Chapter 11 - Paying for the Plan

This chapter describes the current finances of the Wastewater Utility as well as summarizes the financial policies and funding needed to implement the Plan. The detailed financial report by the City's financial consultant, Financial Consulting Solutions Group (FCSG), is presented in Appendix H.

The Utility finances the infrastructure improvements and planning and program implementation services described in the Plan. Finances are managed separately for operations and capital improvements. Most revenue is from monthly rates charged to customers and general facilities charges (GFCs) charged for new sewer connections.

11.1 Revenue and Expenses

Revenue primarily comes from monthly rates and funds staffing and administrative expenses, capital projects, taxes, and depreciation and amortization of capital assets. Rate revenue increased from $16.28 million in 2013 to $19.81 million in 2018. About two-thirds of this revenue is the rate charged by LOTT Clean Water Alliance (LOTT) for wastewater treatment services. This LOTT revenue is collected by the City through monthly charges and is passed through to LOTT. GFCs supplement the capital budget.

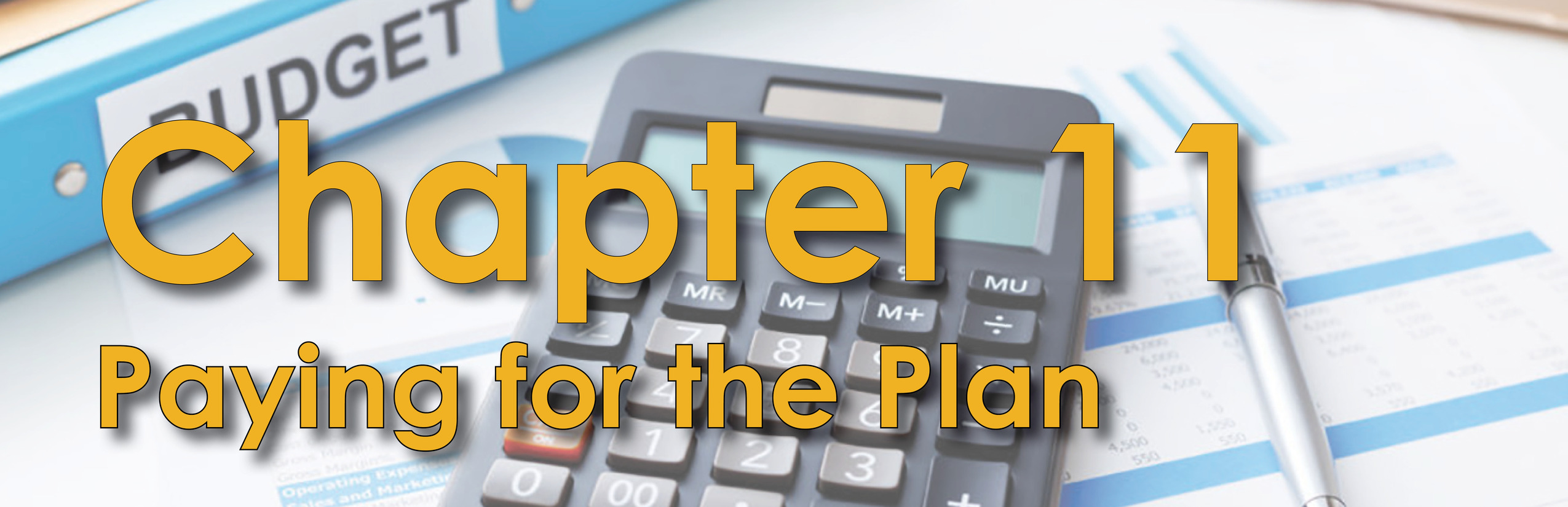

Figure 11.1 illustrates the amounts generated from Utility rates and GFCs in 2018, excluding the $12.7 million in 2018 revenues the City collected for LOTT.

