Chapter 18.156

AFFORDABLE HOUSING FOR NONRESIDENTIAL DEVELOPMENTS

Sections:

18.156.010 Basis and purposes.

18.156.020 Nonresidential development project defined.

18.156.030 Mixed-use projects.

18.156.060 Alternatives to the basic requirement.

18.156.070 Timing of payments.

18.156.080 Credits, changes in use, reimbursements.

18.156.090 Nonresidential affordable housing fee established.

18.156.100 Use of fee revenues.

18.156.110 Administration and enforcement.

18.156.120 Reduction, adjustment or waiver.

18.156.010 Basis and purposes.

In enacting this chapter, the city finds as follows:

(a) The Legislature of the state of California has found that the availability of housing is of vital statewide importance, and that providing decent housing for all Californians requires the cooperative participation of government and the private sector. The Legislature has further found that local governments have a responsibility to use the powers vested in them to make adequate provisions for the housing needs of all economic segments of the community. This chapter is intended to utilize the police powers of the city to enhance the public welfare by making adequate provision for the housing needs of all economic segments of the community through the cooperative participation of government and the private sector. This chapter will also help a nonresidential development project to mitigate its impact on the need for affordable housing, assist in meeting the city’s share of the region’s housing need and help implement the goals, policies, and actions specified in the housing element of the general plan.

(b) The housing element of the city’s general plan, adopted on December 2, 2014, concluded that:

(1) The shortage of affordable housing is one of the greatest challenges facing the San Francisco Bay Area. The region’s housing costs are among the highest in the nation, potentially threatening its future economic vitality, environment, and quality of life.

(2) To provide its fair share of the region’s housing need, the city must have adequate sites zoned to accommodate 5,455 housing units for the period from 2015 to 2023, including sites for 857 extremely low income units, 857 very low income units, 926 low income units, and 978 moderate income units.

(3) Fremont needs new housing to survive as a healthy city and to accommodate additional workers in its industrial and commercial areas, as well as housing for those serving the local economy. In recent years, most of the new homes constructed have been affordable to only a small fraction of the city’s population and workforce. Between 2007 and 2016, the private market did not produce sufficient unregulated housing units affordable to households earning extremely low, very low, low, or moderate incomes.

(4) The city has adopted a goal of encouraging the development of affordable housing to help meet the city’s assigned share of the regional housing need and has adopted a policy of encouraging the development of a diverse housing stock that provides a range of affordability levels. To implement this goal, the city has prepared a study demonstrating the relationship between new commercial development and the need for affordable housing and has identified a commercial linkage fee (fee on nonresidential development) that can be utilized to increase the production of affordable units at all income levels. This chapter also provides alternatives to a fee that allow for creativity in achieving the overall goal of producing and retaining affordable units.

(c) Federal and state government programs do not provide nearly enough affordable housing or subsidies to satisfy the housing needs of moderate, low, very low, and extremely low income households.

(d) Land prices are a key factor preventing development of new affordable housing. New nonresidential construction in the city which typically does not or cannot include affordable units aggravates the existing shortage of affordable housing. Providing affordable housing fees, producing affordable units off site or on site (when permitted by zoning), or dedicating land that can be used for production of affordable units as required by this chapter will help to ensure development of affordable housing.

(e) The “Affordable Housing Nexus Study, Fremont, California” study, dated October 2016 (the “Nexus Study”), prepared by Keyser-Marston Associates, Inc., quantifies the impacts of new nonresidential development on the need for affordable housing in the city and the justified affordable housing fees to mitigate those impacts. The affordable housing fees authorized by this chapter are required to be reasonably related to the need for affordable housing associated with market-rate housing as demonstrated by the most current Nexus Study.

(f) An economically balanced community is possible only if the new nonresidential development built in the city contributes to the goal of fostering an adequate supply of housing for households at all affordability levels. The collection of affordable housing fees from nonresidential projects is the most feasible method of achieving this goal, in part because housing may not be permitted within certain commercial or industrial zones due to overall compatibility of uses. Additionally, the payment of the nonresidential affordable housing fee may provide opportunities to leverage a greater number of housing units that are affordable to households with extremely low, very low, and low incomes than would on-site or off-site construction. Construction of required affordable units offsite or the donation of land suitably zoned to accommodate affordable housing may also meet city goals and is also considered as a feasible method of mitigating the impacts associated with nonresidential development projects. (Ord. 11-2017 § 1, 7-11-17.)

