Chapter 4.80

MULTIFAMILY PROPERTY TAX EXEMPTION

Sections:

4.80.040 Terms of the tax exemption.

4.80.060 Application procedure.

4.80.070 Application review and issuance of conditional certificate.

4.80.080 Extension of conditional certificate.

4.80.090 Application for final certificate.

4.80.100 Issuance of final certificate.

4.80.110 Annual compliance review.

4.80.120 Cancellation of tax exemption.

4.80.130 Annual report by City.

4.80.140 Residential target area creation and standards.

4.80.150 Designated residential target areas.

4.80.010 Purpose.

As provided in State law, the purpose of this chapter is to provide limited eight-year exemptions from ad valorem property taxation for multifamily housing in designated residential targeted areas to:

A. Encourage increased residential opportunities within areas of the City designated by the City Council as residential targeted areas; and/or

B. Stimulate new construction or rehabilitation of existing vacant and underutilized buildings for multifamily housing in designated residential targeted areas to increase and improve housing opportunities; and

C. Assist in directing future population growth to designated residential targeted areas, thereby reducing development pressure on single-family residential neighborhoods; and

D. Achieve development densities which are more conducive to transit use in designated residential targeted areas.

(Ord. 619 § 1, 2013).

4.80.020 Definitions.

When used in this chapter, the following terms shall have the following meanings, unless the context indicates otherwise:

A. “Building Codes” means the City and State building and fire codes as set forth in the University Place Municipal Code.

B. “City” means the City of University Place.

C. “Department” means the City Department of Community and Economic Development.

D. “Director” means the Director of the Department of Community and Economic Development, or designee.

E. “Multifamily housing” means a building having 10 or more dwelling units not designed or used as transient accommodations and not including hotels and motels. Multifamily units that provide either leased or owner occupancy on a nontransient basis may result from new construction or rehabilitation or conversion of vacant, underutilized, or substandard buildings to multifamily housing.

F. “Multifamily property tax exemption” means an exemption from ad valorem property taxation for multifamily housing.

G. “Owner” means the property owner of record.

H. “Rehabilitation improvements” means modifications to existing structures that are vacant for 12 months or longer that are made to achieve a condition of substantial compliance with existing building, fire, and zoning codes, or modification to existing occupied structures which increase the number of multifamily housing units.

I. “Residential targeted area” means those geographic areas identified by the City Council as meeting the requirements of RCW 84.14.040.

J. “Substantial compliance” means compliance with all local building, fire and zoning code requirements.

(Ord. 749 § 10, 2021; Ord. 747 § 1, 2021; Ord. 619 § 1, 2013).

4.80.030 Applicability.

Multifamily housing projects in designated residential targeted areas resulting from new construction or rehabilitation or conversion of vacant, underutilized, or substandard buildings may be entitled to a limited eight-year exemption from ad valorem property taxation as set forth in this chapter.

(Ord. 619 § 1, 2013).

4.80.040 Terms of the tax exemption.

A. Duration of Exemption. The value of improvements qualifying under this chapter is exempt from ad valorem property taxation for eight successive years beginning January 1st of the year immediately following the calendar year after issuance of the final certificate of tax exemption.

B. Limits on Exemption. The exemption does not apply to the value of land or to the value of improvements not qualifying under this chapter, nor does the exemption apply to increases in assessed valuation of land and nonqualifying improvements. In the case of rehabilitation of existing buildings, the exemption does not include the value of improvements constructed prior to submission of the completed application required under this chapter. This chapter does not apply to increases in assessed valuation made by the Pierce County Assessor on nonqualifying portions of building and value of land nor to increases made by lawful order of a county board of equalization, the Department of Revenue, or Pierce County, to a class of property throughout the County or specific area of the County to achieve the uniformity of assessment or appraisal required by law.

C. Conclusion of Exemption. At the conclusion of the eight-year exemption period, the new or rehabilitated housing cost shall be considered as new construction for the purposes described in State law.

(Ord. 619 § 1, 2013).

4.80.050 Project eligibility.

A proposed multifamily housing project must meet the following requirements for consideration for a property tax exemption:

A. Location. The project must be located within a residential target area.

B. Tenant Displacement Prohibited. The project must not displace existing residential tenants of structures that are proposed for redevelopment. If the property proposed to be rehabilitated is not vacant, an applicant shall provide each existing tenant housing of comparable size, quality, and price and a reasonable opportunity to relocate.

