Chapter 3.23

MULTIFAMILY RESIDENTIAL PROPERTY TAX EXEMPTION

Sections:

3.23.030 Residential targeted area – Criteria – Designation – Recession.

3.23.040 Tax exemption for multifamily housing in residential targeted areas authorized.

3.23.060 Application procedure – Fee.

3.23.070 Application review – Issuance of conditional certificate – Denial – Appeal.

3.23.080 Extension of conditional certificate.

3.23.090 Final certificate – Application – Issuance – Denial – Appeal.

3.23.100 Annual certification.

3.23.110 Appeals to the hearing examiner.

3.23.010 Purpose.

The purposes of this chapter are:

A. To encourage increased residential opportunities, including affordable housing opportunities, and to stimulate the construction of new multifamily housing within certain zones.

B. To accomplish the planning goals required under the Washington State Growth Management Act, Chapter 36.70A RCW and countywide planning policies as implemented by the city’s comprehensive plan. (Ord. 1221 § 1, 2021)

3.23.020 Definitions.

As used in this chapter, unless the context or subject matter clearly requires otherwise, the words or phrases defined in this section shall have the indicated meanings:

A. “Administrator” shall mean the city administrator of the city of Lake Forest Park or his/her designee.

B. “Affordable housing” means residential housing that is rented by a person or household whose monthly housing costs, including utilities other than telephone, do not exceed 30 percent of the household’s monthly income.

C. “Affordable unit” means a dwelling unit as defined in this code that is reserved for occupancy by eligible households and sold or rented at an affordable price or affordable rent.

D. “AMI” means the area median income. For Lake Forest Park, the King County median income is used as the AMI.

E. “Eligible household” means one or more adults and their dependents who, as set forth in the MFTE covenant, certify that their household annual income does not exceed the applicable percent of the King County median income, adjusted for household size, and who certify that they meet all of the qualifications for eligibility, including, if applicable, any requirements for recertification on income eligibility.

F. “Household” means a single person, family, or unrelated persons living together.

G. “Household annual income” means the aggregate annual income of all persons over 18 years of age residing in the same household for at least four months.

H. “King County median income” means the median income for the Seattle-Bellevue, WA HUD Metro FMR Area as most recently determined by the Secretary of Housing and Urban Development (the “Secretary”) under Section 8(f)(3) of the United States Housing Act of 1937, as amended. In the event that HUD no longer publishes median income figures for King County, the city may use or determine such other method as it may choose to determine the King County median income, adjusted for household size.

I. “MFTE” means multifamily housing property tax exemption.

J. “MFTE contract” means the agreement between the property owner and the city regarding the terms and conditions of the project and eligibility for exemption under this chapter.

K. “MFTE covenant” means the agreement that is in a form acceptable to the city attorney that addresses price restrictions, eligible household qualifications, long-term affordability, and any other applicable topics of the affordable housing units as referenced in LFPMC 3.23.050.

L. “Multifamily housing” means a building having four or more dwelling units not designed or used as transient accommodations and not including hotels and motels. Multifamily units may result from new construction or rehabilitation or conversion of vacant, underutilized, or substandard buildings to multifamily housing.

M. “Owner” means the property owner of record.

N. “Owner-occupied” means a residential unit that is rented for fewer than 30 days per calendar year.

O. “Permanent residential occupancy” means multifamily housing that is either owner-occupied or rented for periods of at least one month.

P. “Project” means the multifamily housing or portion of the multifamily housing that is to receive the tax exemption.

Q. “Residential targeted area” means the area within the boundary as designated by LFPMC 3.23.030. (Ord. 1221 § 1, 2021)

3.23.030 Residential targeted area – Criteria – Designation – Recession.

A. Following notice and public hearing as prescribed in RCW 84.14.040, the city council may designate one or more residential targeted areas, in addition to the areas stated in subsection D of this section, upon a finding by the city council in its sole discretion that the residential targeted area meets the following criteria:

1. The residential targeted area is within an urban center as defined by Chapter 84.14 RCW;

2. The residential targeted area lacks sufficient available, desirable and convenient residential housing, including affordable housing, to meet the needs of the public who would be likely to live in the urban center if the affordable, desirable, attractive and livable residences were available; and

3. Providing additional housing opportunity in the residential targeted area will assist in achieving one or more of the following purposes:

a. Encourage increased residential opportunities within the city; or

b. Stimulate the construction of new affordable multifamily housing; or

c. Encourage the rehabilitation of existing vacant and underutilized buildings for multifamily housing.

