Chapter 14.112

TRAFFIC IMPACT MITIGATION FEES*

Sections:

14.112.060 Mitigation of Traffic Impacts Required

14.112.070 Relationship to the State Environmental Policy Act (SEPA)

14.112.080 Calculation of Street System Impact Fees

14.112.100 Collection of Impact Fees

14.112.110 Uses of Traffic Impact Fee Revenues

14.112.120 Expenditure Requirements for Impact Fees

14.112.130 Refund of Fees Paid

* Code reviser’s note: Ordinance 955 establishes a temporary traffic impact fee adjustment to stimulate growth of new retail businesses within established subareas, pursuant to Section 14.112.080(d). The ordinance is effective from August 31, 2016, to August 22, 2019, unless extended by ordinance.

14.112.010 Purpose.

The purpose of this chapter is to implement the Capital Facilities Element of the Lake Stevens Comprehensive Plan and the Growth Management Act by:

(a) Ensuring adequate public street system facilities are available to serve traffic from new development.

(b) Ensuring adequate public streets are available to serve growth and maintain existing service levels for present businesses and residents.

(c) Establishing procedures whereby new development pays its proportionate share of the costs of street system capacity improvements, reducing transaction costs for both the City and developers, ensuring new developments do not pay arbitrary or duplicative fees. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.020 Authority.

This chapter is adopted under RCW 82.02.050 through 82.02.100, which authorize cities planning under the Growth Management Act, Chapter 36.70A RCW, to assess, collect, and use impact fees to help finance public facilities needed to accommodate growth. Under the authority of RCW 36.70A.070(3) and 82.02.050(4), the City is authorized to impose, collect, and use impact fees. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.030 Applicability.

This chapter applies to all new development, except as may be exempted below. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.040 Exemptions.

The exemptions for traffic impact fees are the same as for concurrency in Section 14.110.030 except for planned action projects identified in Section 14.110.030(b)(10), which are not exempt under this chapter. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.050 Service Areas.

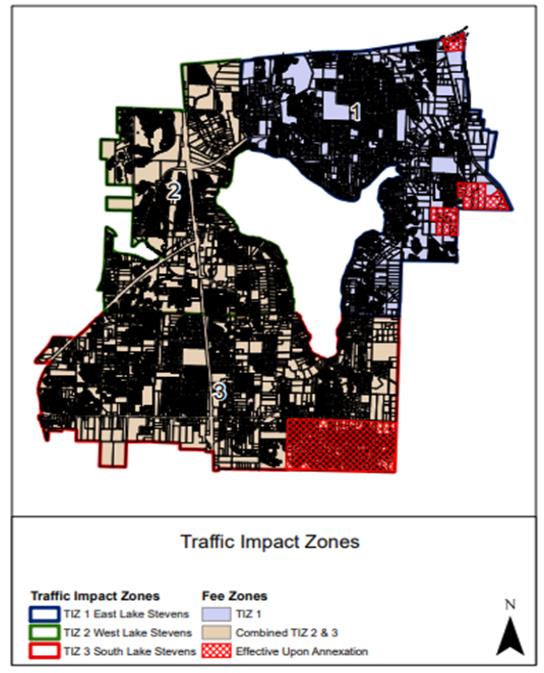

For the provision of public streets, implementation of the Capital Facilities and Transportation Elements of the Comprehensive Plan and administration of this chapter, three traffic impact zones (TIZ) are established. They consist of TIZ 1 - East Lake Stevens, TIZ 2 - West Lake Stevens, and TIZ 3 - South Lake Stevens. The precise boundaries of these service areas are shown in Figure 14.112-I.

Properties within the Urban Growth Area (UGA) that are annexed into the city shall be automatically assigned the same TIZ (service area) as city properties directly contiguous to the annexation, as shown in Figure 14.112-I.

Figure 14.112-I Traffic Impact Zones

(Ord. 1123, Sec. 2 (Exh. A), 2021; Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.060 Mitigation of Traffic Impacts Required.

Any new development activity shall mitigate the development’s impacts on the City’s street system either by payment of an amount calculated pursuant to Section 14.112.080, or by dedication of land pursuant to Section 14.112.090, by construction of off-site street system capacity improvements pursuant to Section 14.112.090, or as otherwise provided in Section 14.112.070. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.070 Relationship to the State Environmental Policy Act (SEPA).

