Chapter 3.62

PARKING AND BUSINESS IMPROVEMENT AREA

3.62.000 Chapter Contents

Sections:

3.62.010 Parking and Business Improvement Area Established.

3.62.020 Programs.

3.62.030 Levy of Special Assessments.

3.62.040 Rate Changes.

3.62.050 Deposit of Revenues.

3.62.060 Collection Schedule.

3.62.070 Delinquent Payments.

3.62.080 Notices.

3.62.090 Disputes.

3.62.100 Expenditures.

3.62.110 Administration.

3.62.120 Contract for Program Management.

3.62.130 Advisory Board.

3.62.140 Bids Required for Construction of Projects.

3.62.150 Commencement of Assessments.

3.62.160 Ratification and Confirmation.

(Ord. 6721 §1, 2010; Ord. 6375 §1-17, 2005, this chapter added July 2008).

3.62.010 Parking and Business Improvement Area Established

As authorized by Chapter 35.87A RCW, there is hereby established a Parking and Business Improvement Area ("Parking and Business Improvement Area" or "PBIA"), consisting of Zones A, B and C, within the boundaries as described below and shown on the map attached hereto as Exhibit A-1. If there is any conflict between said map and narrative description, the text shall prevail.

ZONE A:

All of that portion of the City of Olympia, Washington described as bounded on the North by the centerline of State Avenue, bounded on the South by the centerline of Legion Way, bounded on the West by the centerline of Columbia Street, and bounded on the East by the centerline of Franklin Street.

ZONE B:

All of that portion of the City of Olympia, Washington described as beginning at the centerline intersection of Water Street and 7th Avenue; thence West to the ordinary high water line of Capitol Lake; thence Northerly and Westerly along said line to the East line of the Deschutes Waterway as shown on the official First Class Tideland Plat of the City of Olympia; thence Northerly along said waterway and its extension to the centerline of Olympia Avenue extended Westerly; thence Easterly along said extension to the line of ordinary high tide; thence Northerly along said line to the centerline of Thurston Avenue extended Westerly; thence Easterly along said extension and the centerline of Thurston Avenue to the centerline of Jefferson Street; thence Southerly along said centerline to the centerline of Olympia Avenue; thence Easterly along the centerline, as platted, of said street to a point 150 feet more or less Westerly of the centerline intersection of Pear Street and Olympia Avenue; thence Southerly more or less parallel to Pear Street, said course following original platted lot lines, to the centerline of 7th Avenue; thence Westerly along said centerline to the point of beginning; EXCEPTING, the area described in Zone A above.

ZONE C:

All of that portion of the City of Olympia, Washington described as beginning at the centerline intersection of Columbia Avenue and Union Avenue; thence Northerly along the centerline of Columbia Avenue to the centerline of 7th Avenue; thence Easterly along said centerline to the centerline of Washington Street; thence Southerly along said centerline to the centerline of Union Ave; thence Westerly along said centerline to the point of beginning; ALSO, All of that portion of the City of Olympia, Washington described as beginning at the line of ordinary high tide with to the centerline of Thurston Avenue extended westerly; thence Northerly along said high tide line to a point 600 feet Northerly of the centerline of Corky Avenue extended Westerly; thence Easterly and parallel to Corky Avenue and its extension to the centerline of East Bay Drive; thence Southerly along said centerline to the centerline of Olympia Avenue; thence Westerly along said centerline to the centerline of Jefferson Street; thence Northerly along said centerline to the centerline of Thurston Avenue; thence Westerly along said centerline and its extension to the point of beginning.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §1, 2005).

3.62.020 Programs

Special Assessment revenues shall be used for the purpose of providing special projects and services under the following program headings:

1) Downtown Parking Improvements Program

This program will provide for parking improvements to address the concern for downtown Olympia businesses and property owners, as well as patrons and employees. The PBIA special assessments may be used to fund administrative costs such as staff support, the construction or operation and maintenance of a parking structure or other parking improvements.

2) Clean and Safe Program

This program will provide additional projects and services to make downtown cleaner, more welcoming and improve the public’s perception of safety. This program may include a volunteer effort to provide eyes and ears on the street and to assist people downtown; administration and staff support; graffiti removal; and efforts to reduce offenses such as public urination, drug use and sales, aggressive panhandling and public intoxication.