B. In designating a residential targeted area, the city council may also consider other factors, including:

1. Whether additional housing in the residential targeted area will attract and maintain an increase in the number of permanent residents;

2. Whether providing additional housing opportunities for low and moderate income households would meet the needs of citizens likely to live in the area if affordable residences were available;

3. Whether an increased permanent residential population in the residential targeted area will help to achieve the planning goals mandated by the Growth Management Act under Chapter 36.70A RCW, as implemented through the city’s comprehensive plan; or

4. Whether encouraging additional housing in the residential targeted area supports plans for significant public investment in public transit or a better jobs and housing balance.

C. At any time, the city council may, by ordinance, in its sole discretion, amend or rescind the designation of a residential targeted area pursuant to the same procedural requirements as set forth in this chapter for original designation.

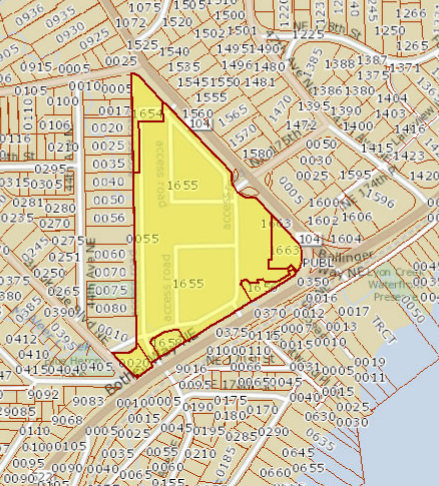

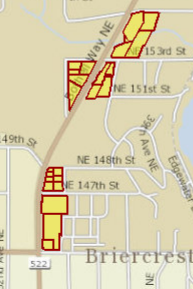

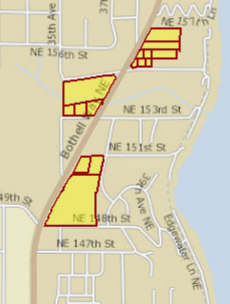

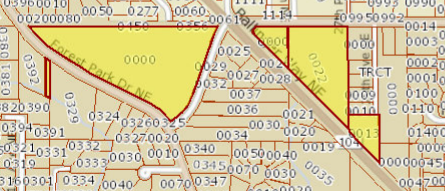

D. The following zones, as shown in Maps 1 through 4 in this section, meet the criteria of this chapter for residential targeted areas and are designated as such:

![]() Map 1 – Town center zone targeted area.

Map 1 – Town center zone targeted area.

![]() Map 2 – Southern gateway – Corridor zone targeted area.

Map 2 – Southern gateway – Corridor zone targeted area.

![]() Map 3 – RM-900 residential multifamily zone targeted area.

Map 3 – RM-900 residential multifamily zone targeted area.

![]() Map 4 – RM-1800 residential multifamily zone targeted area.

Map 4 – RM-1800 residential multifamily zone targeted area.

E. If a part of any legal lot is within a residential targeted area as shown in Maps 1 through 4 in this section, then the entire lot shall be deemed to lie within such residential targeted area. (Ord. 1221 § 1, 2021)

3.23.040 Tax exemption for multifamily housing in residential targeted areas authorized.

A. Duration and Affordability Requirements. The value of improvements qualifying under this chapter will be exempt from ad valorem property taxation. For eight or 12 successive years beginning January 1st of the year immediately following the calendar year of issuance of the certificate of tax exemption where at least the required minimum number of units are affordable units offered for rent or sale as follows:

1. In the town center zone residential targeted area:

|

Length of Exemption |

Number of Units |

Affordability Level |

|---|---|---|

|

8 years |

First 10% |

80% AMI |

|

12 years |

First 10% Second 10% |

80% AMI 60% AMI |

2. In the southern gateway – corridor zone residential targeted area:

|

Length of Exemption |

Number of Units |

Affordability Level |

|---|---|---|

|

8 years |

First 10% |

80% AMI |

|

12 years |

First 10% Second 10% |

80% AMI 60% AMI |

3. In the RM-900 residential multifamily zone residential targeted area:

|

Length of Exemption |

Number of Units |

Affordability Level |

|---|---|---|

|

8 years |

First 10% |

80% AMI |

|

12 years |

First 10% Second 10% |

80% AMI 60% AMI |

4. In the RM-1800 residential multifamily zone residential targeted area:

|

Length of Exemption |

Number of Units |

Affordability Level |

|---|---|---|

|

8 years |

First 10% |

80% AMI |

|

12 years |

First 10% Second 10% |

80% AMI 60% AMI |

B. Limits of Exemption.

1. The property tax exemption does not apply to the value of land or to the value of nonhousing-related improvements not qualifying under Chapter 84.14 RCW.

2. This chapter does not apply to increases in assessed valuation made by the assessor on nonqualifying portions of building and value of land, nor to increases made by lawful order of the King County board of equalization, the Department of Revenue, or King County, to a class of property throughout the county or specific area of the county to achieve uniformity of assessment of appraisal required by law.

3. The property tax exemption only applies to the value of improvements used for permanent residential occupancy. (Ord. 1221 § 1, 2021)

3.23.050 Project eligibility.

A. To be eligible for exemption from property taxation under this chapter, the residential units must satisfy all of the following criteria:

1. The affordable units must be located in the residential targeted area.

2. The affordable units must be within a residential or mixed-use structure containing at least four dwelling units, in which at least 50 percent of the space must provide for permanent residential occupancy.

3. The affordable units shall be intermingled with all other dwelling units in the structure.

4. The type of ownership of the affordable units shall be the same as the type of ownership of the rest of the housing units in the structure.

5. The affordable units shall consist of a range of number of bedrooms that is comparable to units in the overall structure.

6. The size of affordable units shall not be more than 10 percent smaller than the comparable dwelling units in the development, based on number of bedrooms, or less than 500 square feet for a one-bedroom unit, 700 square feet for a two-bedroom unit, or 900 square feet for a three-bedroom unit.

7. The affordable units shall be available for occupancy in the time frame comparable to the availability of the rest of the dwelling units in the structure.

8. The exterior design and the interior finish and quality of the affordable units must be compatible and comparable with the rest of the dwelling units in the structure.

9. The affordable units must be designed and used for permanent residential occupancy.

10. Each affordable unit must have its own private bathroom and private kitchen. Residential projects that utilize common kitchens and/or common bathrooms are not eligible.

11. The affordable units must be constructed and receive a certificate of occupancy after the ordinance codified in this chapter takes effect.

12. The affordable units must be completed within three years from the date of issuance of the conditional certificate of acceptance of tax exemption by the city, or within authorized extension of this time limit.

13. If the percentage of affordable units required is a fraction, then the number of required affordable units shall be rounded up to the next whole number (unit) if the fraction of the whole number is at least 0.50.

14. Prior to issuing a certificate of occupancy, an MFTE covenant in a form acceptable to the city attorney that addresses price restrictions, eligible household qualifications, and other applicable topics shall be recorded with the King County recorder’s office. This MFTE covenant shall be a covenant running with the land and shall be binding on the assigns, heirs, and successors of the owner. Affordable units that are provided under this chapter shall remain affordable from the date of initial occupancy through the life of the project, which ends when the structure including the multifamily project is no longer in use. (Ord. 1221 § 1, 2021)

3.23.060 Application procedure – Fee.

A. The owner of property applying for exemption under this chapter shall submit an application to the administrator, on a form established by the administrator. The owner shall verify the contents of the application by oath or affirmation. The application shall contain the following information:

1. A brief written description of the project, including phasing if applicable, that states which units are proposed for the exemption and whether the request is for eight or 12 years.

2. Preliminary schematic site and floor plans of the multifamily units and the structure(s) in which they are proposed to be located.

3. A table of all units in the project listing unit number, square footage, unit type (studio, one bedroom, etc.), and indicating those proposed for the exemption.

4. If applicable, information describing how the applicant will comply with the affordability requirements in LFPMC 3.23.040 and 3.23.050.

