Chapter 3.41

MULTIFAMILY TAX EXEMPTION PROGRAM

Sections:

3.41.020 Targeted area designated.

3.41.030 Terms of the tax exemptions for multifamily housing in residential target areas.

3.41.050 Application requirements.

3.41.060 Application review and issuance of conditional certificate.

3.41.070 Extension of conditional certificate.

3.41.080 Application for final certificate.

3.41.090 Issuance of final certificate.

3.41.100 Annual compliance review.

3.41.110 Cancellation of tax exemption.

3.41.120 Appeals to hearing examiner.

3.41.010 Purpose.

The purpose of this chapter is to provide limited exemptions from ad valorem property taxation for multifamily housing as authorized by Chapter 84.14 RCW and is intended to:

A. Encourage increased residential opportunities through multiple unit housing in the urban center where commercial zoning exists;

B. Stimulate new construction or rehabilitation of existing vacant and underutilized buildings for multiple unit housing to increase housing diversity and stock;

C. Assist in directing future population growth to a mixed use, thereby reducing development pressure in other areas, reducing dependency on vehicles and encouraging urban centers; and

D. Support walkable community with affordable housing options. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.015 Definitions.

For this program only, the following terms and definitions apply. These definitions may vary from the definitions in LMC Title 21.

“Affordable housing” means residential housing that is rented by a person or household whose monthly housing costs, including utilities (as defined by the Chelan Housing Authority) other than telephone, do not exceed 30 percent of the household’s monthly income. For the purposes of housing intended for owner occupancy, “affordable housing” means residential housing that is within the means of low- or moderate-income households.

“Director” means the director of the department of community development.

“Low-income household” means a single person, family, or unrelated persons living together whose adjusted income is at or below 80 percent of the median family income adjusted for family size, for the county where the project is located, as reported by the United States Department of Housing and Urban Development.

“Moderate-income household” means a single person, family, or unrelated persons living together whose adjusted income is more than 80 percent but is at or below 115 percent of the median family income adjusted for family size, for the county where the project is located, as reported by the United States Department of Housing and Urban Development.

“Multifamily housing” equates to “multiple-unit housing” as defined in RCW 84.14.010(10) and means a building or buildings having four or more dwelling units designed for permanent residential occupancy resulting from new construction or rehabilitation or conversion of vacant, underutilized, or substandard buildings. Units may be in separate buildings (e.g., two duplexes).

“Permanent residential occupancy” means multifamily housing that provides either rental or owner occupancy on a nontransient basis. This includes owner-occupied or rental accommodation that is leased for a period of at least one month. This excludes hotels and motels that predominantly offer rental accommodation on a daily or weekly basis.

“Rehabilitation improvements” means modifications to existing structures that are vacant for 12 months or longer, and that are made to achieve a condition of substantial compliance with existing building codes or modification to existing occupied structures which increase the number of multifamily housing units.

“Substantial compliance” means compliance with local building or housing code requirements that are typically required for rehabilitation as opposed to new construction. [Ord. 1682 § 1 (Att. A), 2023.]

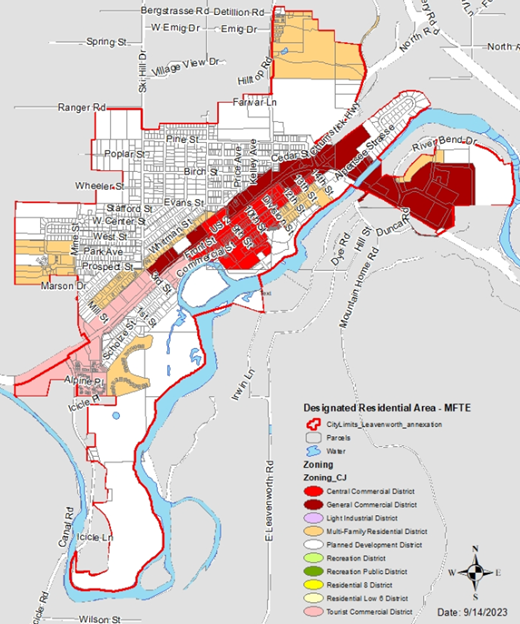

3.41.020 Targeted area designated.

The residential targeted area is defined as all commercial zoning districts and the multifamily zoning district within the city of Leavenworth (not the urban growth area).