3) Civic Beautification and Sign Program

An overall beautification program will help the general aesthetic of downtown. Such a program may include:

a) Streetscape beautification

b) Area-wide Paint Up, Fix Up, Clean Up Campaign

c) Public arts programs

d) Public/private way finding signs

e) Administration and staff support

4) Business Recruitment and Retention Program

Preparation of inventories of commercial vacancies, information about incentives and benefits to locating downtown and development of a common vision for the types of businesses and other organizations would enhance the downtown. Inventory information will facilitate development of specific recruitment and retention strategies for different parts of downtown. Inventories may include:

a) Community preference surveys

b) Inventory of vacancies

c) Advertising vacancies

Administration and staff support to prepare the inventories is included.

5) Commercial Marketing Program

Development of a well-conceived "Buy Local" marketing program that will benefit the whole downtown and to continue the support of long-standing community events through:

a) Advertising and promotion

b) Theme development

c) Special events and activities

d) Tourism attraction

Other existing programs may be reviewed for supplementation with PBIA special assessments, including but not limited to:

a) Community events held downtown including Music in the Park, ArtsWalk, Downtown for the Holidays, PRIDE, and the Pet Parade;

b) Marketing programs including the shopping and restaurant guide, and event management or support;

c) Programs to clean up downtown that include the semi-annual clean-ups, graffiti management, and mural programs.

d) Programs to develop partnerships for local governments, quasi-public and non-profit groups that work in or invest resources in downtown on behalf of the public.

Administration and staff support will be included in the programs and projects listed above.

The list of possible services and projects within the general program categories above is illustrative and not exclusive. The costs are estimated only and the PBIA budget shall be established by City Council and expended based on actual receipts, as set forth in Section 10 below.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6578 §1, 2008; Ord. 6375 §2, 2005).

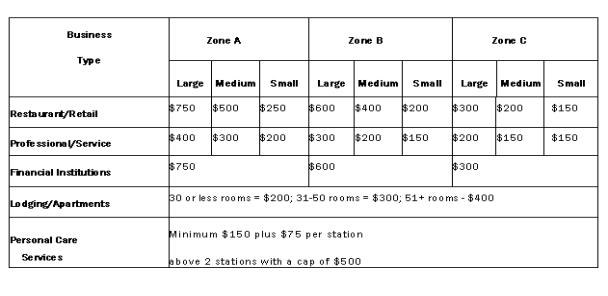

3.62.030 Levy of Special Assessments

To finance the programs authorized in OMC 3.62.020, and in recognition of the special benefits created thereby, a special assessment is hereby levied upon and shall be collected annually from all the businesses and multi-family residence owners / operators ("Ratepayers") in the Parking and Business Improvement Area described in OMC 3.62.010, as authorized by RCW 35.87A.080, except non-profit corporations or organizations. Assessments shall not be pro-rated. The special assessments shall be levied upon the Ratepayers in Zones A, B and C according to the rates established as follows:

Definitions:

Business. Means any person, group or entity, including but not limited to a sole proprietorship, partnership, corporation, limited liability partnership or limited liability corporation, that engages in business with the object of gain, benefit, or advantage to the person, group or entity, or to another person or class, directly or indirectly. "Engages in business" as used herein shall have the meaning set forth in Olympia Municipal Code Section 5.04.040.N.

Employee. Any person whose work is devoted to the ongoing operation of a business or multi-family residence. As used in this ordinance, "Employee" includes a person with an ownership interest in a business, regardless of whether that person is paid a salary or wages.

Financial Institution. Means a bank, savings and loan, credit union, or similar institution.

Full-Time Equivalent (FTE). A position or positions requiring work equal to or exceeding forty (40) hours per week.

Large // Medium // Small. Based on employee count: FTE’s (Full time Equivalent)

|

• |

Small 1-3 FTE’s |

|

• |

Medium 4-6 FTE’s |

|

• |

Large 7+ FTE’s |

Lodging. Means engaging in the business defined in OMC Section 5.04.040.MM.3.f. Examples include the rental of rooms by the day or week to community visitors. "Lodging" also means the rental or lease of a residential dwelling unit, if such unit is contained within any building or buildings containing four (4) or more residential units or any combination of residential and commercial units, whether title to the entire property is held in single or undivided ownership or title to individual units is held by owners who also, directly or indirectly through an association, own real property in common with the other unit owners.

Non-profit corporation or non-profit organization. "Non-profit corporation or non-profit organization" means a corporation or organization in which no part of the income can be distributed to its members, directors, or officers and that holds a current tax exempt status as provided under Sec. 501(c)(3) of the Internal Revenue Code, as may hereafter be amended, or is specifically exempted from the requirement to apply for its tax exempt status under Sec. 501(c)(3) of the Internal Revenue Code, or as may hereafter be amended. Where the term "non-profit organization" is used, it is meant to include non-profit corporations.