5. A statement from the owner acknowledging the potential tax liability when the property ceases to be eligible for exemption under this chapter.

6. Any other information deemed necessary or useful by the administrator.

B. At the time of application under this section, the applicant shall pay to the city an initial application fee established by resolution. If the application is denied, the city may retain that portion of the application fee attributable to its own administrative costs and refund the balance to the applicant.

C. The complete application shall be submitted any time before, but no later than, the date the certificate of occupancy is issued under LFPMC Title 15. (Ord. 1221 § 1, 2021)

3.23.070 Application review – Issuance of conditional certificate – Denial – Appeal.

A. The administrator shall approve or deny an application under this chapter within 90 days of receipt of the complete application. The administrator shall use the criteria listed in this chapter and Chapter 84.14 RCW to review the proposed application. If the application is approved, the owner shall enter into an MFTE contract with the city regarding the terms and conditions of the project and eligibility for exemption under this chapter. The mayor shall be the authorized signatory to enter into the contract on behalf of the city. Following execution of the MFTE contract, the administrator shall issue a conditional certificate of acceptance of tax exemption. The certificate must contain a statement by the administrator that the property has complied with the required finding indicated in RCW 84.14.060. The conditional certificate shall expire three years from the date of approval unless an extension is granted as provided in this chapter.

B. If the application is denied, the administrator shall issue a notice of denial stating in writing the reasons for the denial and send the notice of denial to the applicant’s last known address within 10 days of the denial.

C. An applicant may appeal the administrator’s notice of denial of the application in accordance with LFPMC 3.23.110. (Ord. 1221 § 1, 2021)

3.23.080 Extension of conditional certificate.

A. The conditional certificate may be extended by the administrator for a period not to exceed 24 consecutive months. The applicant shall submit a written request stating the grounds for the extension, together with a fee as established by ordinance or resolution. The administrator may grant an extension if the administrator determines that:

1. The anticipated failure to complete construction or rehabilitation within the required time period is due to circumstances beyond the control of the owner;

2. The owner has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

3. All the conditions of the original contract between the owner and the city will be satisfied upon completion of the project. (Ord. 1221 § 1, 2021)

3.23.090 Final certificate – Application – Issuance – Denial – Appeal.

A. After completion of construction as provided in the MFTE contract between the owner and the city, after issuance of a certificate of occupancy and prior to expiration of the conditional certificate of exemption, the applicant may request a final certificate of tax exemption. The applicant shall file with the administrator such information as the administrator may deem necessary or useful to evaluate eligibility for the final certificate, and shall include:

1. A statement of expenditures made with respect to each multifamily housing unit, including phasing if applicable, and the total expenditures made with respect to the entire property.

2. A description of the completed work and a statement of qualification for the exemption.

3. A statement that the work was completed within the required three-year period or any approved extension.

4. If applicable, information on the applicant’s compliance with the affordability requirements in LFPMC 3.23.040 and 3.23.050.

B. Within 30 days of receipt of all materials required for a final certificate, the administrator shall determine whether the completed work is consistent with the application and MFTE contract and is qualified for limited exemption under Chapter 84.14 RCW, and which specific improvements completed meet the requirements of this chapter and the required findings of RCW 84.14.060.

C. If the administrator determines that the project has been completed in accordance with subsection A of this section, the city shall file a final certificate of tax exemption with the assessor within 10 days of the expiration of the 30-day period provided under subsection B of this section.

D. The administrator shall have recorded, or require the applicant or owner to record, with the King County recorder’s office, the MFTE contract and such other document(s) as will identify such terms and conditions of eligibility for exemption under this chapter as the administrator deems appropriate for recording, including requirements under this chapter relating to affordability of units.

E. The administrator shall notify the applicant in writing that the city will not file a final certificate if the administrator determines that the project was not completed within the required three-year period or any approved extension, or was not completed in accordance with subsection B of this section; or if the administrator determines that the owner’s property is not otherwise qualified under this chapter or if the owner and the administrator cannot agree on the allocation of the value of the improvements allocated to the exempt portion of rehabilitation improvements, new construction and multi-use new construction.