C. Noncompliance with Building Codes. Existing dwelling units proposed for rehabilitation must fail to comply with one or more standards of the building codes.

D. Size of Project. The new, converted, or rehabilitated multiple-unit housing must provide for a minimum of 50 percent of the space for permanent residential occupancy. The project, whether new, converted, or rehabilitated multiple-unit housing, must include at least 10 units of multifamily housing within a residential structure or as part of an urban development. In the case of existing multifamily housing that is occupied or which has not been vacant for 12 months or more, the multifamily housing project must also provide for a minimum of four additional multifamily units for a total project of at least 10 units including the four additional units. Existing multifamily housing that has been vacant for 12 months or more does not have to provide additional units. In addition, a proposed multifamily housing project must construct or rehabilitate a minimum of 24,000 square feet of residential living space. Common areas and hallways shall be excluded from this calculation.

E. Proposed Completion Date. New construction of multifamily housing and rehabilitation improvements must be completed within three years from the date of approval of the application.

F. Compliance with Guidelines and Standards. The project must be designed to comply with the City’s Comprehensive Plan, building, housing, and zoning codes, and any other applicable regulations.

G. Design Review Compliance. Projects in a residential target area for which design review criteria have been promulgated must also meet the design review criteria under Chapter 19.50 UPMC and UPMC 19.85.050.

(Ord. 747 § 2, 2021; Ord. 619 § 1, 2013).

4.80.060 Application procedure.

A property owner who wishes to propose a project for a tax exemption shall complete the following procedures:

A. The application provided by the City shall be filed with the Department along with the required fees as established pursuant to State law.

B. A complete application shall include:

1. A completed City of University Place application form setting forth the grounds for the exemption.

2. Preliminary floor and site plans of the proposed project.

3. A statement acknowledging the potential tax liability when the project ceases to be eligible under this chapter.

4. An affidavit stating the occupancy record of the property for a period of 12 months prior to filing the application.

5. Verification by oath or affirmation of the information submitted.

6. For rehabilitation projects, the applicant shall provide a report prepared by a licensed architect identifying property noncompliance with the building codes. This report shall identify specific code violations and must include supporting data that satisfactorily explains and proves the presence of a violation. Supporting data must include a narrative and such graphic materials as needed to support this application. Graphic materials may include, but are not limited to, building plans, building details, and photographs.

(Ord. 619 § 1, 2013).

4.80.070 Application review and issuance of conditional certificate.

The Director may certify as eligible an application which is determined to comply with the requirements of this chapter. A decision to approve or deny an application shall be made within 90 calendar days of receipt of a complete application.

A. Approval. The Director may approve the application if he/she finds that:

1. A minimum of 10 new units and 24,000 square feet of living space are being constructed or rehabilitated or in the case of occupied rehabilitation or conversion within 12 months of occupancy, a minimum of four additional multifamily units for a total project of at least 10 units including the four additional multifamily units are being developed.

2. The proposed project is or will be, at the time of completion, in conformance with all applicable local plans and regulations.

3. The owner has complied with all standards, requirements and guidelines adopted by the City under this chapter.

4. The site is located in a residential target area.

B. If an application is approved, the applicant shall enter into an agreement with the City regarding the terms and conditions of implementation of the project, and the Director shall issue a conditional certificate of acceptance of tax exemption. The conditional certificate shall expire three years from the date of approval unless an extension is granted as provided in this chapter.

C. If an application is denied, the Director shall state in writing the reasons for denial and shall send notice to the applicant at the applicant’s last known address within 10 calendar days of the denial. As mandated by State law, an applicant may appeal a denial to the City Council within 30 calendar days of receipt of the denial by filing a complete appeal application and fee with the Director. The appeal before the City Council will be based on the record made before the Director. The Director’s decision will be upheld unless the applicant can show that there is no substantial evidence on the record to support the Director’s decision. The City Council’s decision on appeal will be final.

(Ord. 747 § 3, 2021; Ord. 619 § 1, 2013).

4.80.080 Extension of conditional certificate.

A. Extension. The conditional certificate and time for completion of the project may be extended by the Director for a period not to exceed a total of 24 consecutive months. To obtain an extension, the applicant must submit a written request with a fee stating the grounds for the extension. An extension may be granted if the Director determines that:

1. The anticipated failure to complete construction or rehabilitation within the required time period is due to circumstances beyond the control of the owner; and

2. The owner has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

3. All the conditions of the original contract between the applicant and the City will be satisfied upon completion of the project.