[Ord. 1682 § 1 (Att. A), 2023.]

3.41.030 Terms of the tax exemptions for multifamily housing in residential target areas.

A. Duration of Exemption. The value of improvements qualifying under this chapter will be exempt from ad valorem property taxation as follows:

1. For 12 successive years beginning January 1st of the year immediately following the calendar year of issuance of the certificate (of occupancy), if the property otherwise qualifies for the exemption under Chapter 84.14 RCW and meets the condition committing to rent a total of 20 percent of the multifamily housing units as affordable housing units to low-income households. Fractional remainders shall be rounded up to the next whole number.

2. For 20 successive years beginning January 1st of the year immediately following the calendar year of issuance of the certificate (of occupancy), if the property owner qualifies for the exemption under Chapter 84.14 RCW and meets the condition committing to sell a minimum of 25 percent to a qualified nonprofit or local government partner that will assure permanent affordable homeownership to low-income households. Fractional remainders shall be rounded up to the next whole number. The remaining 75 percent of the units may be rented or sold at market rates.

B. Limits on Exemption. The exemption does not apply to the value of land or to the value of improvements not qualifying under this chapter or Chapter 84.14 RCW, nor does the exemption apply to increases in assessed valuation of land and non-qualifying improvements. In the case of rehabilitation of existing buildings, the exemption does not include the value of improvement construction prior to submission of the completed application required under this chapter.

C. Maximum Exemption. The city council may adopt conditions to limit the number of units that may receive an exemption, consistent with LMC 3.41.060(B).

D. Cancellation of Exemption. The exemption may be canceled under the process outlined in LMC 3.41.110. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.040 Project eligibility.

A proposed project must meet the following requirements for consideration for a property tax exemption:

A. Location. The project must be located within the residential targeted area designated defined in LMC 3.41.020.

B. Tenant Displacement. The project must not displace existing residential tenants of structures that are proposed for redevelopment, unless the applicant has provided each existing tenant housing of comparable size, quality, and price and a reasonable opportunity to relocate. Applications for new construction cannot be submitted for vacant property upon which an occupied residential rental structure previously stood during any portion of the 12-month period immediately preceding submission of the application, unless the applicant has provided each displaced tenant housing of comparable size, quality, and price and a reasonable opportunity to relocate.

C. Violation of Building Codes. Existing dwelling units proposed for rehabilitation must fail to comply with one or more standards of applicable building or housing codes in LMC Title 15; the rehabilitation improvements shall achieve a condition of substantial compliance with the applicable building, construction, and housing codes contained in LMC Title 15 and all uniform codes adopted pursuant to LMC Title 15.

D. Requalification Option. Programs shall permit existing tenants an option to qualify for a renewal if their incomes do not increase beyond 115 percent AMI.

E. Size. The project must include at least four units of multifamily housing within one or more residential structures or as part of a mixed-use development. A minimum of four new units must be constructed or at least four additional units must be added to existing occupied multifamily housing. Existing multifamily housing that has been vacant for 12 months or more does not have to provide additional units.

F. Similar Quality and Construction. Units designated as income-restricted shall be similar in size and configuration to market-rate units.

G. Permanent Residential Housing. At least 50 percent of the new, converted, or rehabilitated multifamily housing must be provided for permanent residential occupancy as defined under RCW 84.14.010(12).

H. Proposed Completion Date. New construction, conversion, or rehabilitation must be scheduled to be completed within three years from the date of approval of the application.

I. Compliance With Regulations and Standards. The project must be in compliance with adopted regulations and standards in effect at the time the application is approved.

J. Financial Analysis. The applicant shall provide a financial analysis of the impact of the exemption for the applicant.

K. Partnership With Affordable Housing Organization. The applicant shall partner with a nonprofit or government agency for the lifetime of the affordability requirements. The nature of this partnership will depend on the length of the exemption:

1. For the 12-year exemption, the property owner will coordinate with the partner organization to promote access to rent-restricted units to qualifying households.

2. For the 20-year exemption, the applicant will provide documentation that at least 25 percent of units were constructed or sold to the partner to meet the requirements under LMC 3.41.030(A)(2). Alternately, an applicant that is a nonprofit or government agency may meet this requirement itself. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.050 Application requirements.

