Part 5

Local Taxpayers Bill of Rights

A. General

§24-501 Introduction.

1. The rules and regulations attached hereto as Schedule 1 and incorporated herein are hereby approved and adopted.

2. The disclosure statement, substantially in the form set forth in Schedule 2 attached hereto and incorporated herein, is hereby approved and adopted.

3. The form of Petition for Appeal and Refund, substantially in the form set forth in Schedule 3 attached hereto and incorporated herein, is hereby approved and adopted.

4. The Governing Body hereby determines that administrative appeal procedures relating to petitions for appeal and refund submitted by taxpayers in connection with the assessment determination or refund of an eligible tax under the LTBR shall be undertaken by the Board of Supervisors in executive session.

5. The administrative appeal procedures set forth in the rules and regulations and substantially in the form set forth in Schedule 4, attached hereto and incorporated herein, are hereby approved and adopted.

6. The part shall become effective in accordance with the provisions of law and shall be applicable in eligible taxes as of January 1, 1999.

(Ord. 99-02.1, 5/10/1999, §1)

B. Rules and Regulations for Compliance with the Local Taxpayers Bill of Rights

§24-511 Introduction.

The Local Taxpayers Bill of Rights, enacted as part of Act 50 of 1998 (hereinafter the "LTBR"), requires that every political subdivision levying an eligible tax adopt regulations governing the administration and collection of the tax, and setting forth a process for handling appeals from decisions on assessments and refunds. This document provides the regulations required. by LTBR. The disclosure statement also required by the LTBR is provided in a separate document, which is available upon request of the Tax Administrator.

(Ord.99-02-1, 5/10/1999, SCHEDULE 1)

§24-512 Definitions.

Appeals Board - the Board of Supervisors in executive session.

Assessment - the determination by the Tax Administrator of the amount of underpayment by a taxpayer.

Eligible Tax - any of the following taxes specified within the term "eligible tax" under the LTBR, including interest and penalties provided by law, when levied by the Governing Body of the Local Government, but specifically not including any real estate tax:

A. Any tax authorized or permitted under the Act of December 31, 1965 (P.L. 1257, No. 511), known as the Local Tax Enabling Act or Act 511.

B. Any per capita tax.

C. Any occupation, occupation assessment or occupation privilege tax.

D. Any tax levied on income.

E. Any tax measured by gross receipts.

F. Any tax on a privilege.

G. Any tax on amusements or admissions.

H. Any tax on earned income and net profits.

Local Government - Wolf Township, Lycoming County, Pennsylvania.

Local Taxpayers Bill of Rights - subchapter C of Act 50 of 1998 of the Pennsylvania General Assembly, 53 Pa.C.S.A. §8421-8428.

Overpayment - any payment of tax which is determined in the manner provided by law not to be legally due.

Petition - the Petition for Appeal and Refund described in §24-515.

Tax Administrator - the employee, agent, appointed tax collector, elected Tax Collector, tax collection agency or other person to whom the Governing Body of the Local Government has assigned or delegated responsibility for the audits, assessment, determination or administration of an eligible tax. Under the LTBR, this Tax Administrator is also referred to and defined as the local taxing authority. In the case of the local government, the Tax Administrator is the elected Tax Collector.

Taxpayer - an individual, partnership, association, corporation, limited liability company, estate, trust, trustee, fiduciary or any other entity subject to or claiming exemption from any eligible tax or under a duty to perform an act for itself or for another under or pursuant to the authority of an eligible tax levied by the Local Government.

Underpayment - the amount or portion of any eligible tax determined to be legally due in the manner provided by law for which payment or remittance has not been made.

Voluntary Payment - a payment of an eligible tax made pursuant to the free will of the taxpayer. The term does not include a payment made as a result of distraint or levy or pursuant to a legal proceeding in which the Tax Administrator is seeking to collect its delinquent eligible taxes or file a claim therefor.

(Ord.99-02-1, 5/10/1999, SCHEDULE 1)

§24-513 Requirements for Requests for Taxpayer Information.

1. Minimum Time Periods for Taxpayer Response.

A. The taxpayer shall have at least 30 calendar days from the mailing date to respond to requests for information by the Tax Administrator. The Tax Administrator shall grant a reasonable extension upon written application explaining the reason(s) necessitating the extension, which must amount to good cause. If the Tax Administrator denies a request for extension, the Tax Administrator must inform the taxpayer in writing of the basis for the denial and that the taxpayer must immediately provide the requested information. If the Tax Administrator grants an extension request, he must notify the taxpayer in writing of the amount of the extension. Generally, an extension will not exceed 30 calendar days in length, and may be less, depending on the circumstances.

B. The Tax Administrator shall note the taxpayer of the procedures to obtain an extension in its initial request for information. Please refer to the notice explaining the Request for Extension of Time to Provide Information attached as Schedule 1A.

C. The Tax Administrator shall take no lawful action against a taxpayer for the tax year in question until the expiration of the applicable response period for submission of the information requested, including extensions. For example, the Tax Administrator may not engage in any collection efforts until after expiration of the response period. After expiration of the response period, the Tax Administrator may engage in collection efforts permitted by the LTBR and discussed in §24-525 below.

2. Requests for Prior Tax Returns.

A. Except as provided in §24-514.B, an initial inquiry by the Tax Administrator regarding a taxpayer's compliance with any eligible tax may include taxes required to be paid or tax returns required to be filed no more than 3 years prior to the mailing date of the notice.

B. The Tax Administrator may make an additional subsequent request for a tax return or supporting information if, after the initial request, the Tax Administrator determines that the taxpayer failed to file a tax return, under reported income or failed to pay a tax for one or more of the tax periods covered by the initial request. Generally, however, the Tax Administrator should not make routine requests for additional prior year returns.

Notwithstanding the foregoing, the limitations in subsection .B, above, on subsequent requests for prior year returns shall not apply if the Tax Administrator has sufficient information to indicate that the taxpayer failed to file a required return or to pay an eligible tax which was due more than 3 years prior to the date of the notice. Thus, in situations involving failure to file a required return or to pay a required eligible tax, the Tax Administrator shall, in his discretion, have the ability to request prior year returns due more than 3 years prior and supporting information.