Personal Care Service Business. Means a hair salon, barber shop, manicurist, tanning salon, acupuncturist, massage therapist, esthetician, exercise studio, yoga studio, Pilates studio, soothsayer, and the like.

Professional Services Businesses. Means Architects, Engineers, Attorneys, Dentists, Doctors, Accountants, Optometrists, Realtors, Insurance Offices, Mortgage Brokers and most other businesses that require advanced and/or specialized licenses and/or advanced academic degrees.

Restaurant. Means a business that sells prepared foods and drinks.

Retail. Means a business that engages in sales at retail and / or retail sales, as those terms are defined in Olympia Municipal Code Section 5.04.040.MM.1.a and .1.c - .1e, but does not include the provision of any services. "Retail" includes, as an example, the buying and reselling of goods, such as that engaged in by clothing stores, shoe stores, office supplies, etc.

Service Business. Means a business that engages in retail services, as that term is defined in Olympia Municipal Code Section 5.04.040.JJ, or engages in the activities set forth in OMC 5.04.040.MM.1.b, MM.2, MM.3a - e, MM.4, and MM.6-7. Examples include repair shops, automotive-oriented service businesses, computer repair and support, tech support services, entertainment businesses such as theaters, etc.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6691 §1, 2010; Ord. 6375 §3, 2005).

3.62.040 Rate Changes

Changes in the assessment rate shall only be made by ordinance adopted by the Olympia City Council and as authorized in RCW 35.87A.140.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §4, 2005).

3.62.050 Deposit of Revenues

There is hereby created in the City a separate subaccount designated as the Parking Business Improvement Area Account (called "the Account"). The following monies shall be deposited in the Account:

A. All revenues from special assessments levied under this ordinance;

B. All income to the City from public events financed with special assessments;

C. Gifts, donations and voluntary assessment payments for the Account; and

D. Interest and all other income from the investment of Account deposits.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §5, 2005).

3.62.060 Collection Schedule

Special assessments shall be collected on an annual basis.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §6, 2005).

3.62.070 Delinquent Payments

If an assessment has not been paid within thirty (30) days after its due date, it will be considered delinquent. The City Manager or their designee is authorized to assign delinquent assessments to a collection agency or bring an action in any court of competent jurisdiction.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §7, 2005).

3.62.080 Notices

Notices of assessment and all other notices contemplated by this ordinance may be sent by ordinary mail or delivered by the City to the address shown on City of Olympia records, as they may be modified from time to time based on information provided by the Program Manager (if any). Failure of the Ratepayer to receive any mailed notice shall not release the Ratepayer from the duty to pay the assessment and any collection agency charges.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §8, 2005).

3.62.090 Disputes

Any Ratepayer aggrieved by the amount of an assessment may appeal the City’s rate classification to the City Manager or the City Manager’s designee for review. The City Manager or the City Manager’s designee may uphold the assessment or adjust the assessment consistent with this ordinance. The City Manager’s or the City Manager’s designee’s decision shall be final and not appealable to any court or body. The appellant Ratepayer has the burden of proof to show that the assessment is inconsistent with the applicable assessment fee provided for herein.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 7187 §3, 2019; Ord. 6721 §1, 2010; Ord. 6691 §2, 2010; Ord. 6375 §9, 2005).

3.62.100 Expenditures

Expenditures from the Account shall be made upon vouchers drawn for services rendered and shall be used exclusively for the statutory purposes each as more fully defined in Section 2. Pursuant to RCW 35.87A.110, the City Council shall have the sole discretion and authority to adopt a work program and budget for expenditures from the Account at such times as the Council may determine.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §10, 2005).

3.62.110 Administration

The City Manager or the City Manager’s designee shall administer the program for the City with authority to:

A. Classify Ratepayers within the three zones under Sections 1 and 3. As part of this classification, the City Manager or designee is authorized to make a determination of the number of regular FTEs employed by a Ratepayer prior to issuing assessment notices each calendar year. The classification and FTE determination shall be based on information from City of Olympia records as they may be modified from time to time based on information provided by the Program Manager (if any);

B. Collect the special assessments; and

C. Upon Council approval, execute an annual program management contract with a Program Manager.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 7187 §3, 2019; Ord. 6721 §1, 2010; Ord. 6375 §11, 2005).