A property owner who wishes to propose a project for a tax exemption shall complete the following procedures:

A. A complete application shall include:

1. A completed city application setting forth the grounds for the exemptions;

2. Preliminary floor and site plans of the proposed project;

3. A statement acknowledging the potential tax liability when the project ceases to be eligible under this chapter; and

4. Verification by oath or affirmation of the information submitted.

B. For rehabilitation projects, or where demolition or new construction is required, the applicant shall also submit an affidavit that existing dwelling units either have been unoccupied for a period of 12 months prior to filing the application, or that relocation requirements have been satisfied. At the city’s discretion, the applicant shall either secure from the city prior to commencement of rehabilitation improvements verification of property noncompliance with LMC Title 15, or file with the affidavit a report prepared by a registered architect identifying property noncompliance with LMC Title 15 which shall identify specific code violations and must include supporting data that satisfactorily explains and proves the presence of a violation.

C. The applicant shall pay fees, as defined in the rate and fee schedule, adopted by the city council. Additional fees to cover the county assessor’s administrative costs shall also be paid to the city.

D. The applicant shall file the required application and documentation along with the required fees with the Leavenworth community development department. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.060 Application review and issuance of conditional certificate.

A. The director of community development or their designee will review an application for completeness and fulfillment of eligibility requirements and approval criteria, return incomplete applications for correction or supplementation, and forward complete applications to the city council for review and determination.

B. The city council may approve the application if it determines that the application meets the requirements of Chapter 84.14 RCW and this chapter, and finds that:

1. A minimum of four new units are being constructed or, in the case of occupied rehabilitation or conversion within 12 months of occupancy, a minimum of four additional multifamily units are being developed; and

2. The project will not have significant individual or cumulative impacts on municipal revenue or tax obligations on property owners;

3. Defined length of initial exemption as:

a. For 12-year exemption, meeting the requirements of this chapter.

b. For a 20-year exemption, meeting the requirements of this chapter;

4. The owner has complied with all standards and guidelines adopted by the city under this chapter; and

5. The site is located within the residential targeted area designated;

6. Application fee has been paid.

C. If an application is approved, the applicant shall enter into a contract with the city, satisfactory to the city council, regarding the terms and conditions of the project. Upon council approval of the contract, the director or their designee shall issue a conditional certificate of acceptance of tax exemption which shall contain a statement by the director or their designee that the property has complied with the requirements of this chapter. The conditional certificate expires three years from the date of approval unless an extension is granted as provided in this chapter.

D. A decision to approve or deny an application shall be made within 90 days of receipt of a complete application. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.070 Extension of conditional certificate.

The conditional certificate may be extended by the director for a period not to exceed 24 consecutive months. The applicant must submit a written request stating the grounds for the extension, accompanied by a processing fee, set in the rate and fee schedule. An extension may be granted if the director determines that:

A. The anticipated failure to complete construction or rehabilitation within the requirement time period is due to circumstances beyond the control of the owner;

B. The owner has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

C. All the conditions of the original contract between the applicant and the city will be satisfied upon completion of the project. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.080 Application for final certificate.

Upon completion of the improvements agreed upon in the contract between the applicant and the city and upon issuance of a temporary or permanent certificate of occupancy, the applicant may request a final certificate of tax exemption. The applicant must file with the department the following:

A. A statement of expenditures made with respect to each multifamily housing unit and the total expenditures made with respect to the entire property;

B. A description of the completed work and a statement of qualifications for the exemptions;

C. A statement that the work was completed within the required three-year period or within any authorized extension. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.090 Issuance of final certificate.

Within 30 days of receipt of all materials required for a final certificate, the director shall determine which specific improvements satisfy the requirements of the contract, application, and this chapter.

A. If the director determines that the project has been completed in accordance with the contract between the applicant and the city and has been completed within the authorized time period, the city shall, within 10 days of the expiration of the above-stated 30-day review period, file a final certificate of tax exemption with the county assessor and Department of Commerce.