3. Use of Federal or State Tax Information.

A. The Tax Administrator may require a taxpayer to provide copies of the taxpayer's Federal individual income tax return if the Tax Administrator can demonstrate that the Federal tax information is reasonably necessary for the enforcement or collection of tax and the information is not available from other available sources or the Pennsylvania Department of Revenue. The Tax Administrator may also require a taxpayer to provide copies of the taxpayer's state individual income tax return.

(Ord.99-02-1, 5/10/1999, SCHEDULE 1, §101)

§24-514 Notice of Basis of Underpayment.

1. The Tax Administrator must notify the taxpayer in writing of the basis for any underpayment that the Tax Administrator has determined to exist with respect to any eligible tax. The purpose of this notification is for the taxpayer to understand the exact reason why the Tax Administrator believes an underpayment exists. This notification from the Tax Administrator shall be written in a manner calculated to be understood by an average person. The notification must include:

A. The tax period or periods (usually measured in calendar years) for which the underpayment is asserted.

B. The amount of the alleged underpayment of the eligible tax detailed by tax period.

C. The legal basis (including any statutory or case law citations) upon which the Tax Administrator has relied to determine that an underpayment of an eligible tax exists.

D. An itemization of the changes made by the Tax Administrator to a return or report filed by the taxpayer that results in the determination that an underpayment exists. A copy of any revised return or report in the Tax Administrator's file must be provided to the taxpayer.

(Ord.99-02-1, 5/10/1999, Schedule 1, §102)

§24-515 Petitions for Appeals of Assessments or Refund of Taxes Paid.

1. Filing of Petitions.

A. A taxpayer has the legal right to challenge an assessment or denial of a refund claim under the LTBR. However, a taxpayer has a right to one appeal only. If a taxpayer loses an assessment appeal, the taxpayer is not entitled to a second refund appeal after paying the tax.

B. No administrative appeals are provided for other decisions, including but not limited to, the denial of an extension of time to provide information or the modification or termination of an installment agreement.

C. The LTBR requires political subdivisions to establish appeals procedures. In order to begin the appeals process, the taxpayer must file a complete and timely petition (the petition). A petition is timely filed if the letter transmitting the petition postmarked by the United States Postal Service or actually received on or before the final day on which the petition is due. Receipts from carriers other than the United States Postal Service are not accepted as proof of timely filing.

2. Deadlines for filing of a petition are as follows:

A. Petitions challenging the denial of a refund shall be filed within 3 years after the due date for filing the report or return as extended or 1 year after the actual payment of the tax, whichever is later. If no report or return is required, the petition shall be filed within 3 years after the due date for payment of the eligible tax or within 1 year after actual payment, whichever is later.

B. Petitions for reassessment of tax shall be filed within 90 days of the date of the assessment notice which has been sent to the taxpayer by the Tax Administrator.

3. The Tax Administrator shall make available a form of Petition for Appeal and Refund attached as Schedule 2.

4. Contents.

A. Any petition filed under §24-505.1 shall:

(1) State the legal basis for claiming the refund or disagreeing with the Tax Administrator's assessment.

(2) State the tax period or periods (i.e., years) to which it pertains.

(3) State the amount of the claim and the type of eligible tax detailed by tax period.

(4) Include all supporting documentation and calculations.

(5) Provide the name, address and telephone number of the taxpayer's representative, if any.

(6) Include a statement certifying that the facts in the petition are true and correct, under penalty of perjury, and that the petition is not filed for purposes of delay.

(7) Include such other information (essentially identification) as is reasonably requested by the Tax Administrator on the Petition for Appeal and Refund provided to taxpayer.

5. The taxpayer shall have his or her petition decided by the Governing Body acting in executive session based solely on the petition and record (including information on file and information submitted by the taxpayer). No hearing, oral testimony or oral argument is required, but can be requested by the taxpayer. The Governing Body may choose to grant a hearing in its sole discretion.

(Ord.99-02-1, 5/10/1999, Schedule 1, §103)

§24-516 Appeals Board.

1. The decision by the Governing Body acting in executive session shall be based solely on the petition and record. Decisions on petitions shall be issued within 60 days of the date a complete and accurate petition is received. Failure to act within 60 days shall result in the petition being deemed approved.

2. Any person aggrieved by a decision under this Section who has a direct interest in the decision shall have the right to appeal to the Court of Common Pleas of the County of Lycoming vested with the jurisdiction of local tax appeals by or pursuant to 41 Pa.C.S. §5571(b).

3. Decisions by the Appeals Board shall be made according to principles of law and equity.

(Ord.99-02-1, 5/10/1999, Schedule 1, §104)

§24-517 Conduct of Appeals.

1. A taxpayer may or may not choose to be represented by a taxpayer representative. The taxpayer representative may be a lawyer, certified public accountant, accountant or other tax advisor possessing appropriate tax training to represent taxpayers in tax appeals. The taxpayer must submit a written authorization to use a taxpayer representative. However, a simple letter signed by a taxpayer authorizing representation will be accepted as authorization. Such authorization shall include the representative's name, address and telephone number.

2. Copies of notices or communications may be sent by the Tax Administrator or other representative of the political subdivision to the taxpayer's representative. However, the original notice or communications will always be sent directly to the taxpayer. Action taken by the taxpayer's authorized representative (for example, requesting an extension of time or submitting factual information) shall have the same force and effect as if taken directly by the taxpayer.

3. The final decision shall be in writing and signed by a representative of the Appeals Board. Final decision shall be mailed to the taxpayer, with a copy also mailed to the taxpayer's authorized representative (if any).

(Ord.99-02-1, 5/10/1999, Schedule 1, §105)

§24-518 Refunds.

1. A taxpayer who has paid an eligible tax may file a written request for refund or credit. A request for refund shall be made within 3 years of the due date, as extended, for filing the report or tax return, or one year after actual payment of the tax, whichever is later. If no report is required, the request shall be made within 3 years after the due date for payment of the tax or within 1 year after actual payment of the tax, whichever is later.

2. A tax return filed by the taxpayer showing an overpayment shall be deemed to be a written request for a cash refund unless otherwise indicated on the tax return.

3. A request for refund under this Section shall not be considered a petition and shall not preclude a taxpayer.

4. For amounts paid as a result of a notice asserting or informing a taxpayer of an underpayment, a written request for refund shall be filed within 1 year of the date of payment.

(Ord.99-02-1, 5/10/1999, Schedule 1, §106)

§24-519 Disclosure Statement and Taxpayer Notice.