3.62.120 Contract for Program Management

Pursuant to RCW 35.87A.110, the City Manager or designee may contract with a chamber of commerce or similar business association entity or entities operating within the boundaries of the PBIA to act as a Program Manager. The Program Manager shall administer the PBIA’s operation, including but not limited to implementation of the projects and activities contained in the work program adopted by the City Council under OMC 3.62.020, performing the administrative duties allocated to the City Manager or the City Manager’s designee under this Chapter.

Any contract entered into under this Section shall include provisions to address the following:

A. Provisions for the Program Manager to:

1. Create and maintain a business data base of all Ratepayers within the boundaries of the PBIA;

2. Classify each Ratepayer within each of the three zones, based on the number of regular FTEs for each Ratepayer;

3. Provide the data base and classifications to the City in sufficient time for its use in mailing annual special assessment notices, but no later than November 1 of each calendar year;

4. Perform all basic Municipal Services Contract provisions (periodic billing and reporting requirements, internal controls and maintain accurate records, etc.);

5. Perform the projects and services listed in Section 020 as approved annually by the City Council pursuant to Subsection B.2 below;

6. Submit reimbursement request on vouchers drawn for services rendered (consistent with the Council adopted budget and work program for that calendar year);

7. Provide administrative support for the creation and operation of the PBIA Advisory Board created pursuant to Section 13 below, including soliciting nominations and conducting an election for Board representatives.

B. Provisions for the CITY to:

1. Review the PBIA Advisory Board’s annual proposed budget recommendations for special services and projects;

2. Adopt a work program and budget for expenditures;

3. Send a bill to each business within the boundary on an annual basis based on the assessment list provided by the Program Manager;

4. Resolve Ratepayer disputes;

5. Collect special assessments;

6. Pursue collection by sending the bill to a collection agency or commencing an action in a court of competent jurisdiction to collect the special assessment;

7. Review and reimburse eligible expenses; and

8. Conduct periodic review of the Program Manager’s performance.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 7187 §3, 2019; Ord. 6721 §1, 2010; Ord. 6691 §3, 2010; Ord. 6375 §12, 2005).

3.62.130 Advisory Board

There is hereby created an advisory board to the Olympia City Council. The Board shall consist of an odd number totaling at least 11 member representatives of Ratepayers representing a diversity of business classifications, interests, and viewpoints within the PBIA. Board members shall be elected by a majority of Ratepayers within the PBIA voting in an election conducted by the Program Manager under Section 12 above. The Council may also appoint a nonvoting Council member representative and/or City staff liaison. The Board’s duties shall include the annual development of a proposed work program with specific projects and budgets and the recommendation of the same to the City Council for its consideration, and preparation of a plan for regular communication of PBIA projects and information to Ratepayers, including specific provisions for communication with non-English speaking Ratepayers and other projects and activities as approved by the City Council in the Board’s annual work plan.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6578 §2, 2008; Ord. 6375 §13, 2005).

3.62.140 Bids Required for Construction of Projects

Pursuant to RCW 35.87A.200, the City Manager and/or the Program Manager utilized under Section 12 above shall call for competitive bids by appropriate public notice and award contracts, whenever the estimated cost of any Parking and Business Improvement Area public works construction project, including cost of materials, supplies and equipment, exceeds the sum of two thousand five hundred dollars. Pursuant to RCW 35.87A.210, the cost of a public works construction project for the purposes of this Section shall be aggregate of all amounts to be paid for the labor, materials and equipment on one continuous or inter-related project where work is to be performed simultaneously or in near sequence.

Breaking a public works construction project into small units for the purposes of avoiding the minimum dollar amount prescribed herein is contrary to public policy and is prohibited.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §14, 2005).

3.62.150 Commencement of Assessments

Assessments shall commence as of January 1, 2006 for all existing businesses located within the assessment area depicted in Section 1 above. Any new business or multi-family residence commencing operation within the boundaries of the PBIA after November 1 of any given year shall be exempt from payment of the assessment until November 1 following the business’ or multi-family residence’s commencement of operation; provided, that no exemption under this section have a duration of longer than one year. Such a business or multi-family residence shall be assessed the January 1 following commencement of its operation. Assessments shall not be prorated.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §15, 2005).

3.62.160 Ratification and Confirmation

The making of contracts and expenditures and the sending of assessment notices pursuant to the authority and prior to the effective date of this ordinance are hereby ratified and confirmed.

(Ord. 7296 §1, 2021; Ord. 7250 §3, 2020; Ord. 6721 §1, 2010; Ord. 6375 §17, 2005. Formerly 3.62.170).