B. Denial and Appeal. If an extension is denied, the Director shall state in writing the reason for denial and shall send notice to the applicant’s last known address within 10 calendar days of the denial. Pursuant to State law, an applicant may appeal the denial of an extension to the Hearings Examiner, pursuant to the UPMC, within 14 calendar days of receipt of the denial by filing a complete appeal application and fee with the Director. No appeal to the City Council is provided from the Hearings Examiner’s decision. Under State law, the applicant may appeal the Hearings Examiner’s decision to the Pierce County Superior Court, if the appeal is filed within 30 calendar days of receiving notice of that decision.

(Ord. 619 § 1, 2013).

4.80.090 Application for final certificate.

Upon completion of the improvements agreed upon in the contract between the applicant and the City and upon issuance of a certificate of occupancy, the applicant may request a final certificate of tax exemption by filing with the Director the following:

A. A statement of expenditures made with respect to each multifamily housing unit and the total expenditures made with respect to the entire property;

B. A description of the completed work and a statement of qualification for the exemption; and

C. A statement that the work was completed within the required three-year period or any authorized extension.

(Ord. 619 § 1, 2013).

4.80.100 Issuance of final certificate.

Within 30 calendar days of receipt of all materials required for a final certificate, the Director shall determine whether the specific improvements satisfy the requirements of the contract, application, and this chapter.

A. Granting of Final Certificate. If the Director determines that the project has been completed in accordance with this chapter and the contract between the applicant and the City, and has been completed within the authorized time period, the City shall, within 10 calendar days of the expiration of the 30-day review period above, file a final certificate of tax exemption with the Pierce County Assessor.

B. Denial and Appeal. The Director shall notify the applicant in writing that a final certificate will not be filed if the Director determines that:

1. The improvements were not completed within the authorized time period; or

2. The improvements were not completed in accordance with the agreement between the applicant and the City; or

3. The owner’s property is otherwise not qualified under this chapter.

Pursuant to State law an applicant may appeal a denial to the Hearings Examiner pursuant to the UPMC within 14 calendar days of issuance of the denial of a final certificate by filing a complete appeal application and fee with the Director. No appeal to the City Council is provided from the Hearings Examiner’s decision. Under State law, the applicant may appeal the Hearings Examiner’s decision to the Pierce County Superior Court, if the appeal is filed within 30 calendar days of receiving notice of that decision.

(Ord. 619 § 1, 2013).

4.80.110 Annual compliance review.

A. Within 30 calendar days after the first anniversary of the date of filing the final certificate of tax exemption and each year thereafter for a period of eight years, the property owner shall be required to file a notarized declaration with the Director indicating the following:

1. A statement of occupancy and vacancy of the multifamily units during the previous 12 months; and

2. A certification that the property continues to be in compliance with the contract with the City and this chapter; and

3. A description of any subsequent improvements or changes to the property.

B. City staff shall also conduct on-site verification of the declaration. Failure to submit the annual declaration shall result in a review of the exemption as provided in State law.

(Ord. 619 § 1, 2013).

4.80.120 Cancellation of tax exemption.

If the Director determines that the owner is not complying with the terms of the contract or this chapter, the tax exemption shall be canceled. This cancellation may occur in conjunction with the annual review or at any other time when noncompliance has been determined. If the owner intends to convert the multifamily housing to another use, the owner shall notify the Director and the Pierce County Assessor in writing within 60 calendar days of the change in use.

A. Effect of Cancellation. If a tax exemption is canceled due to a change in use or other noncompliance, the following taxes and penalties will apply:

1. Additional real property tax, plus interest, shall be imposed based upon the value of the nonqualifying improvements. This additional tax is calculated based upon the difference between the property tax paid and the property tax that would have been paid if it had included the value of the nonqualifying improvements dated back to the date that the improvements were converted to a nonqualifying use.

2. A penalty shall be imposed amounting to 20 percent of the value of the additional property tax plus interest.

3. The interest is calculated at the same statutory rate charged on delinquent property taxes from the dates on which the additional property tax could have been paid without penalty if the improvements had been assessed at full value without regard to this tax exemption program.

4. The additional taxes, interest and penalties will become a lien on the land and attach at the time the property or portion of the property is removed from multifamily use or the amenities no longer meet applicable requirements. The lien has priority over and must be fully paid and satisfied before a recognizance, mortgage, judgment, debt, obligation, or responsibility to or with which the land may become charged or liable. The lien may be foreclosed upon expiration of the same period after delinquency and in the same manner provided by law for foreclosure of liens for delinquent real property taxes. An additional tax unpaid on its due date is delinquent. From the date of delinquency until paid, interest must be charged at the same rate applied by law to delinquent ad valorem property taxes.

