Chapter 3.39

TRANSPORTATION IMPACT FEES

Sections:

3.39.070 Transportation impact fee fund established.

3.39.085 Computation of transportation fee amount.

3.39.090 Impact fee determination and collection.

3.39.100 Impact fee adjustments, independent calculations.

3.39.130 Appeals and payments under protest.

3.39.140 Council review of impact fees.

3.39.010 Purpose.

This chapter is intended to:

(1) Assist in the implementation of the Comprehensive Plan for the City of Woodinville.

(2) Ensure that those public facilities and services necessary to support development shall be adequate to serve the development at the time the development is available for occupancy and use, or shortly thereafter, without decreasing current service levels below established minimum standards for the City.

(3) Establish standards and procedures so that new development pays a proportionate share of costs for new facilities and services and does not pay arbitrary or duplicative fees for the same impact. (Ord. 527 § 1, 2012)

3.39.020 Authority.

(1) This chapter is enacted pursuant to the Washington State Growth Management Act codified at Chapter 36.70A RCW and at RCW 82.02.050 to 82.02.100.

(2) The City has conducted studies documenting costs and demand for new facilities and services. These studies are included in the City’s Transportation Master Plan, as may be amended and adopted, from time to time, by the City Council; and are hereby incorporated into this chapter by reference as if set forth in full. The City of Woodinville Comprehensive Plan is also incorporated into this chapter by reference. (Ord. 527 § 1, 2012)

3.39.030 Definitions.

(1) Dwelling Unit. See definition in WMC 21.11A.050.

(2) “Encumber” means to transfer impact fee dollars from the transportation impact fee fund to a fund for a particular system improvement that is fully within the current year’s budget. Funds may only be encumbered by an action of the City Council. The fund encumbering the impact fee dollars shall bear the name of the system improvement financed with such money.

(3) “Project improvements” means site improvements and facilities that are planned and designed to provide service for a particular development project and that are necessary for the use and convenience of the occupants or users of the project, and are not system improvements. No improvement or facility included in the City’s Transportation Facilities Plan or Transportation Improvement Plan approved by the City Council shall be considered a project improvement. Project improvements are also improvements to the City’s transportation system, directly adjoining property being developed, that are required in order to mitigate the direct impacts caused by the development such as frontage improvements, are considered part of and within the definition of project improvements.

(4) “Public facilities” for the purpose of this chapter means public transportation facilities and includes motorized and nonmotorized transportation facilities owned or operated by the City.

(5) “System improvements” means public facilities that are included in the City’s Capital Facilities Plan and are designed to provide service to the community at large, in contrast to project improvements. (Ord. 737 § 9, 2022; Ord. 712 § 1, 2020; Ord. 527 § 1, 2012)

3.39.040 Applicability.

All persons receiving building permits for the following within the City of Woodinville after the effective date of the ordinance codified in this chapter shall be required to pay traffic impact fees in an amount and manner set forth in this chapter:

(1) New single detached dwelling unit.

(2) New multifamily dwelling units including:

(a) Apartments.

(b) Duplexes.

(c) Townhomes.

(d) Senior citizen assisted units.

(3) New commercial buildings.

(4) New industrial buildings.

(5) New retail buildings.

(6) Expansion of any commercial, retail or industrial building for the amount of expansion area and use only.

(7) Expansion or remodeling of any multifamily housing that results in additional dwelling units being created for the number of additional dwelling units being created only.

(8) Change of use inside of any commercial, retail, industrial, or multifamily building that results in a predicted amount of traffic being generated greater than the previous use unless exempt under WMC 3.39.050. The impact fee amount will only be calculated for the increase in predicted traffic volumes. (Ord. 527 § 1, 2012)

3.39.050 Exemptions.

The following development activities are exempt from paying transportation impact fees because they do not have a measurable impact on the City’s transportation facilities, or because the City has chosen to exempt them pursuant to RCW 82.02.060(2), as development with broad public purposes.

(1) Existing Dwelling Unit. Any alteration, expansion, reconstruction, remodeling or replacement of existing single-family or multifamily dwelling units that does not result in the creation of additional dwelling units.

