.) Coronado’s office inventory also includes small amounts of second-story space that lacks amenities such as air conditioning, e.g., the Winchester Building and the Spreckels Building. There have been no new office buildings built in Coronado since the early 1980s when California Plaza and El Dorado Square were constructed.

Overall, the office market is healthy with relatively low vacancy throughout. There may be moderate demand for suites larger than 1,000 SF to serve tenants wishing to expand. This is evidenced in part by the instances of street level retail shop space being occupied by potential office users; however, this segment is dominated by real estate agents and financial service firms and is not considered a deep pool of prospective tenants. There is not a significant demand for new office buildings within the Plan area but the City should consider facilitating periodic infusions of office space in mixed-use buildings as warranted by market conditions.

Housing Market Overview

The majority of housing stock within the Plan area is concentrated between Second and Sixth Streets. It consists primarily of for-sale condominiums and rental properties in various multi-unit configurations. Plan area housing products vary widely with respect to age, style, density, and orientation to Orange Avenue.

There are very few detached housing units within the Plan area, however, attached housing values in the Orange Avenue corridor are strong at approximately $317/SF. The rental housing market is also quite strong and demand for units is high. According to local leasing agents, units within the Plan area are much sought after by prospective renters. Most units are one- and two-bedroom units, typically with 1 bath. Average rents for 2 BR/1 BA units range from $800 to $1,200 per month and 2 BR/ 2 BA units rent for between $1,000 and $1,300 per month. Reported vacancy within the Plan area is quoted as zero by local leasing agents. Three-bedroom units are rare and can rent for between $1,750 and $2,200 per month in proximity to the Plan area.

Lodging Market Overview

The City of Coronado is recognized as a world-class resort destination with the Hotel Del Coronado as its anchor. The majority of Coronado’s lodging properties are located along Orange Avenue or are close to the boundaries of the Plan area. According to estimates prepared by the Coronado Visitors Bureau, approximately one million visitors come to Coronado each year.

The lodging market is supported primarily by three main segments of the visitor market -- tourists, groups, and the military. The Hotel Del Coronado caters largely to groups and, to a lesser extent, tourists. The mid-market and economy lodging facilities are supported mainly by tourists and spill-over from the group market segment. The more affordable properties report that the military segment currently comprises about 50% of their business, as Coronado military installations have increased activity and personnel in relation to the events of 9/11 and ongoing overseas conflicts; however, this percentage has historically been lower.

Despite the high occupancy figures typically achieved in Coronado, the introduction of new room supply into Coronado is unlikely due to several limiting factors, including:

|

• |

Lack of encouragement from City government. |

|

• |

Lack of available sites |

|

• |

Numerous hotel projects planned for Downtown San Diego. |

|

• |

Slow population growth. |

Summary of Assets and Constraints that Affect Land Uses

This section summarizes the aspects of the Plan area and the City of Coronado that either support or constrain the market conditions affecting various land uses. The key assets and constraints are summarized as follows:

• Assets

|

• |

High Incomes – Household and per capita incomes in Coronado are very strong, as compared with comparable incomes for the San Diego region. These factors indicate that Coronado residents have above-average amounts of disposable income to spend on goods and services. |

|

• |

Strong Demand for Housing – The Plan area is surrounded by dense rental and multi-unit for-sale housing. The Orange Ave. corridor between Second St. and Seventh St. consists primarily of housing. Demand for units in the Plan area is very high and vacancy is practically non-existent with many property owners/managers maintaining lengthy waiting lists of applicants looking for Coronado housing. |

|

• |

Access/Views of the Ocean and Bay – Coronado offers visitors and residents excellent access to both San Diego Bay and the Pacific Ocean, each within almost a “stones throw” from the other. The narrow Coronado peninsula separates the tranquil bay from the crashing surf at the white-sand Coronado Beach, recently rated as the second-best beach in the country by the TravelChannel. Views of the water and the San Diego skyline are wonderful. |