B. Notice and Appeal. Pursuant to State law, upon determining that a tax exemption is to be canceled, the Director shall notify the owner by mail, return receipt requested.

The property owner may appeal the determination to the Hearings Examiner pursuant to the UPMC by filing a notice of appeal with the City Clerk within 30 calendar days, specifying the factual and legal basis for the appeal. The Hearings Examiner will conduct a hearing under the UPMC. Under State law, an aggrieved party may appeal the Hearings Examiner’s decision to the Pierce County Superior Court.

(Ord. 619 § 1, 2013).

4.80.130 Annual report by City.

The City shall report annually by December 31st of each year to the Washington State Department of Community, Trade and Economic Development. The report must include the following information:

A. The number of tax exemption certificates granted;

B. The total number and type of units produced or to be produced;

C. The number and type of units produced or to be produced meeting affordable housing requirements;

D. The actual development cost of each unit produced;

E. The total monthly rent or total sale amount of each unit produced;

F. The income of each renter household at the time of initial occupancy and the income of each initial purchaser of owner-occupied units at the time of purchase for each of the units receiving a tax exemption and a summary of these figures for the City; and

G. The value of the tax exemption for each project receiving a tax exemption and the total value of tax exemptions granted.

(Ord. 619 § 1, 2013).

4.80.140 Residential target area creation and standards.

A. Criteria. Following a public hearing, the City Council may, in its sole discretion, designate one or more residential target areas (RTAs). Each designated RTA must meet the following criteria, as determined by the City Council:

1. The target area lacks sufficient available, desirable, and convenient residential housing to meet the needs of the public who would likely live in the mixed-use center if desirable, attractive, and livable places were available; and

2. The providing of additional housing opportunity in the target area will assist in achieving the following purposes:

a. Encourage increased residential opportunities within the target area; or

b. Stimulate the construction of new multifamily housing and the rehabilitation of existing vacant and underutilized buildings for multifamily housing.

In designating an RTA, the City Council may also consider other factors, including, but not limited to: whether additional housing in the target area will attract and maintain a significant increase in the number of permanent residents; whether an increased residential population will help alleviate detrimental conditions and social liability in the target area; and whether an increased residential population in the target area will help to achieve the planning goals mandated by the Growth Management Act under RCW 36.70A.020.

The City Council may amend or rescind the designation of an RTA at any time pursuant to the same procedure as set forth in this chapter for original designation.

B. Target Area Standards and Guidelines. For each designated residential target area (RTA), the City Council may, in addition to the other requirements of this chapter, adopt basic requirements for both new construction and rehabilitation supported by the City’s property tax exemption for multifamily housing program. The City Council may also adopt guidelines including the following:

1. Requirements that address demolition of existing structures and site utilization; and

2. Building requirements that may include elements addressing parking, height, density, environmental impact, public benefit features, compatibility with the surrounding property, and such other amenities as will attract and keep permanent residents and will properly enhance the livability of the residential target area. The required amenities shall be relative to the size of the proposed project and the tax benefit to be obtained.

(Ord. 747 § 4, 2021).