Any taxpayer contacted by the Tax Administrator regarding the assessment, audit, determination, review or collection of an eligible tax will receive a Taxpayer Notice. The notice shall be incorporated into any other correspondence sent to a taxpayer by the Tax Administrator regarding the assessment, audit, determination, review or collection of tax. The notice shall be substantially in the following form:

A. You are entitled to receive a disclosure statement that sets forth a written explanation of your rights with regard to the assessment, audit, determination, review, appeal, enforcement, refund and collection of any local taxes by calling Melanie McCoy, Tax Collector, at 570-584-2098 during the hours of 6:00 p.m. to 8:00 p.m. on Monday and 1:00 p.m. to 4:00 p.m. on Wednesday.

B. You may request a copy in person, by telephone or by mailing a request to the following address: 67 Reservoir Road, Hughesville, PA 17737.

C. The disclosure statement will be made available to taxpayers upon request at no charge to the taxpayer, including mailing costs. In general, the Tax Administrator will make reasonable efforts to supply all taxpayers with a copy of the disclosure statement.

(Ord. 99-02-1, 5/10/1999, Schedule 1, §19)

§24-520 Interest on Overpayment.

1. General Rule. All overpayments of an eligible tax made to the Local Government shall bear simple interest from the date of overpayment of such eligible tax until the date of resolution.

2. Interest Rate. Interest on overpayments shall be paid at the same rate as the Commonwealth of Pennsylvania is required to pay pursuant to §806.1 of the Act of April 9, 1929 (P.L. 343 No. 176), known as the Fiscal Code (72 P.S. §1 et seq.) As of December 1998, this interest rate is currently 9% annually (.00247 % daily).

3. Exceptions to Payments of Interest.

A. No interest shall be paid if an overpayment is refunded or applied against any other eligible tax, interest or penalty due to the Local Government within 75 days after the last date prescribed for filing the report or tax return of the tax liability or within 75 days after the date the return or report of the liability is due is filed, whichever is later.

B. Interest is not required to be paid on taxpayer overpayments of interest or penalty(ies).

4. Acceptance of Refund Check. The taxpayer's acceptance of a refund check from the Tax Administrator or political subdivision shall not prejudice any right of the taxpayer to claim any additional overpayment and interest thereon. Tender of a refund check by the Local Government shall be deemed to be acceptance of the check by the taxpayer for purposes of this subsection.

5. Definitions.

A. The following words and phrases shall have the meanings given to them in this subsection.

(1) Date of Overpayment. The later of the date paid or the date the tax is deemed to have been overpaid as follows:

(a) Any tax actually deducted and withheld at the source shall be deemed to have been overpaid on the last day for filing the report for the tax period, determined without regard to any extension of time for filing.

(b) Any amount overpaid as estimated tax for the tax period shall be deemed to have been overpaid on the last day for final report for the tax period, determined without regard to any extension of time for filing.

(c) An overpayment made before the last day prescribed for payment shall be deemed to have been paid on the last day.

(d) Any amount claimed to be overpaid with respect to which a lawful administrative review or appellate procedure is initialed shall be deemed to have been overpaid 60 days following the date of initiation of the review or procedure.

(e) Any amount shown not to be due on an amended income or earned income and net profits tax return shall be deemed to have been overpaid 60 days following the date of filing of the amended income tax return.

(2) Date of Resolution. The date the overpayment is refunded or credited as follows:

(a) For a cash refund, a date preceding the date of the refund check by not more than 30 days.

(b) For a credit for an overpayment, the date of the Tax Administrator's notice to the taxpayer of the determination of the credit; or the due date for payment of the eligible tax against which the credit is applied, whichever first occurs. For a cash refund of a previously determined credit, interest shall be paid on the amount of the credit from a date 90 days after the filing of a request to convert the credit to cash refund to a date preceding the date of the refund check by not more than 30 days, whether or not the refund check is accepted by the taxpayer after tender.

(Ord.99-02-1, 5/10/1999, Schedule 1, §108)

§24-521 Abatement of Certain Interest and Penalty.

1. Errors and Delays. The purpose of this provision is to provide, in the discretion of the Tax Administrator, a mechanism to abate (i.e., reduce) interest and/or penalties where an underpayment is the result of an error or delay in performance by a representative of the Tax Administrator. Accordingly, in the case of any underpayment, the Tax Administrator, in its discretion, may offer to abate all or any part of the interest relating to an eligible tax for any period for any one or all of the following reasons:

A. Any underpayment of eligible tax finally determined to be due, which is attributable in whole or in part to any error or delay by the Tax Administrator in the performance of a ministerial act. For purposes of this paragraph, an error or delay shall be taken into account only if no significant aspect of the error or delay can be attributed to the taxpayer and after the Tax Administrator has contacted the taxpayer in writing with respect to the underpayment of tax finally determined to be due or payable.

B. Any payment of an eligible tax to the extent that any error or delay in the payment is attributable to an officer, employee or agent of the Tax Administrator being erroneous or dilatory in performance of a ministerial act. The Tax Administrator shall determine what constitutes timely performance of ministerial acts performed under this subsection.

(1) Abatement of any penalty or excess interest due to erroneous written advice by the Tax Administrator. The Tax Administrator shall abate any portion of any penalty of excess interest attributable to erroneous advice furnished to the taxpayer in writing by an officer, employee or agent of the Tax Administrator acting the officer's employee's or agent's official capacity if:

(a) The written advice was reasonably relied upon by the taxpayer and was in response to a specific written request of the taxpayer.

(b) The portion of the penalty or addition to tax or excess interest did not result from a failure by the taxpayer to provide adequate or accurate information to the Tax Administrator.

(B) Notwithstanding the foregoing, it shall be in the sole discretion of the Tax Administrator whether or not to provide written tax advice to a taxpayer. Taxpayers shall not have any right to compel the Tax Administrator to provide written tax advice.

(Ord. 99-02-1, 5/10/1999, Schedule 1, §109)

§24-522 Application of Payments.

Unless otherwise specified by the taxpayer, all voluntary payments of an eligible tax shall be prioritized by the Tax Administrator in the following order:

A. Tax.

B. Interest.

C. Penalty.

D. Any other fees or charges.

(Ord. 99-02-1, 5/10/1999, Schedule 1, §110)

§24-523 Installment Agreements.