B. Denial and Appeal. The director shall notify the applicant in writing that a final certificate will not be filed if the director determines that:

1. The rehabilitation or new construction was not completed within three years of the application date, or within any authorized extension of the time limit;

2. The improvements were not completed in accordance with the contract between the applicant and the city; or

3. The owner’s property is otherwise not qualified for limited exemption under this chapter.

C. Within 14 days of receipt of the director’s denial of a final certificate, the applicant may file an appeal with the city’s hearing examiner, as provided in LMC Title 21. The applicant may appeal the hearing examiner’s decision as provided in RCW 84.14.090 to the superior court. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.100 Annual compliance review.

A. Within 30 days after the first anniversary of the date of filing the final certificate of tax exemption, and each year thereafter, for the duration of the period of the exemption, the property owner shall file an annual report with the community development director indicating the following. The director shall share the report with the county assessor, as appropriate, the report to verify exemption status.

1. A statement of occupancy and vacancy of the multifamily units during the previous year;

2. A certification that the property continues to be in compliance with the contract with the city, including, without limitation, any affordable unit requirements; and

3. A description of any subsequent improvements or changes to the property;

4. The total number and type of units in the project;

5. The number, size, and type of units meeting affordable housing requirements;

6. The total monthly rent or total sale amount of each unit produced, affordable and market rent;

7. The annual income and household size of each renter household for each of the affordable units.

B. City staff shall also conduct on-site verification of the annual report. Failure to submit the annual report may result in the tax exemption being canceled. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.110 Cancellation of tax exemption.

If the director or their designee determines the owner is not complying with the terms of the contract or with this chapter, or for any reason no longer qualifies for the tax exemption, the tax exemption will be canceled. This cancellation may occur in conjunction with the annual review or at any other time when noncompliance has been determined. If the owner intends to convert the multifamily housing to another use, the owner must notify the director and county assessor within 60 days of the change in use.

A. Effect of Cancellation. If a tax exemption is canceled due to a change in use or other noncompliance, the following taxes and penalties will apply:

1. Additional real property tax, plus interest, shall be imposed based upon the value of the nonqualifying improvements. This additional tax is calculated based upon the difference between the property tax paid and the property tax that would have been paid if it had included the value of the nonqualifying improvements dated back to the date the improvements were converted to a nonqualifying use.

2. A penalty shall be imposed amounting to 20 percent of the value of the additional property tax plus interest.

3. The interest is calculated at the same statutory rate charged on delinquent property taxes from the dates on which the additional property tax could have been paid without penalty if the improvements had been assessed at full value without regard to this tax exemption program.

4. The additional taxes, interest and penalties will become a lien on the land and attach at the time the property or portion of the property is removed from multifamily use or the amenities no longer meet applicable requirements. The lien has priority over and must be fully paid and satisfied before a recognizance, mortgage, judgment, debt, obligation, or responsibility to or with which the land may become charged or liable. The lien may be foreclosed upon expiration of the same period after delinquency and in the same manner provided by law for foreclosure of liens for delinquent real property taxes. An additional tax unpaid on its due date is delinquent. From the date of delinquency until paid, interest must be charged at the same rate applied by law to delinquent ad valorem property taxes.

B. Notice and Appeal. Upon determining that a tax exemption is to be canceled, the director or their designee shall notify the property owner by certified mail, return receipt requested. The property owner may appeal the determination by filing a notice of appeal with the city clerk within 30 days, specifying the factual and legal basis for the appeal. The hearing examiner will conduct a hearing at which all affected parties may be heard and all competent testimony received. The hearing examiner will affirm, modify, or repeal the decision to cancel the exemption based on the evidence received. An aggrieved party may appeal the hearing examiner’s decision to the Chelan County superior court as provided in RCW 84.14.110. [Ord. 1682 § 1 (Att. A), 2023.]

3.41.120 Appeals to hearing examiner.

A. An owner aggrieved by the denial of an application, extension of conditional certificate, final certification, or cancellation of an exemption under this chapter shall have the right to appeal to the hearing examiner. Any such appeal shall be in writing and shall be filed with the city within 30 days of the decision. The appeal shall specify the factual and legal basis on which the decision is alleged to be erroneous. The appeal shall be accompanied by the applicable appeal fee established by resolution of the city council. Failure to follow the appeal procedures in this section shall preclude the owner’s right to appeal.

B. An appeal shall be processed in accordance with LMC Title 21, with the exception that, in accordance with RCW 84.14.070, the owner has 30 days to file the appeal. [Ord. 1682 § 1 (Att. A), 2023.]