(2) Development activities for retail, commercial, and industrial buildings if all the listed conditions below are met:

(a) The proposed development does not add to the footprint, internal floor area, floors and/or mezzanines to the existing building;

(b) The proposed development does not generate any additional predicted average daily trips as calculated pursuant to WMC 3.39.090; and

(c) The proposed development is an internal alteration/tenant improvement of an existing building. (Ord. 668 § 1, 2018; Ord. 630 § 2, 2016; Ord. 527 § 1, 2012)

3.39.060 Service area.

The service area for the existing and proposed public transportation facilities is defined as that area which is coextensive with the corporate boundaries of the City, as they now exist or as they may be amended through annexation or other means from time to time. (Ord. 527 § 1, 2012)

3.39.070 Transportation impact fee fund established.

(1) A special purpose transportation impact fee fund is hereby established to account for the receipt and expenditure of monies collected under this chapter. All transportation impact fees and any investment income generated by such fees shall be deposited and monitored in the transportation impact fee fund. Any monies collected and unexpended before the effective date of the ordinance codified in this chapter shall be combined into one transportation impact fee fund and no separate accounting shall be required in the future for these monies.

(2) Procedures for administration of the fund and accounts shall be established by the Finance Director. These accounts shall be expended in accordance with the City’s normal budget procedures subject to the limitations set forth in WMC 3.39.080 and RCW 82.02.070. Annually, the City shall prepare a report on the impact fee fund showing the source and amount of all moneys collected, interest earned, and system improvements that were financed in whole or in part by these impact fees. (Ord. 527 § 1, 2012)

3.39.080 Use of funds.

(1) Transportation impact fees shall be used for development of transportation facilities that constitute system improvements.

(2) Impact fees may be spent on the following items to the extent that they directly relate to a particular system improvement: facility planning, land acquisition, site improvements, necessary off-site improvements, facility construction, facility engineering and design work, facility permit fees, facility financing, grant-matching funds, applicable mitigation costs, capital equipment pertaining to a particular system improvement, and any other capital costs related to a particular system improvement, including but not limited to signalization, traffic safety, and nonmotorized transportation improvements.

(3) Impact fees may also be used to recoup transportation facility improvement costs previously incurred by the City to the extent that new growth and development will be served by the previously acquired or constructed improvements resulting in such costs.

(4) In the event that bonds or similar debt instruments are or have been issued for the construction of public facility or system improvements for which impact fees may be expended, impact fees may be used to pay debt service on such bonds or similar debt instruments to the extent that the facilities or improvements provided are consistent with the requirements of this chapter and are used to serve new development. The Transportation Improvement Plan and Transportation Facilities Plan should distinguish between facilities and funds needed to serve new development and those facilities and funds needed to correct existing deficiencies.

(5) Projects that are classified as system improvement projects, that are eligible for partial or full funding by transportation impact fees are listed with their estimated costs in Exhibit B.