The Tax Administrator has the discretion to enter into written agreements with any taxpayer under which the taxpayer is allowed to satisfy liability for tax in installment payments if the Tax Administrator determines that the installment agreement will facilitate collection.

A. Extent to which installment agreements remain in effect.

(1) Except as otherwise provided in this subsection, any installment agreement entered into by the Tax Administrator under this Section shall remain in effect for the term of the agreement.

(2) The Tax Administrator may terminate any prior installment agreement entered into under this Section if:

(a) Information which the taxpayer provided to the Tax Administrator prior to the date of the installment agreement was inaccurate, false, erroneous or incomplete in any manner, determined in the reasonable discretion of the Tax Administrator

(b) The Tax Administrator reasonably believes and has determined that collection of the eligible tax under the installment agreement is in jeopardy.

B. Tax Administrator finds that the financial condition of the taxpayer has significantly changed, the Tax Administrator may unilaterally alter, modify or terminate the installment agreement, but only if the following conditions are satisfied:

(1) The Tax Administrator provides a notice of its findings to the taxpayer no later than 30 days prior to the date of change of the installment agreement.

(2) The notice given by the Tax Administrator to the taxpayer provides the reasons why the Tax Administrator believes that a significant change, justifying a change to the installment agreement, has occurred.

C. The Tax Administrator may unilaterally and without notification alter, modify or terminate an installment agreement entered into by the Tax Administrator under this Section if the taxpayer fails to do any of the following:

(1) Pay any installment at the time it is due under the installment agreement.

(2) Pay any other liability relating to an eligible tax at the time the liability is due.

(3) Provide a financial condition update as requested by the Tax Administrator.

D. No administrative appeal is permitted in the event of an alteration, modification or termination of an installment agreement. However, an appeal may be made to the Court of Common Pleas of this County.

E. Prepayment permitted. Nothing in this Section shall prevent a taxpayer from prepaying in whole or in part any eligible tax under any installment agreement with the Tax Administrator.

(Ord.99-02-1, 5/10/1999, Schedule 1, §111)

§24-524 Confidentiality of Tax Information.

1. Any information obtained by the Tax Administrator or Appeals Board, or any of their respective officers, agents, legal counsel, financial accountants, or employees as a result of any audit, assessment, return, report, investigation, hearing, or verification of a taxpayer's confidential tax information. It shall be unlawful, except for official purposes or as provided by laws, for such persons to:

A. Divulge or make known in any manner any confidential information obtained through any audit, return assessment, investigation, report, investigation, appeal, hearing or verification of a taxpayer to any person other than the taxpayer or the taxpayer's authorized representative.

B. Permit confidential tax information or any book containing any abstract or particulars thereof to be seen or examined by any person other than the taxpayer or the taxpayer's authorized representative.

C. Print, publish or make known in any manner any confidential tax information of a taxpayer.

2. An offense under this Section is a misdemeanor of the third degree and, upon conviction thereof, a fine of not more than $2,500 and costs, or a term of imprisonment for not more than 1 year, or both, may be imposed on the offender. If the offender is an officer or employee of the Tax Administrator or the Appeals Board, the officer or employee shall be dismissed from office or discharged from employment.

(Ord.99-02-1, 5/10/1999, Schedule 1, §112)

§24-525 Collections.

If after the decision of an appeal, or if no appeal is requested by a taxpayer, the Tax Administrator may engage in efforts to collect any eligible tax determined to be legally due. Such efforts may include, but shall not be limited to, obtaining additional information, auditing taxpayer records, compromising the amount of tax, interest, or penalty owed, obtaining liens on the taxpayer's property, or obtaining wage attachments, levies and seizures of the taxpayer's property. As provided in §24-523 of these regulations, the Tax Administrator may enter into a written installment agreement with the taxpayer if the Tax Administrator determines that an installment agreement will facilitate collection. The Tax Administrator also reserves the right to seek criminal prosecution of a taxpayer in appropriate circumstances.

(Ord.99-02-1, 5/10/1999, Schedule 1, §113)

C. Request for Extension of Time to Provide Information

§24-531 Taxpayers Rights.

This notice explains certain rights you have with respect to the request for information. You should read this notice carefully, as your rights may expire if you do not follow the instructions within prescribed time periods.

A. Under Pennsylvania law, we are required to allow you 30 calendar days to respond to our request for information. This 30-day period is measured from our date of mailing the request for information. You must respond by either providing our Tax Administrator with the requested information, or requesting an extension of time in which to provide the information that we have requested. If you need an extension of time, please send a written request, specifying the reasons for the extension and the facts supporting those reasons, to the attention of the following person at the following address: Melanie McCoy, Tax Collector, 67 Reservoir Road, Hughesville, PA 17737.

B. A reasonable extension of time will be granted for good cause. Absent from extraordinary circumstances, we will grant no longer than a 30-day extension of time. The Tax Administrator will notify you in writing of whether an extension of time has been granted. If the request is granted, the Tax Administrator also will inform you of the amount of the time extension. If your request for an extension of time is denied, the Tax Administrator will inform you of the basis for the denial and that you must provide the requested information immediately.

(Ord. 99-02.1, 5/10/1999, Schedule 1A)

D. Disclosure Statement under the Local Taxpayers Bill of Rights

§24-541 Obligation of Taxpayers.

It is the obligation of all taxpayers to file all local tax returns voluntarily and pay all local taxes to which they are subject. However, when the duly appointed or elected tax collector or tax collection agency for the Municipality and/or school district in which the taxpayer resides determines that a required return has not been filed, or a tax liability has not been paid, the Local Taxpayers Bill of Rights grants certain legal rights to taxpayers, and imposes obligations on taxing authorities to ensure that equity and fairness guide local governments in the collection of taxes. In addition, the Local Taxpayers Bill of Rights provides the local government entity with certain legal methods to enforce taxpayer obligations. This disclosure statement sets forth your rights as a taxpayer in connection with any audit, examination, appeal or refund claim of taxes for the Township of Wolf, and any enforcement or collection actions taken by the tax collector (the "Tax Administrator") on behalf of the Township of Wolf.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-542 Applicability/Eligible Taxes.