18.156.020 Nonresidential development project defined.

For purposes of this chapter a “nonresidential development project” shall mean a building containing commercial and/or industrial services or uses including but not limited to: assembly, automotive, commercial recreation, entertainment, hotel, motel, office, industrial, manufacturing, research and development, retail, services, warehouse/distribution, and wholesale uses. (Ord. 11-2017 § 1, 7-11-17.)

18.156.030 Mixed-use projects.

When a mixed-use project is proposed, the nonresidential portions of the project shall be subject to the provisions of this chapter and the residential portions shall be evaluated as a “residential project” as defined in Chapter 18.155. (Ord. 11-2017 § 1, 7-11-17.)

18.156.040 Basic requirement.

An affordable housing fee is hereby imposed on all nonresidential development projects as set forth in Section 18.156.090. No application for a building permit for a nonresidential development project shall be approved, nor shall any such project be constructed, without compliance with this chapter. (Ord. 11-2017 § 1, 7-11-17.)

18.156.050 Exemptions.

The following types of projects are exempt from the provisions of this chapter:

(a) Development for public use on property owned by and serving federal, state, or local government, including hospital, park, school, and utility district purposes.

(b) Additions to existing nonresidential buildings where the addition represents less than 1,000 square feet.

(c) Supportive services within the nonresidential portion of a mixed-use project that are linked to a supportive housing project.

(d) Parking garages, trash enclosures, equipment yards, external covered walkways, and atriums shall not count toward the gross square footage. Stairwells, elevator shafts, storage areas and similar spaces, however, shall count toward the gross square footage of a project.

(e) The city council may enact additional temporary exemptions or reductions in the affordable housing fee by resolution. (Ord. 11-2017 § 1, 7-11-17.)

18.156.060 Alternatives to the basic requirement.

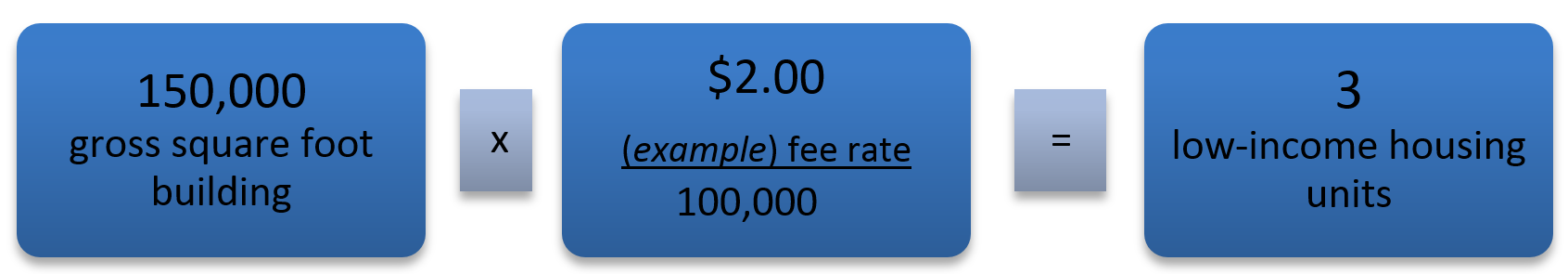

(a) Production of Affordable Units. As an alternative to payment of all or part of the affordable housing fee required under this chapter, an applicant may elect to produce affordable housing for low income households to mitigate the impacts of the development project. The units produced should generally be representative of affordable housing units produced over the past several years within Fremont in regard to square footage and number of bedrooms. Any applicant electing this alternative must demonstrate that it will construct or cause to be constructed new affordable housing units (rental or ownership) as determined by the following formula:

(1) Production Rate. The production rate shall be the affordable housing fee per gross square foot in effect at the time of project approval divided by 100,000.

Example:

(2) Requirements. Proposals to provide affordable units shall be governed by the requirements set forth in Chapter 18.155, Affordable Housing, substituting the production requirement in subsection (a)(1) of this section for the requirements in Section 18.155.030.

(3) Guidelines. The community development director may issue additional guidelines for the housing production alternatives.