4.80.150 Designated residential target areas.

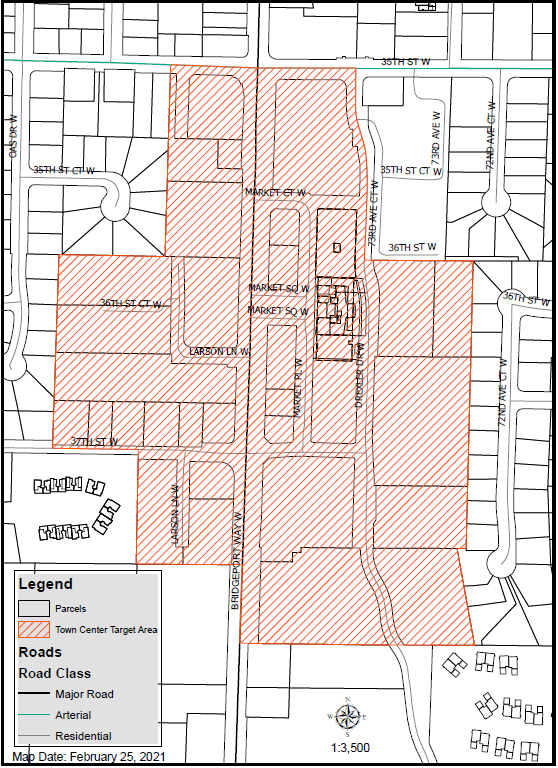

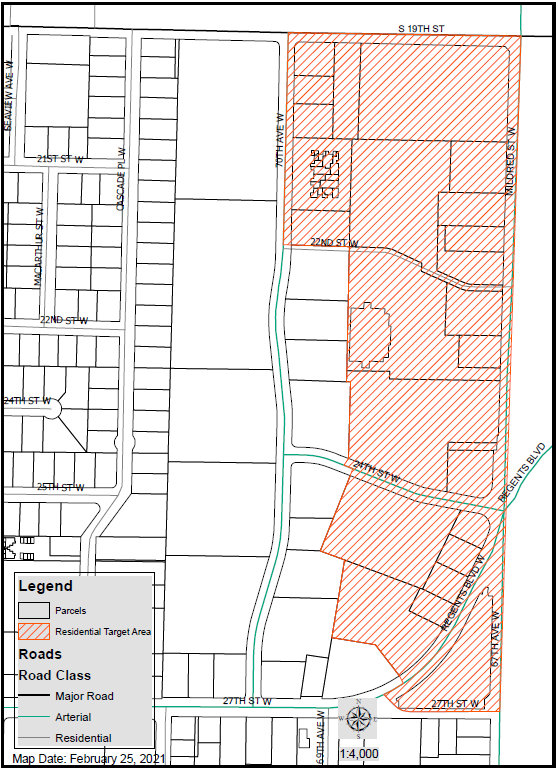

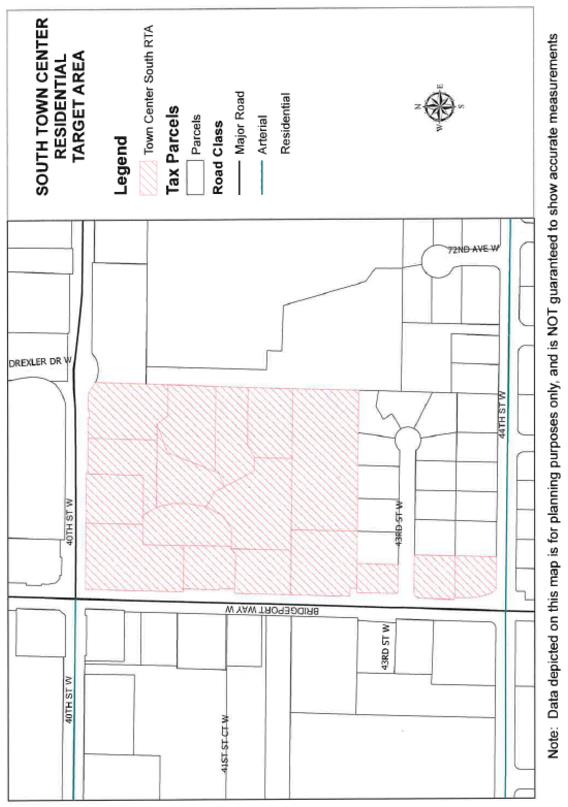

A. The boundaries of the residential target areas are located within the areas listed below, and as indicated on the maps in this section as follows:

|

Map Exhibit |

Name of Residential Target Area |

|---|---|

|

Exhibit A |

Town Center |

|

Exhibit B |

Northeast Business District |

|

Exhibit C |

Town Center South |

A copy of the maps depicting each residential target area shall be on file with the office of the City Clerk and available for public inspection during normal business hours at no charge.

B. Location. If a part of any legal lot is within a designated residential targeted area at the time the residential target area is established, then the entire lot shall be deemed to lie within such residential targeted area. Property located outside of, but adjacent to, the described areas is not designated as a residential targeted area.

EXHIBIT A

CITY OF UNIVERSITY PLACE

TOWN CENTER RESIDENTIAL TARGET AREA

EXHIBIT B

CITY OF UNIVERSITY PLACE

NORTHEAST RESIDENTIAL TARGET AREA

EXHIBIT C

SOUTH TOWN CENTER

RESIDENTIAL TARGET AREA

(Ord. 750 § 1, 2021; Ord. 747 § 5, 2021).