1. This disclosure statement applies to all eligible taxes levied by the Township of Wolf. For this purpose, eligible taxes do not include real property taxes. The specific eligible tax(es) levied by the Township of Wolf are:

A. Per capita tax.

B. Earned income tax.

2. Unless expressly provided in the Local Taxpayers Bill of Rights, the failure of any person acting on behalf of the Tax Administrator to comply with any provisions of this disclosure statement, related regulations or the Local Taxpayers Bill of Rights will not excuse the taxpayer from paying the taxes owed.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-543 Audit/or Examinations.

1. If we contact you about your tax return or payment of any eligible taxes, we will send you a letter with either a request for more information or a reason why we believe a change to your return or taxes may be needed. If we request information, you will have 30 calendar days from the date of the mailing to respond. Reasonable extensions of such time will be granted upon application for good cause. We will notify you of the procedures to obtain an extension with our initial request for tax information. Our initial inquiry may include taxes required to be paid or tax returns required to be filed no more than 3 years prior to the mailing date of our notice. If you give us the requested information or provide an explanation, we may or may not agree with you. If we do not agree with you, we will explain in writing our reasons for asserting that you owe us tax (which we call "an underpayment"). Our explanation will include:

A. The tax period or periods for which the underpayment is asserted.

B. The amount of the underpayment detailed by tax period.

C. The legal basis upon which we have relied to determine that an underpayment exists.

D. An itemization of the revisions made by our return or report that results in our decision that an underpayment exists if you agree with our changes, you should pay the additional tax.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-544 Requests for Prior Year Returns.

1. An initial request by the Tax Administrator into prior year returns may cover tax returns required to be filed as far back as 3 years prior to the mailing date of the notice.

2. If the Tax Administrator determines that the taxpayer failed to file a tax return, under reported income or failed to pay a tax for one or more of the tax periods covered by the initial request, the Tax Administrator may request additional information.

3. The Tax Administrator may also require a taxpayer to provide copies of Federal and Pennsylvania tax returns when the Tax Administrator can show that the taxpayer's Federal tax return(s) is(are) reasonably necessary for the enforcement or collection of tax, and the information is not available from other sources or the Pennsylvania Department of Revenue.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-545 Appeals of Decisions.

1. If we notify you that you owe more tax (what we call an assessment) and you do not agree with our decision, you may appeal or seek review by filing a petition for reassessment within 90 days of the date of the mailing of the assessment notice. The petition must either be in our hands or postmarked by the U.S. Postal Service within this 90-day period. Receipts from other carriers (such as Federal Express) are not accepted as proof of delivery.

2. Your petition must explain the legal basis for your position and include all supporting documents. For your convenience, a form for submission of a petition is available at 695 Rt. 405 Highway, Hughesville, PA 17737. Your petition must be mailed or delivered to the attention of the Township Secretary at the following address: 695 Rt. 405 Highway, Hughesville, PA 17737. A decision by the governing body in executive session, will be made within 60 days of the date your complete and accurate petition is received. If you do not agree with the decision of the governing body in executive session, you may appeal to the appropriate Court of Common Pleas of Lycoming County. You must file your appeal within 30 days after notice of the decision of the Governing Body in executive session.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-546 Refunds.

1. You may file a claim for refund (Refund Claim) if you think you paid too much tax (what we call an "overpayment"). You must file the refund claim within 3 years of the due date for filing the return as extended or 1 year after actual payment of the tax, whichever is later.

2. If no report or local tax return is required for the tax, the refund claim must be made within 3 years after the due date for payment of the tax or within 1 year after actual payment of the tax, whichever is later.

3. If your refund claim relates to amounts paid as a result of a notice asserting an underpayment of tax, your request for refund claim must be filed within 1 year of the date of payment.

4. Refund claims must be made on forms prescribed by, us and must include supporting documentation. You can obtain forms for refunds claims by contacting us at 695 Rt. 405 Highway, Hughesville, PA 17737. Your refund claim must be filed with us at 695 Rt. 405 Highway, Hughesville, PA 17737.

5. If you file a tax return showing an overpayment of tax, we will treat that as a request for a cash refund unless you indicate otherwise.

6. If your refund claim is denied, you may file a petition contesting the denial of the refund. Any petition must be filed with the same time limits that apply for a refund claim.

7. Alternatively, you may file a petition for a refund without first filing a refund claim. A hearing date will be set after your petition is received and a decision by the governing body in executive session will be made within 60 days of the date your complete and accurate petition is received.

8. The Appeals Petition form must be used to request a review of a refund claim denial. Your petition must be mailed or delivered to the attention of the Secretary, Wolf Township Board of Supervisors at the following address: 695 Rt. 405 Highway, Hughesville, PA 17737.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-547 Enforcement Procedures.

Once it has been determined that you owe a tax, we will take all action we are legally permitted to take to enforce our claim. Such action may include obtaining additional information from you, auditing your records, entering into a settlement with you of the disputed amount of the tax, or obtaining liens on your property, wage attachments, levies, and seizures and sales of your property in appropriate circumstances. We may enter into a written agreement with you for payment of the tax in installments if we believe that such an agreement will facilitate collection. We may also impose interest and applicable penalties on the tax you owe, and may seek criminal prosecution of you in appropriate circumstances.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-548 Tax Information Confidentiality.

Information gained by the Tax Administrator or governing body as a result of any audit, return, report, investigation, hearing, appeal or verification shall be confidential. However, confidentiality will not preclude disclosure for official purposes, whether in connection with legal proceedings or otherwise, and it will not preclude disclosure to the extent required by applicable law.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

§24-549 Taxpayer Complaints.

If you have a complaint about any action relating to the political subdivision's taxes, the Secretary of Wolf Township may be contacted in writing at 695 Rt. 405 Highway, Hughesville, PA 17737. This individual will attempt to facilitate resolution of your complaint by working with the appropriate personnel of the Tax Administrator and/or Governing Body.