For the 2018 Utility expenses, approximately 38 percent of the Utility's costs were attributable to capital projects and debt-service; the remaining 62 percent supported operations and administration expenses. The City's six-year Capital Facilities Plan (CFP) is updated each year by City Council. The CFP includes the capital projects identified in Chapter 10

11.2 Assets and Liabilities

The Utility maintains a balance sheet of current and long-term assets and liabilities. Between 2013 and 2018, total assets increased from $49.5 million to $52.5 million. Current and long-term liabilities decreased from $9.06 million to $6.8 million. As of 2018, the City's long-term debt was $6.2 million from two bonds, a Public Works Trust Fund loan, and a State Revolving Fund loan.

View Figure 11.1 Categories of Utility Revenue, 2018

11.3 Rates and Rate Structure

The Utility's rate structure for all customers is based on equivalent residential units (ERUs). The ERU is based on the wastewater, also known as sewage, generated from residential and commercial sources. See Section 2.3, Wastewater Flows, in Chapter 2 for an explanation of how the ERU is calculated. See table 11.1 for the number of wastewater accounts by customer class.

The 2019 Utility rate for single-family customers is $13.29 to $21.47 per ERU per month. Gravity sewer, STEP system and community onsite sewage system customers pay the same monthly rate. In addition, the City collects monthly rates of $39.80 per ERU, which is paid to LOTT for wastewater treatment services. See Appendix H for additional details on current rates, including for commercial and multi-family customers.

The Utility collects general facility charges (GFCs) from new developments. These charges are one-time fees that recover a proportionate share of the costs associated with existing and planned Utility infrastructure from newcomers to the City's wastewater system. Its purpose is to promote equity between existing and future customers. The GFC establishes a pro rata share of capitalized system costs attributable to new development and imposes that cost as a condition of service. The current wastewater GFC is $3,442 per ERU. While revenue generated by GFCs varies appreciably from year to year, annual revenues averaged approximately $1.4 million over the past five years (2014-2018).

|

Residential |

14,414 |

|---|---|

|

Multi-Family |

755 |

|

Commercial |

1,355 |

|

Government |

132 |

|

TOTAL |

16,656 |

11.4 Financial Policies

As an enterprise fund, the Utility is fully self-sufficient, relying solely on its own revenues for financial viability. The consultant's analysis of the Utility's ability to fund the Plan is based on a set of fiscal policies that define the City's minimum financial criteria. These fiscal policies relate to cash management, capital funding strategy, financial performance and rate equity.

Cash Management

The City's policy is to maintain working capital and other reserves consistent with possible fluctuation in revenues and expenditures. Historically, the Utility's standard is to maintain a minimum operating fund balance equal to 10 percent of annual operating expenses (excluding payments to LOTT as a "pass-through" of revenue derived from LOTT's monthly rate). In addition, a capital contingency reserve equal to 5 percent of active capital appropriations is maintained in case of capital cost overruns or acceleration of capital expenditures.

It is worth noting that a change to a tiered flat-rate structure based on water usage for residential customers implemented in 2016 increased the volatility of Utility revenues. The primary reason for the increase in revenue volatility is that residential customers could choose to conserve water, thereby falling into a lower rate tier. In the two years since the volume-based rates were implemented, utility revenue has been at or above projected levels. However, an especially cool and wet summer could increase the number of customers at the lowest tier, decreasing revenue below projections.

Capital Funding Strategy

The City has two basic policies associated with providing ongoing capital funding resources:

• To require an equitable financial contribution from all new development; this requirement is met through the GFC. GFC revenues are used first to pay current Utility debt service payments, and second as a source of cash funding for future capital projects.

• To require existing ratepayers to support the City’s full cost of providing service, including annual depreciation expense on Utility assets. Though depreciation is not a cash expense per se, the City uses depreciation expense as a basis for funding capital re-investment in the system. To avoid charging customers for the future replacement of assets that they are concurrently paying for through the debt service component of rates, the City’s capital re-investment policy determines annual funding levels by deducting current debt principal payments from depreciation expense in the useful life of the infrastructure. This approach does not ensure full cash funding of system replacements but is a common way to equitably charge current customers for use and decline of the system. It provides a major source of capital re-investment, which can be augmented with use of debt financing.