F. The applicant may appeal the city’s decision to not file a final certificate of tax exemption to the city’s hearing examiner within 30 days of issuance of the administrator’s notice as outlined in LFPMC 3.23.110. (Ord. 1221 § 1, 2021)

3.23.100 Annual certification.

A. A residential unit or units that receive a tax exemption under this chapter shall continue to comply with the contract and the requirements of this chapter in order to retain its property tax exemption.

B. Within 30 days after the first anniversary of the date the city filed the final certificate of tax exemption and each year for the tax exemption period, the property owner shall file a certification with the administrator, verified upon oath or affirmation, which shall contain such information as the administrator may deem necessary or useful, and shall include the following information:

1. A statement of occupancy and vacancy of the multifamily units during the previous year.

2. A certification that the property has not changed use since the date of filing of the final certificate of tax exemption and continues to be in compliance with the contract with the city and the requirements of this chapter.

3. A description of any improvements or changes to the property made after the filing of the final certificate or last declaration, as applicable.

4. If applicable, information demonstrating the owner’s compliance with the affordability requirements of LFPMC 3.23.040 and 3.23.050, including:

a. The total monthly rent or total sale amount of each unit; and

b. The income of each renter household at the time of initial occupancy and the income of each initial purchaser of owner-occupied units at the time of purchase for each of the units receiving a tax exemption.

5. The value of the tax exemption for the project.

6. Any additional information requested by the city in regard to the units receiving a tax exemption (pursuant to meeting any reporting requirements under Chapter 84.14 RCW).

C. Failure to submit the annual declaration may result in cancellation of the tax exemption pursuant to this section.

D. For the duration of the exemption granted under this chapter, the property shall have no violation of applicable zoning requirements, land use regulations, building codes, fire codes, and housing codes contained in this code for which the designated city department shall have issued a notice and order and that is not resolved within the time period for compliance provided in such notice and order.

E. For owner-occupied affordable units, in addition to any other requirements in this chapter, the affordable owner-occupied units must continue to meet the income eligibility requirements of LFPMC 3.23.040. In the event of a sale of an affordable owner-occupied unit to a household other than an eligible household, or at a price greater than prescribed in the contract referenced in LFPMC 3.23.070, the property tax exemption for that affordable owner-occupied unit shall be canceled pursuant to this section.

F. For property with renter-occupied dwelling units, in addition to any other requirements in this chapter, the affordable renter-occupied units must continue to meet the income eligibility requirements of LFPMC 3.23.040. In the event of a rental of an affordable renter-occupied unit to a household other than an eligible household, or at a rent greater than prescribed in the contract referenced in LFPMC 3.23.040, the property tax exemption for the property shall be canceled pursuant to this section.

G. If the owner converts the multifamily housing to another use, the owner shall notify the administrator and the county assessor within 60 days of the change in use. Upon such change in use, the tax exemption shall be canceled pursuant to this section.

H. The administrator shall cancel the tax exemption for any property or individual unit that no longer complies with the terms of the contract or with the requirements of this chapter. Upon cancellation, additional taxes, interest and penalties shall be imposed pursuant to state law. Upon determining that a tax exemption shall be canceled, the administrator shall notify the property owner by certified mail, return receipt requested. The property owner may appeal the determination by filing a notice of appeal within 30 days of the date of notice of cancellation, specifying the factual and legal basis for the appeal. The appeal shall be heard by the hearing examiner pursuant to LFPMC 3.23.110. (Ord. 1221 § 1, 2021)

3.23.110 Appeals to the hearing examiner.

A. The city’s hearing examiner is provided jurisdiction to hear appeals of the decisions of the administrator to deny issuance of a final certificate of tax exemption or cancel tax exempt status. All appeals shall be closed record and based on the information provided to the administrator when the administrative decision was made.

B. The hearing examiner’s procedures, as adopted by city council resolution, shall apply to hearings under this chapter to the extent they are consistent with the requirements of this chapter and Chapter 84.14 RCW. The hearing examiner shall give substantial weight to the administrator’s decision and the burden of proof shall be on the appellant. The decision of the hearing examiner constitutes the final decision of the city. An aggrieved party may appeal the decision to superior court under RCW 34.05.510 through 34.05.598 if the appeal is properly filed within 30 days of the date of the notification by the city to the appellant of that decision. (Ord. 1221 § 1, 2021)