|

Project Name (1) |

All Capacity Improvements Projects (2) |

Proposed Systems Improvement Projects for TIF (3) |

||

|---|---|---|---|---|

|

Trestle Replacement |

$ |

8,030,000 |

$ |

8,030,000 |

|

Sammamish River Bridge |

$ |

6,490,000 |

$ |

6,490,000 |

|

SR 522/195th Street Interchange – Interim |

$ |

750,000 |

$ |

– |

|

Woodinville-Snohomish Road Widening |

$ |

18,100,000 |

$ |

18,100,000 |

|

SR 522/195th Street Interchange – Full Interchange |

$ |

32,500,000 |

$ |

– |

|

135th Ave Grid Road 171st to LBC |

$ |

6,028,000 |

$ |

6,028,000 |

|

173rd Grid Road |

$ |

2,118,000 |

$ |

2,118,000 |

|

138th Grid Road |

$ |

3,630,000 |

$ |

3,630,000 |

|

178th Grid Road |

$ |

4,180,000 |

$ |

4,180,000 |

|

SR 202 Improvements |

$ |

6,326,000 |

$ |

– |

|

140th Ave Widening (to 5 lanes) |

$ |

2,635,000 |

$ |

2,635,000 |

|

Wood – Duvall Road/Woodinville Way (left turn lane) |

$ |

1,500,000 |

$ |

1,500,000 |

|

171st/140th Dual Left Turn (northbound to westbound) |

$ |

3,750,000 |

$ |

3,750,000 |

|

169th 124th Roundabout |

$ |

2,500,000 |

$ |

2,500,000 |

|

SR 202 – Winery Hill Road Intersection Roundabout |

$ |

1,750,000 |

$ |

1,750,000 |

|

Woodinville – Duvall Road Widening |

$ |

7,033,000 |

$ |

7,033,000 |

|

Little Bear Creek Widening |

$ |

6,375,000 |

$ |

6,375,000 |

|

NE 195th/130th Traffic Signal |

$ |

1,000,000 |

$ |

1,000,000 |

|

132nd/143rd Roundabout |

$ |

1,500,000 |

$ |

1,500,000 |

|

124th/149th Traffic Signal |

$ |

750,000 |

$ |

750,000 |

|

136th/NE 195th Traffic Signal |

$ |

750,000 |

$ |

750,000 |

|

Total System Capacity Improvements |

$ |

117,695,000 |

$ |

78,119,000 |

NOTES:

(1) Source: Transportation Master Plan adopted May 2010.

(2) Capacity Projects for Medium Growth Scenario.

(3) System Improvement Projects included in Transportation Improvement Fee.

(Ord. 527 § 1, 2012)

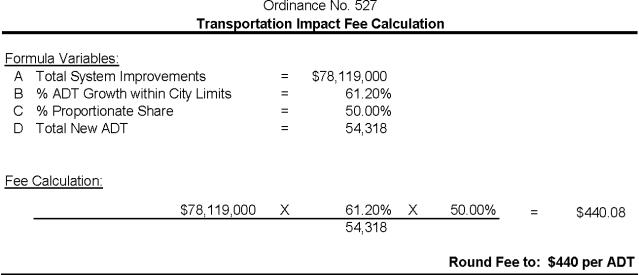

3.39.085 Computation of transportation fee amount.

The City of Woodinville shall use the amount of average daily traffic (ADT) as the measurement to determine transportation impacts of a development and impact fee.

(1) Calculation of Impact Fee Amount. The amount of the traffic impact fee assessed under this chapter shall be calculated as follows:

|

• |

A = Total estimated cost of system improvement projects |

|

• |

B = Percent of growth of traffic (ADT) from internal within City limits |

|

• |

C = Proportionate share of ADT growth assigned to development activity |

|

• |

D = New average daily traffic that will either originate in, transit through, or drive to the City |

|

• |

Impact fee amount = (A x B x C)/D |

The above calculation variables may be amended and adopted, from time to time, by the City Council and are hereby adopted as shown in Exhibit A at the end of this section.

(2) Implementation of Impact Fee Amount. The impact fee amount shall be implemented as follows:

|

Amount Effective: |

|

|---|---|

|

Effective Date of Ordinance 527: |

$290.00/ADT |

|

1/1/2014: |

$320.00/ADT |

|

1/1/2015: |

$355.00/ADT |

|

1/1/2016: |

$395.00/ADT |

|

1/1/2017: |

$440.00/ADT |

|

Impact Fee Calculation Formula (WMC 3.39.085): |

|

|

• |

A = Total estimated cost of system improvement projects |

|

• |

B = Percent of growth of traffic (ADT) from internal within City limits |

|

• |

C = Proportionate share of ADT growth assigned to development activity |

|

• |

D = New average daily traffic that will either originate in, transit through, or drive to the City |

|

• |

Impact fee amount = (A x B x C)/D |

Calculation of Fee Amount per WMC 3.39.085 established by Ordinance No. 527

(Ord. 527 § 1, 2012)

3.39.090 Impact fee determination and collection.

(1) At the time of building permit issuance, City staff shall determine the total impact fee owed based on the fee schedule in effect at the time of such issuance. Impact fee collection shall occur at the time of building permit issuance, unless the applicant applies for the deferred payment of impact fees pursuant to subsection (2) of this section and satisfies all requirements contained therein.