Financial Performance

These policies include the requirement to maintain a balanced budget, to meet minimum reserve requirements and to set rates to ensure payment of annual debt service for revenue bonds.

11.5 Paying for the Plan

Implementation of the Plan will increase the average annual CFP funding from approximately $1.5 million to $3.9 million. Capital expenditures will total $23.9 million between 2020 and 2025. Debt financing of a portion of these costs is not anticipated.

The financial analysis established a hierarchy of capital funding:

• First using available cash and investment resources; existing capital fund balances are used to directly fund project costs.

• Second, use Utility equity resources – ongoing revenue from GFCs to directly fund project costs.

The following rates will fund Plan implementation:

• Monthly City Wastewater Utility Rates: Annual rate revenue increases of 4.5 percent from 2020 – 2024.

• Increased GFC. An increase of 45 percent from $3,442.00 to $4,999.00 per ERU, to reflect the current pro rata share of system costs

11.6 Comparison of LOTT and Olympia’s Budget Categories

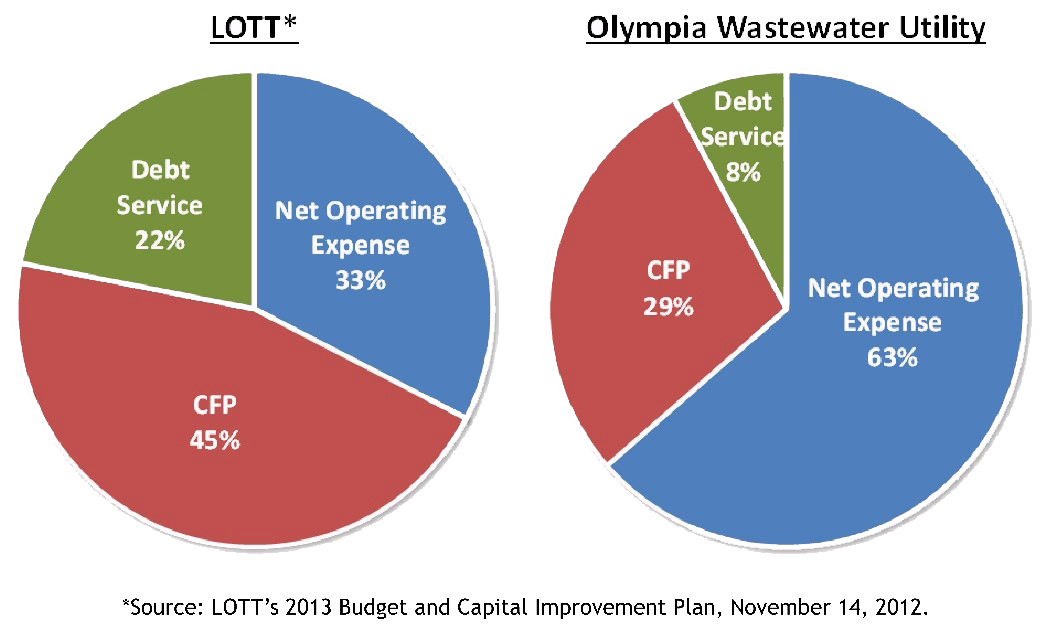

Implementation of the Plan is reflected in three budget categories: (1) net operating expense, (2) debt service (bonds and loans), and (3) capital facilities plan expense. Figure 11.2 shows this cost breakdown for each entity, for a two-year period.

The pie charts in Figure 11.2 indicate that LOTT's budget is capital project-intensive, while the City's Wastewater Utility budget is operations and maintenance-intensive. LOTT is responsible for funding the network of infrastructure that comprises the regional treatment and transmission system. The City's Wastewater Utility budget, by contrast, is smaller in scale and funds a variety of annual operating costs including taxes, interfund transfers, and City overhead in addition to more labor-intensive functions such as field work and customer service.