(Ord. 99-02.1, 5/10/1999, Schedule 2)

E. Petition for Appeal and Refund Form

WOLF TOWNSHIP, LYCOMING COUNTY,

PENNSYLVANIA

PETITION FOR APPEAL AND REFUND

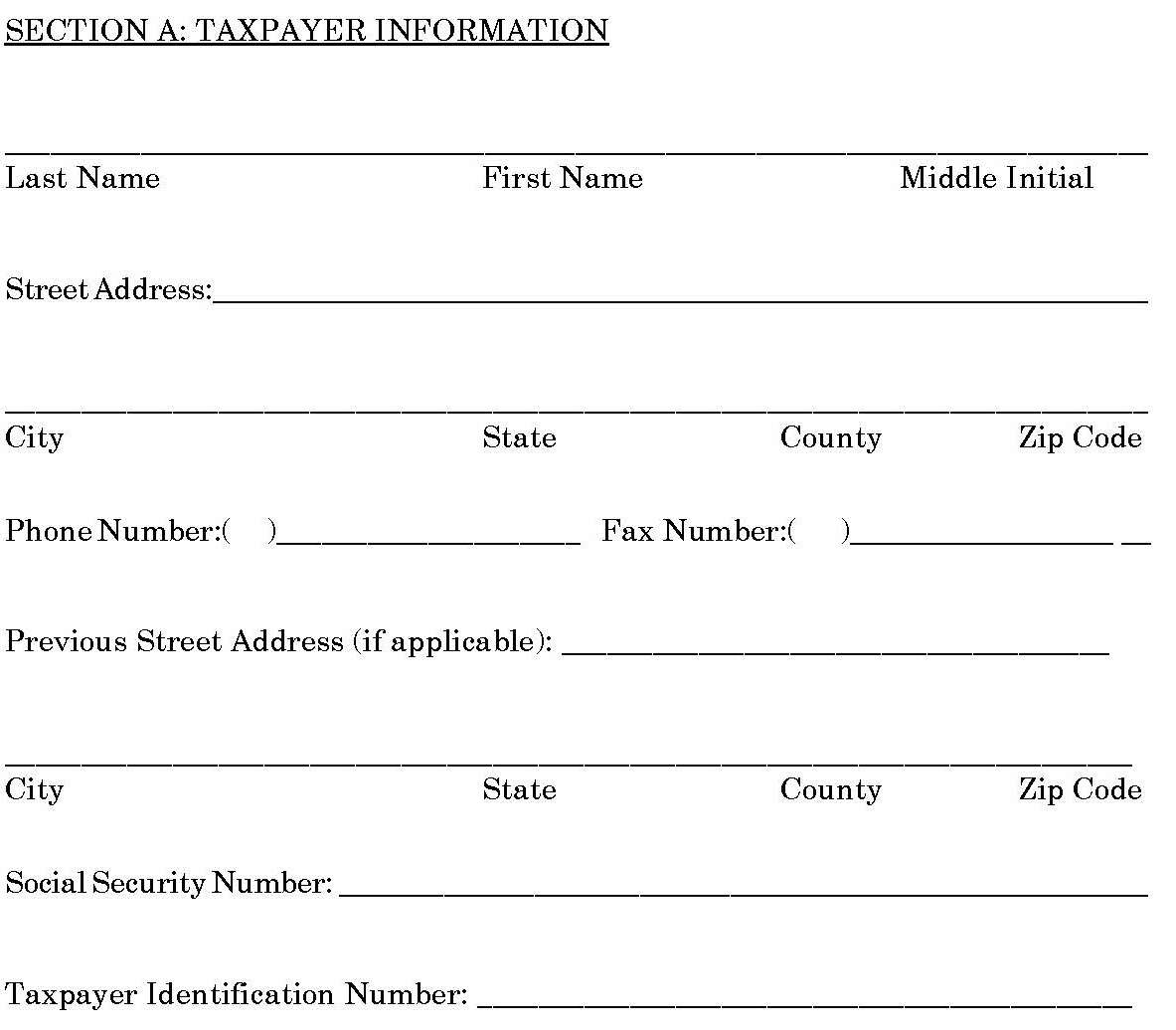

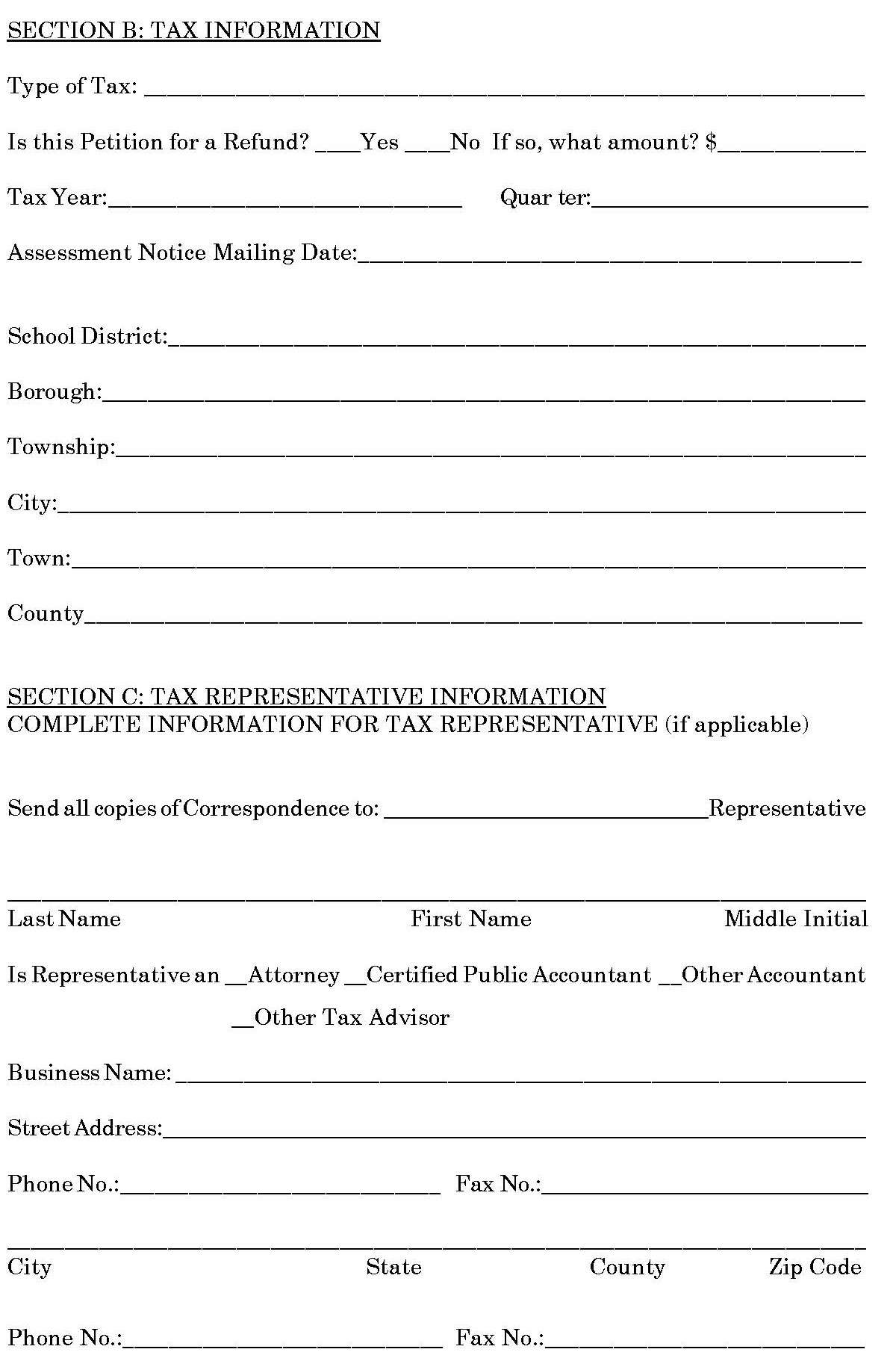

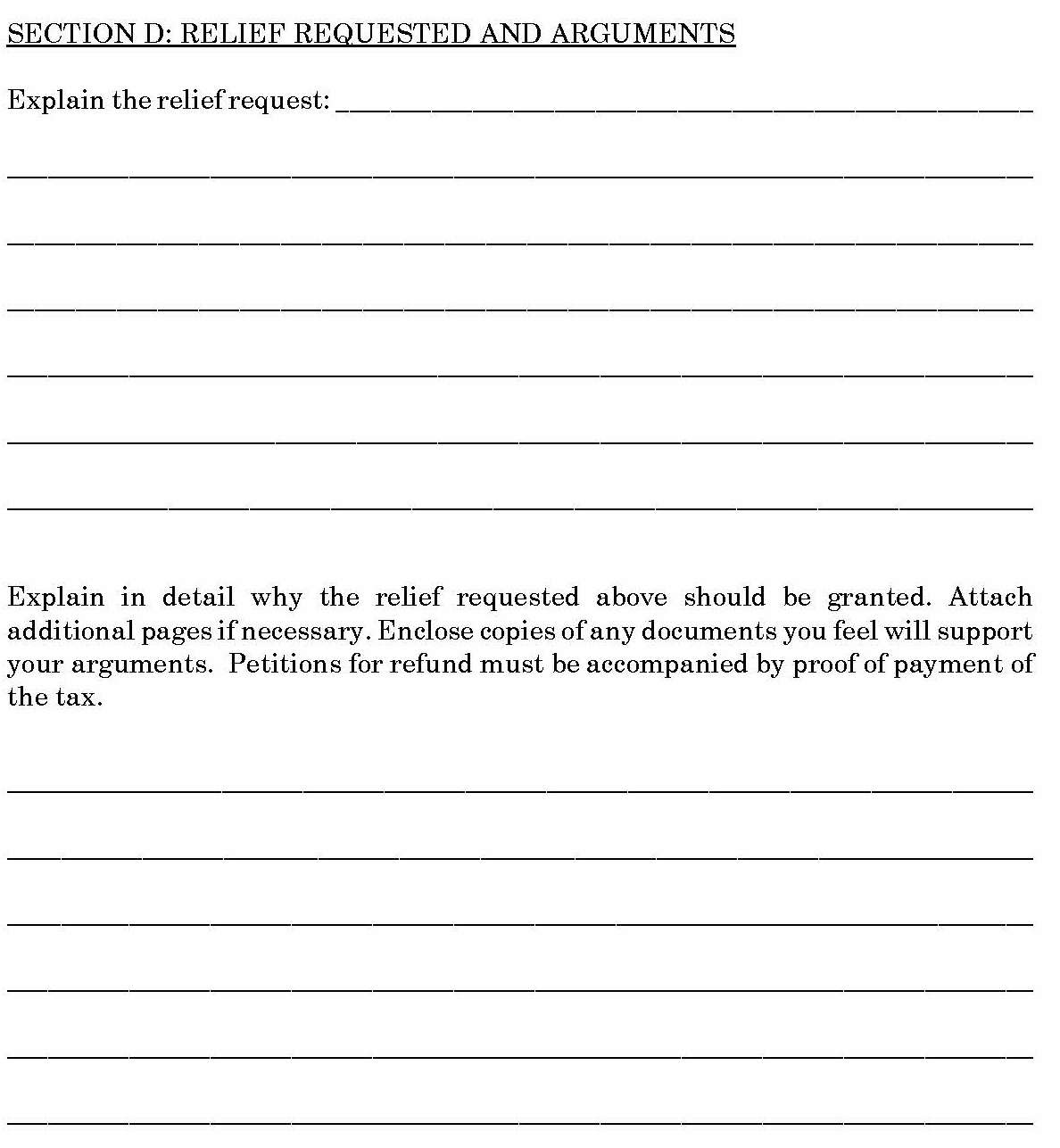

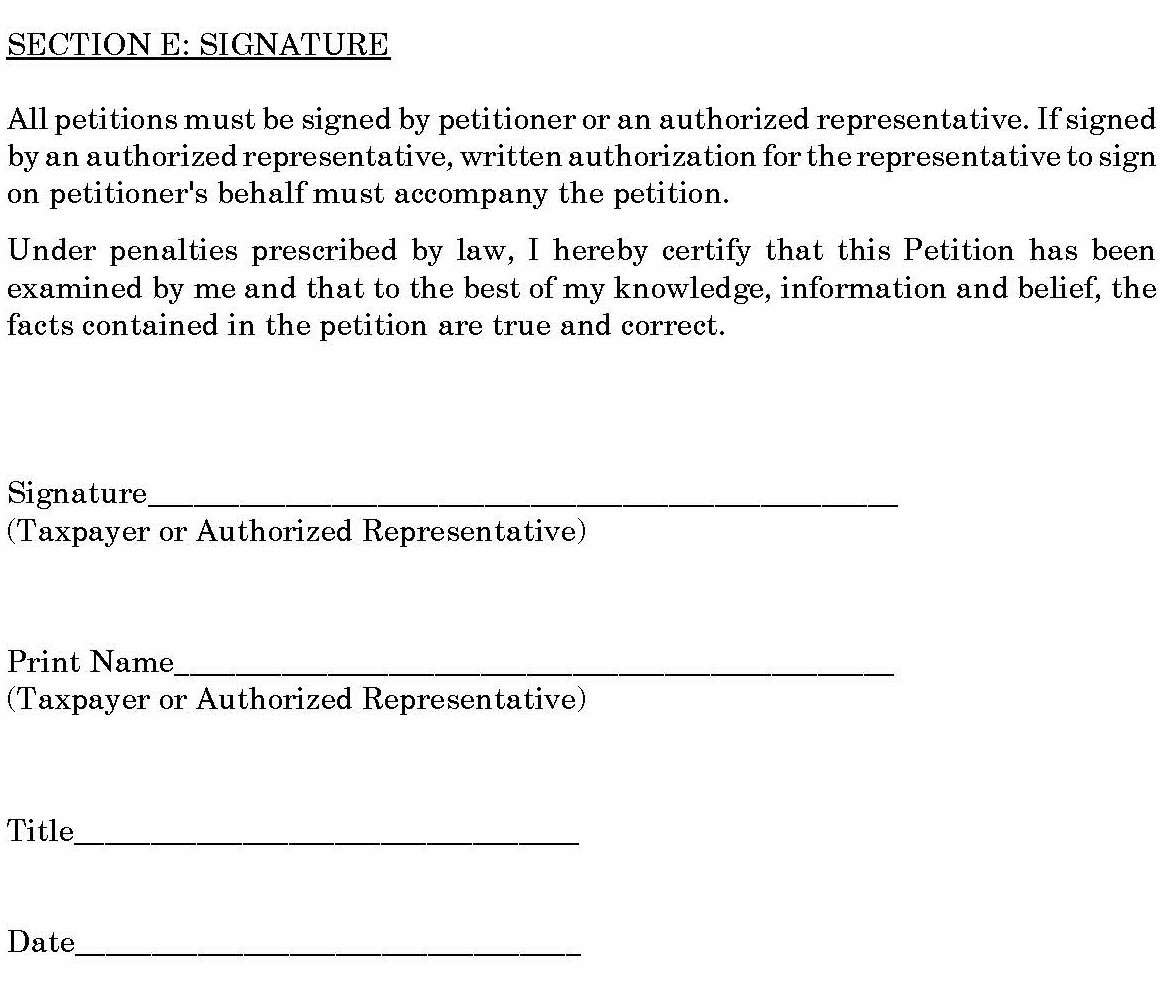

INSTRUCTIONS: This form is to be used by taxpayers appealing an assessment of tax by the Tax Administrator or an appeal of a denial of claim for refund by the Tax Administrator. Please complete the petition using blue or black ink, or type petition. Attach a copy of the assessment notice being appealed, or if seeking a refund, proof that such tax was paid. Mail this petition to the Township Secretary at 695 Rt. 405 Highway, Hughesville, PA 17737. Petitions appealing an assessment notice must be received by the governing body within 90 days of the date of the assessment notice. Petitions for refunds must be received by the Governing Body within the later of 3 years of the due date for filing the return or one year after actual payment of tax. Petitions filed via any other method are considered filed on the date received. Answer all questions below as completely as possible. If an item is not applicable, enter “N/A.”

(Ord. 99-02.1, 5/10/1999, Schedule 3)

F. Administrative Appeal Procedures Applicable to Petitions For Appeal and Refund

§24-561 General.