This chapter establishes minimum impact fees, applied to all developments. These fees are presumed to mitigate traffic demand on the capacity of the city street system. However, each development shall be reviewed and be subject to the substantive authority of SEPA for potential adverse traffic impacts on the street system not mitigated by this fee. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.080 Calculation of Street System Impact Fees.

(a) The traffic impact fees will be collected and spent for capacity improvements to the public street system identified in the City’s Capital Facilities Plan. In accordance with RCW 82.02.050(3), the impact fees shall only be imposed for system improvements reasonably related to development impacts and shall not exceed a proportionate share of the costs of the identified system improvements in the adopted Capital Facilities Plan.

(b) The street system impact fee cost basis is established in the Traffic Impact Fee Cost Basis for the City of Lake Stevens, as amended, based on methodology consistent with the requirements of RCW 82.02.050 through 82.02.100 including, but not limited to, the following:

(1) Street system capacity improvements identified in the City GMA Capital Facilities Plan that are reasonably necessary to maintain adopted street system levels of service while accommodating the future development envisioned in the City’s adopted GMA Comprehensive Plan.

(2) The costs of the needed street system capacity improvements estimated by the Public Works Director using generally accepted engineering practices.

(3) The estimated costs adjusted (reduced) to account for portions of the identified street system improvements that will likely be constructed by new development as part of their required on-site public street improvements and/or frontage improvements.

(4) The estimated costs adjusted (reduced) to provide a credit for taxes (excluding impact fees paid under this section) paid by new development which help pay for the identified capacity improvements.

(5) The estimated costs adjusted (reduced) to account for any improvements needed to remedy any level of service deficiencies in the street system serving existing uses.

(6) The estimated costs adjusted (reduced) to reflect impacts on the capacity of the street system from new vehicle trips which have neither origin nor destination within the City of Lake Stevens (often referred to as “pass-through” trips).

(7) The final adjusted total costs of the identified improvements, as adjusted above, and aggregated for each traffic impact zone, are the cost basis of the impact fee.

(8) The number of weekday afternoon (PM) peak hour trips likely generated by existing land uses and future land uses (i.e., new development) are estimated based on current land use data and the adopted GMA Comprehensive Plan future land use map. The total existing and new trips are aggregated into the traffic impact zones.

(9) The maximum impact fee that can legally be charged to new development for each new weekday PM peak hour trip generated equals the cost basis of the impact fee divided by the new weekday PM peak hour trips for each traffic impact zone.

(10) The actual level of impact fees as established in Traffic Impact Fee Cost Basis for the City of Lake Stevens, as amended, shall not exceed the maximum as calculated above.

(c) A development shall mitigate its traffic impact upon the future capacity of the street system by paying an impact fee reasonably related to the impact of the development on public streets located in the same traffic impact zone as the development. A development’s street system impact fee will equal the number of new average weekday afternoon (PM) peak-hour trips generated by the development, based on the latest edition of the Institute of Traffic Engineers (ITE) Trip Generation Report, times the per trip amount identified in the currently adopted fees resolution, for the type and location of the development, except that the following adjustments may be made:

(1) In accordance with RCW 82.02.060(5), the Public Works Director shall have the authority to adjust the amount of the impact fee to consider unusual circumstances in specific cases, based on analysis of specific trip generating characteristics of the development (e.g., mixed-use characteristics, ridesharing programs, transit availability, etc.), to ensure that impact fees are fairly imposed; and

(2) In accordance with RCW 82.02.060(5), the Public Works Director shall have the authority to adjust the amount of the impact fee to be imposed on a particular development to reflect local information when available, including studies and data submitted by the developer.

(d) The City Council shall have the authority to adjust the amount of the impact fees pursuant to RCW 82.02.060(2) to reflect other public benefits resulting from proposed development or redevelopment in accordance with specific programs as determined and adopted by the City Council. Public benefits and/or broad public purposes for adjustments primarily include the economic development goals identified in the City’s Comprehensive Plan related to job creation and growth of new retail sales tax receipts. The City Council shall identify the public funding source other than impact fees collected to compensate for any reductions in impact fees pursuant to this provision. (Ord. 922, Sec. 1, 2014; Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.090 Offsets.