(2) The applicant may request to defer payment of impact fees for single-family residential construction with the following conditions:

(a) In order for an applicant to qualify for the option to defer payment of impact fees, all of the following requirements must be met:

(i) Prior to building permit issuance, the applicant submits a written request to defer payment for specifically identified building permits. The request shall identify the applicable building permit number(s), the applicant’s corporate identity, the full name of all legal owners, the tax parcel identification number(s), and the calculated impact fee amount at the time of building permit issuance.

(ii) The legal owners pay an administrative fee as provided by the City’s current fee schedule.

(iii) All legal owners of the property sign a deferred impact fee payment lien in a form acceptable to the City and consistent with RCW 82.02.050(3)(c). The lien shall be granted in favor of the City in the amount of the deferred impact fee. The legal owners shall record the lien against the subject property.

(b) Deferred impact fees shall be paid at the time of final inspection, or at the time of the granting of a certificate of occupancy, or within 18 months from the date of building permit issuance, whichever occurs first.

(c) The City shall have the authority to withhold final inspection and to suspend or refuse to issue a certificate of occupancy or equivalent inspection or certification until impact fees have been paid in full.

(d) In the event that deferred impact fees are not paid within 18 months from the date of building permit issuance, the City may institute foreclosure proceedings under the process set forth in Chapter 61.12 RCW.

(e) The option for deferred payment is limited to the first 20 single-family residential building permits per year per applicant, in accordance with a contractor registration number or other unique identification number.

(f) For the purposes of this section, an “applicant” includes an entity that controls the applicant, is controlled by the applicant, or is under common control with the applicant.

(3) An applicant may request that the impact fee be calculated in advance of building permit issuance, but any such advance calculation shall not be binding upon the City and should only be used as guidance by the applicant. Applicants should note that it is not possible to have a vested right to pay a particular impact fee in advance of building permit issuance. If the City Council revises the impact fee formula or the impact fees themselves prior to the time that a building permit is issued for a particular development, the formula or fee amount in effect at the time of building permit issuance shall apply to the development.

(4) The City shall use as a basis to predict the amount of new average daily trips created by any proposed development the current edition of the publication titled “Trip Generation, an ITE Informational Report” published by the Institute of Transportation Engineers, or other factual basis accepted by the Public Works Director.

(5) This impact fee owed for a development shall be determined by multiplying the number of predicted new average daily trips by the impact fee amount per average daily trip as computed in WMC 3.39.085.

(6) If the predicted number of average daily trips for a property is less than the existing number of average daily trips from the existing uses on the same property as a result of the proposed development, transportation impact fees will not be assessed by the City. The highest number of predicted average daily trips from a previous use of the site since 2005 will be used as a basis for number of existing average daily trips generated by that property.

(7) The number of average daily trips remains with the property or lot and cannot be moved, traded, bought, sold, or transferred to another property within the City. (Ord. 630 § 3, 2016; Ord. 527 § 1, 2012)

3.39.100 Impact fee adjustments, independent calculations.

A fee payer may request an adjustment to the impact fees determined according to the fee schedule adopted by this chapter by preparing and submitting to the Public Works Director an independent fee calculation for the development activity for which a building permit is sought. Said independent fee calculation must be supported by studies and data. The documentation submitted shall show the basis upon which the independent fee calculation was made. The City may, in its sole and exclusive discretion, also adjust the applicable fee at the time of imposition where unusual circumstances exist.

(1) If the Public Works Director agrees with the independent fee calculation, a written agreement to accept such amount shall be transmitted to the fee payer who shall, in turn, present it to the Permit Center upon impact fee collection.

(2) If the Public Works Director does not agree with the independent fee calculation, the fee payer may appeal this decision to the Hearing Examiner through procedures outlined in Chapter 21.81 WMC. (Ord. 527 § 1, 2012)

3.39.110 Impact fee credits.

(1) A developer shall be entitled to a credit against the transportation impact fee due in relation to a project under the fee schedule adopted by this chapter in any of the following situations:

(a) Whenever a project is approved subject to a condition that the developer actually provide a particular system improvement;

(b) Whenever a developer has agreed, pursuant to the terms of a voluntary agreement with the City, to provide a particular system improvement; or

(c) Whenever a developer or property owner (“developer”) dedicates, conveys or contributes land, right-of-way and/or improvements for use by the City for a system improvement, separate from or in advance of filing a land use application or a development application, that otherwise qualifies for a credit against the transportation impact fee adopted by this chapter. Provided, however, any credit to which a developer is otherwise entitled by this section shall be reduced or offset by any unpaid amount due and owing by the developer to the City for system improvements under the terms of a development agreement or other contractual agreement entered into between the developer and the City.