If the taxpayer does not agree with the local Tax Administrator's (hereinafter "Administrator") assessment or determination of refund claim, the taxpayer may file an appeal by petition to the Wolf Township Board of Supervisors requesting a review of the Administrator's assessment or determination of refund claim.

(Ord. 99-02.1, 5/10/1999, Schedule 4, §I)

§24-562 Obtaining a Hearing.

To obtain a hearing, a taxpayer must complete a petition form and timely file it with the Board of Supervisors and mail it to the Administrator's address indicated in section §24-565.4 below.

(Ord. 99-02.1, 5/10/1999, Schedule 4, §II)

§24-563 Form and Content of the Petition.

The petition must include all of the following information:

A. Petitioner's name, address, phone number and contact person (if any).

B. Petitioner's Social Security number, account number or taxpayer identification number.

C. Type of tax.

D. Tax year and/or quarter

E. School district and/or borough, township, city, town or county.

F. Name, address and phone number of authorized representative (if any).

G. Relief the petitioner is requesting.

H. Petitioner's argument(s) in support of the relief requested.

I. Signature of petitioner.

(Ord. 99-02.1, 5/10/1999, Schedule 4, §III)

§24-564 Forwarding Appeal.

1. Upon receipt of the taxpayer's petition, the Administrator shall forward the petition immediately to the Board of Supervisors.

2. The Board of Supervisors shall issue a written decision on the taxpayer's petition within 60 days of the date on which a complete and accurate petition is received from the taxpayer.