|

• |

Hotel Del Coronado – The Hotel Del Coronado is recognized throughout the world as a landmark resort destination. Its one-of-a-kind historic architecture and location on Coronado’s white-sand beach have established the hotel as an anchor of not only Coronado’s lodging market but also of San Diego County’s lodging market. |

|

• |

Strong Military Presence – Coronado is home to two major military installations, the Naval Amphibious Base (NAB) and NASNI. The base-related workforce is estimated at approximately 35,000, inclusive of enlisted, officers, and civilian workers. Although the military bases provide top-quality on-base retail and services to enlisted and retired military personnel, spill-over demand from the military for services is a positive economic generator for the City. |

|

• |

Small-town Ambience – Despite its reputation as a major tourist destination and a key west-coast military installation, Coronado is a small town in terms of population. It has retained its small-town atmosphere by concentrating its commercial uses in a pedestrian-oriented corridor reminiscent of a time before malls when shopping was a pedestrian exercise concentrated in a business district. The Orange Avenue corridor’s small storefronts, wide sidewalks, and low buildings have preserved a small town ambience and an inviting pedestrian scale. |

• Constraints

|

• |

Small Population Base and Isolated Geography – Coronado’s population base is relatively small in comparison to other cities in the region. The City’s ability to compete for retail sales in a trade area beyond Coronado is hampered by is physical separation from San Diego/South Bay proper which, in turn, limits the City’s potential to attract a broad range of national retail tenants. The City’s population growth is stagnant and, at least with respect to retail sales potential, the enlisted and retired military personnel are considered absent because they primarily utilize on-base retail as opposed to Orange Ave. retailers. |

|

• |

Competition from On-base Retail – The only large format retailer in Coronado is the U.S. Military. The Navy Exchange at NASNI offers approximately 100,000 square feet of shopping comparable to a Wal-Mart or Target, inclusive of a food court and other amenities. The NASNI Exchange is the eighth largest Navy Exchange worldwide in terms of sales volume. The NAB offers an additional 20,000 square feet but does not provide the range of goods and services found at NASNI. Adjacent to the NASNI Exchange is a 48,000 SF Commissary. The NASNI Exchange offers a standard discount of approximately 17% before sales tax and the Commissary offers a 30% discount. Neither Exchanges nor Commissaries are subject to state or local sales tax regimes. |

|

• |

Competition from Established Nodes – Coronado faces stiff competition from the proliferation of regional malls in proximity to the City. Four regional malls offering nearly five million square feet of anchors stores and in-line space are located within seven miles (or within 25 minutes drive) of Downtown. |

|

• |

Limited Transportation Access – Vehicular access to Coronado is limited to Hwy. 75 from the south through Imperial Beach and the Coronado Cays and via the Coronado Bridge. Although these routes provide access through Imperial Beach/Coronado Cays from the south and from the City of San Diego to the east, it is not direct access to the Specific Plan area. This may limit the City’s chances of attracting national retail tenants. Also, the $1.00 toll to cross the Coronado Bridge was eliminated in the summer of 2002 and there now may be increased traffic volumes as a result. |

|

• |

Lack of Assemblage Opportunities – There are few vacant sites within the boundaries of the Plan area that can be combined to form larger development opportunities. Moreover, existing parcels tend to be narrow and deep, fronted by Orange Avenue and backed by multi-unit residential properties. |

|

• |

Limited Public Parking – Public parking in proximity to the Plan area is very limited. Although there are parking spaces available to the public, they are few in number and identifying signage is absent. Public parking is available in the northern segment of the Plan area at Coronado Ferry Landing and in the southern segment of the Plan area at Coronado Plaza and along Isabella Ave. |

|

• |

Disagreement Between City and Business – Many business and property owners expressed the opinion that the City is overly restrictive and un-supportive of the business community. Fair and consistent policies must be established and followed in order to overcome the skepticism regarding the objectives of City government. |