(b) Property Dedication. The applicant may propose to dedicate, without cost to the city, real property for the construction of affordable housing. The city may approve property dedication pursuant to this subsection only if the proposal meets all of the following conditions:

(1) The property shall, at time of project approval, have the general plan land use and zoning needed to accommodate 120 percent of the affordable units required in subsection (a)(1) of this section;

(2) The property to be dedicated shall be suitable for construction of affordable housing at a feasible cost, shall be served by utilities, streets and other infrastructure, and shall have no hazardous materials or other conditions that constitute material constraints on development of affordable housing on the property; and

(3) The property shall be dedicated to the city prior to issuance of any building permit for the nonresidential development project. (Ord. 11-2017 § 1, 7-11-17.)

18.156.070 Timing of payments.

The fee imposed by this chapter is due and shall be collected prior to the issuance of a building permit. The collection of fees may be deferred until the certificate of occupancy or final building inspection (whichever occurs first) if approved by the community development director in accordance with city fee deferral procedures. No certificate of occupancy shall be issued for a nonresidential development project that has not paid the fees (or provided units or land for units) as required under this chapter. (Ord. 11-2017 § 1, 7-11-17.)

18.156.080 Credits, changes in use, reimbursements.

(a) Only the net new square footage shall be charged an affordable housing fee as provided in this chapter.

(b) If fees are established by use categories, and a use changes from a lower to higher fee classification, the use shall be charged the incremental difference.

(c) When a use changes from a higher to a lower fee classification, there shall be no reimbursement provided.

(d) The community development director may provide reimbursements in cases where the collected fees have not been committed and either: (1) no construction occurs (e.g., because of an expired or abandoned building permit), or (2) a planned change of use does not occur. (Ord. 11-2017 § 1, 7-11-17.)

18.156.090 Nonresidential affordable housing fee established.

(a) A nonresidential affordable housing fee is established to pay for housing affordable to households of very low, low and moderate income.

(b) Nonresidential affordable housing fees shall be set by city fee resolution or other action of the city council. Fees may be assessed on a square footage or other reasonable basis. The city council may review the fees from time to time at its sole discretion and, based on that review, may adjust the fee amount within the range justified by the most recently adopted Nexus Study and shall not exceed the cost of mitigating the impact of nonresidential development on the need for affordable housing in the city. The adopted nonresidential affordable housing fee shall be adjusted once each fiscal year by the community development director based on the annual percentage increase or decrease in an index established by the city council fee resolution; provided, that any increased adjustment does not exceed the amounts justified by the most recently adopted Nexus Study. (Ord. 11-2017 § 1, 7-11-17.)

18.156.100 Use of fee revenues.

(a) All fees collected pursuant to this chapter shall be deposited into the city of Fremont affordable housing development fund.

(b) The fees collected pursuant to this chapter and all earnings from investment of the fees shall be expended exclusively to provide or assure continued provision of affordable housing in the city through acquisition, construction, development assistance, rehabilitation, financing, or other methods, and for costs of administering these programs. A maximum of five percent of the fund may be used for administrative costs directly related to the provision of affordable housing financed by the fund. The housing shall be of a type, or made affordable at a cost or rent, for which there is a need in the city and which is not adequately supplied in the city by private housing development in the absence of public assistance and to the extent feasible shall be utilized to provide for low, very low, and extremely low income housing. (Ord. 11-2017 § 1, 7-11-17.)

18.156.110 Administration and enforcement.

(a) The community development director shall be responsible for administration and interpretation of this chapter.

(b) The city attorney is authorized to enforce the provisions of this chapter by civil action and any other proceeding or method permitted by law.

(c) Failure of any official, division, or department to fulfill the requirements of this chapter shall not excuse any applicant or owner from the requirements of this chapter. (Ord. 11-2017 § 1, 7-11-17.)

18.156.120 Reduction, adjustment, or waiver.

As part of an application for a nonresidential project, an applicant may request a reduction, adjustment, or waiver of the fee required under this chapter if the imposition of the fee would result in an uncompensated taking or other unconstitutional result. The applicant shall set forth in detail the factual and legal basis for the request, including all supporting technical documentation, and shall bear the burden of demonstrating the alleged unconstitutional result. Any reduction, adjustment, or waiver may be approved by the approval authority only to the limited extent necessary to avoid an unconstitutional result. If a reduction, adjustment, or waiver is approved, any change in the nonresidential project shall invalidate the reduction, adjustment, or waiver, and a new application shall be required for a reduction, adjustment, or waiver pursuant to this section. (Ord. 11-2017 § 1, 7-11-17.)