(2) If, in any of the cases in subsection (1) of this section, the land dedicated, facility constructed, or fee paid is allocated partly toward system improvements and partly toward project improvements, the credit shall be limited to that portion allocated to system improvements.

(3) The amount of credit granted pursuant to subsection (1) of this section shall not exceed the total amount of the impact fees due from the developer in relation to the project for which such credit is earned. Such credits may be used to satisfy impact fees otherwise due in relation to the project or may be held for future use in relation to the property upon which the project is developed. The developer may also receive a refund of impact fees already paid in relation to the project up to the total amount of the credit due; provided, however, such refund shall not be authorized if there are unpaid monies due and owing by the developer to the City for system improvements constructed by the City pursuant to a development agreement or other contractual agreement between the developer and the City.

(4) Impact fee credits shall not be transferable from one property, project or development activity to another.

(5) For the purposes of calculating the credit, the land value or costs of construction shall be determined as follows:

(a) The amount of credit for land dedicated shall be by an appraisal conducted by an independent professional appraiser chosen by the fee payer from a list of at least three such appraisers provided by the City. The cost of the appraisal shall be borne by the fee payer. For the purposes of this section, the date of value shall be the date the land was dedicated to the City. The appraisal shall only value the land dedicated and not any alleged damages to any abutting property.

(b) The amount of credit for system improvements constructed shall be based upon the actual cost of construction of such system improvements at the time of construction supported by invoices and other required records deemed reasonably necessary by the Public Works Director. The credit may include only such design or engineering costs as the Public Works Director determines are reasonably necessary in direct relation to construction of the system improvements. The cost to construct required frontage improvements to existing streets, including but not limited to the cost to construct curb and gutter, and street widening for non-through traffic capacity purposes, illumination systems, storm drainage systems, sidewalks and walkways, and landscaping, shall not be included in the amount of credit for facilities constructed as system improvements.

(6) This subsection (6) applies only to residential developments and the residential portion of a mixed use development. In cases where a developer would be entitled to a credit under this section, but the amount of the credit has yet to be determined on a per dwelling unit basis, the City shall take the total credit amount available to the entire plat or project under this section, calculated by applying subsections (1), (3) and (5) of this section, and divide that amount by the number of dwelling units approved for that plat or project. The impact fee and credit may then be calculated and collected on a per dwelling unit basis as building permits are issued for those dwelling units. Where building permits for some, but not all, of the dwelling units within a plat or project have already been obtained at the time the ordinance codified in this chapter becomes effective, the credit for the unpermitted dwelling units will be calculated to arrive at a per dwelling unit amount in the same manner. For example, if a plat has been approved for 20 dwelling units, and building permits have only been issued for 10 of those units, the per dwelling unit credit for the remaining 10 units will equal the total credit amount divided by 20 dwelling units.

(7) This subsection (7) applies to nonresidential developments, or the nonresidential portion of a mixed use development. In cases where a developer would be entitled to a credit under this section, but the amount of the credit has yet to be determined on a per square foot basis, the City shall take the total credit amount available to the entire plat or project under this section, calculated by applying subsections (1), (3) and (5) of this section, and divide that amount by the number of square feet approved for that plat or project. The impact fee and credit may then be calculated and collected on a per square foot basis as building permits are issued for that square footage.

(8) Determinations made pursuant to this section may be appealed to the Examiner under Chapter 21.81 WMC.