(a) The required traffic impact fees shall be reduced by the amount of any payment for public street system improvements previously made for the development either as a condition of approval or under voluntary agreements with the City entered into after the effective date of the ordinance codified in this chapter.

(b) Whenever a development has agreed to, pursuant to the terms of a voluntary agreement with the City, or is granted approval subject to a condition that the developer provide right-of-way for or construct off-site street system capacity improvements that are identified in the Traffic Impact Fee Cost Basis for the City of Lake Stevens, as amended, as being part of the street system impact fee cost basis, the developer shall be entitled to an offset for up to the value of land or up to the actual cost of construction against the impact fee assessed under Section 14.112.060.

(c) The land value or cost of construction shall be estimated at the time of approval and shall be based on acceptable evidence and documentation provided by the developer. The evidence and documentation shall be reviewed and, if acceptable, approved by the Public Works Director or designee. When land is proposed for dedication, the person required to pay impact fees shall present either a Member of the Appraisal Institute (MAI) appraisal or evidence of the assessed value as determined by the County Assessor’s Office. If construction costs are estimated, the documentation shall be confirmed after the construction is completed to assure that an accurate offset amount is provided. If the land value or construction cost is less than the calculated fee amount, the difference remaining shall be chargeable as an impact fee.

(d) The amount of the offset for a development activity shall not exceed the amount of the impact fee the development activity is required to pay.

(e) Any claim for offset should be made at least 30 days prior to application for a building permit so as to eliminate or minimize any delays in issuance of a permit. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.100 Collection of Impact Fees.

Impact fees for each development shall be assessed and collected at the time of issuance of a building permit, unless deferred pursuant to Chapter 14.124. Where no building permit will be associated with the development, such as a development requiring a conditional use permit, payment is required as a precondition to approval. (Ord. 970, Sec. 5, 2016; Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.110 Uses of Traffic Impact Fee Revenues.

(a) Traffic impact fee revenue will be used for capital improvements on the public street system, not operating or maintenance expenses.

(b) Traffic impact fees shall be used for costs associated with City street system capacity improvements, including, but not limited to, planning, design, engineering, right-of-way acquisition, financing, project administration, construction, and/or construction engineering.

(c) In the event that bonds or similar debt instruments are issued for the advanced provision of system improvements, for which impact fees may be expended and where consistent with provisions of the bond covenants, impact fees may be used to pay debt service on such bonds or similar debt instruments to the extent that facilities or improvements provided are consistent with the requirements of this section.

(d) Traffic impact fees are collected and spent on street system improvements as opposed to project improvements, in accordance with RCW 82.02.090. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.120 Expenditure Requirements for Impact Fees.

Traffic impact fee payments not expended within 10 years shall be refunded, pursuant to Section 14.112.130; unless the City Council makes written findings that there exists an extraordinary and compelling reason for fees to be held longer than 10 years. In order to verify these two requirements, impact fee revenues must be deposited into separate accounts of the City, and annual reports must describe revenue and expenditures. (Ord. 876, Sec. 6 (Exh. 4), 2012)

14.112.130 Refund of Fees Paid.

(a) Traffic impact fees collected pursuant to this chapter shall be deposited into an interest bearing account established for the City.

(b) If a development approval expires without commencement of construction, then the developer shall be entitled to a refund of impact fees paid, with interest, of the impact fee paid for that development. The developer must submit an application for such a refund to the Finance Director within 30 days prior to the expiration of the permit. By resolution, the City Council may adopt fees to offset administrative costs of collecting and refunding mitigation fees.

(c) Any funds not expended or encumbered by the end of 10 years from the date the fee was paid shall be returned to the developer/owner with interest; provided, that the developer/owner submits a request for a refund to the City of Lake Stevens within one year of the expiration of the 10-year period.

(d) Impact fees that are not expended or encumbered within these time limitations, and for which no application of a refund has been made in accordance with this section, shall be retained and expended on public street system facilities.

(e) Interest due upon the refund of impact fees shall be calculated according to the average rate received by the City on invested funds throughout the period during which the fees were retained. (Ord. 876, Sec. 6 (Exh. 4), 2012)