3. In evaluating and making a decision as to any petition, the Board of Supervisors shall apply the principles of law and equity.

(Ord. 99-02.1, 5/10/1999, Schedule 4, §IV)

§24-565 Deadlines for Filing.

1. Refund Petitions.

A. If a taxpayer determined that he or she has paid a tax to which he or she is not subject, a petition for refund of the overpaid local tax must be filed with the Administrator.

B. Refund petitions shall be filed within 3 years after the due date for filing the report or return, as extended or one year after actual payment of the tax, whichever is later.

C. If no report or return is required, the refund petition shall be filed within 3 years after the due date for payment of the tax to be refunded or within 1 year after actual payment, whichever is later.

2. Petitions for Reassessment.

A. Any taxpayer who disagrees with an assessment or determination of a local tax may petition the Board of Supervisors for a reevaluation of the taxpayer's assessment.

B. Petitions for reassessment of a tax shall be filed with the Administrator within 90 days of the date of the assessment notice.

3. Timely Filing.

A. A petition for refund or petition for reassessment is timely filed if the letter transmitting the petition is postmarked by the United States Postal Service on or before the final day on which the petition must be filed.

4. Mailing Address.

Petitions shall be mailed to the following address:

Melanie McCoy, Tax Collector

Attn: Wolf Township Board of Supervisors

67 Reservoir Road

Hughesville, PA 17737

(Ord. 99-02.1, 5/10/1999, Schedule 4, §V)