(9) A credit must be requested within 30 days of building permit issuance or it is deemed waived. (Ord. 712 § 2, 2020; Ord. 584 § 2, 2014; Ord. 563 § 1, 2013; Ord. 527 § 1, 2012)

3.39.120 Impact fee refunds.

(1) The current owner of property on which impact fees have been paid may receive a refund of such fees if the impact fees have not been expended or encumbered within 10 years of their receipt by the City, unless there exists an extraordinary and compelling reason for fees to be held longer than 10 years. Such extraordinary or compelling reasons shall be identified in written findings by the City Council. In determining whether impact fees have been expended or encumbered, impact fees shall be considered expended or encumbered on a first in, first out basis.

(2) The City shall provide for the refund of fees according to the requirements of this section and RCW 82.02.080.

(3) The City shall notify potential claimants of the refund availability by first-class mail deposited with the United States Postal Service addressed to the owner of the property at the owner’s last known address.

(4) An owner’s request for a refund must be submitted to the City Council in writing within one year of the date the right to claim the refund arises or the date that notice is given, whichever date is later.

(a) Any impact fees that are not expended or encumbered within six years of their receipt by the City, and for which no application for a refund has been made within this one-year period, shall be retained by the City and expended consistent with the provisions of this chapter.

(b) Refunds of impact fees shall include any interest earned on the impact fees.

(5) Should the City seek to terminate all impact fee requirements, all unexpended or unencumbered funds, including interest earned, shall be refunded to the current owner of the property for which an impact fee was paid. Upon the finding that all fee requirements are to be terminated, the City shall place notice of such termination and the availability of refunds in a newspaper of general circulation at least two times and shall notify all potential claimants by first-class mail addressed to the owner of the property at the owner’s last known address. All funds available for refund shall be retained for a period of one year. At the end of one year, any remaining funds shall be retained by the City, but must be expended for the original purposes, consistent with the provisions of this section. The notice requirement set forth above shall not apply if there are no unexpended or unencumbered balances within the account or accounts being terminated.

(6) A developer may request and shall receive a refund, including interest earned on the impact fees, when the developer does not proceed to finalize the development activity as required by statute or City code or the International Building Code.

(7) The amount to be refunded shall include the interest earned by this portion of the account from the date that it was deposited into the impact fee fund. (Ord. 712 § 3, 2020; Ord. 527 § 1, 2012)

3.39.130 Appeals and payments under protest.

(1) This subsection (1) applies when an applicant seeks a building permit to construct a portion of a development that has already been reviewed and approved, in other respects, pursuant to procedures that comply with Chapter 36.70B RCW. An example of this circumstance would be an application for a permit to build one house in a large subdivision that was previously approved. In this case, any appeal of the decision of the City with regard to the imposition of an impact fee or the amount of any impact fees, impact fee credit, or impact fee refund must be taken before the Hearing Examiner pursuant to WMC 21.81.020 in conjunction with an appeal of the underlying building permit. The right to such an administrative appeal is triggered by the City’s issuance or denial of a building permit.

(2) This subsection (2) applies when an applicant seeks a building permit in conjunction with other development approvals that may be subject to an open record hearing and closed record appeal pursuant to procedures that comply with Chapter 36.70B RCW. An example of this circumstance would be an application for a short plat and building permit to build a new office park. In this case, any appeal of the decision of the City with regard to the imposition of an impact fee or the amount of any impact fees, impact fee credit, or impact fee refund must be made according to the process outlines for and in conjunction with the underlying development approval.

(3) Any applicant may pay the impact fees imposed by this chapter under protest in order to obtain a building permit.

(4) Only the applicant has standing to appeal impact fee matters. (Ord. 706 § 8, 2020; Ord. 527 § 1, 2012)

3.39.140 Council review of impact fees.

The impact fee schedule adopted by this chapter shall be reviewed by the City Council, as it deems necessary and appropriate in conjunction with the update of the City’s Transportation Facilities Plan and Transportation Improvement Plan. (Ord. 527 § 1, 2012)

3.39.170 Schedule of fees.

A transportation impact fee shall be assessed against all development in an amount as determined by WMC 3.39.085 for proposals that require a building permit unless exempt under WMC 3.39.050. The transportation impact fee schedule established under this chapter, which may be amended from time to time by the City Council, is hereby included as Exhibit A in WMC 3.39.085. (Ord. 527 § 1, 2012)