Chapter 12.03

TRANSPORTATION IMPACT FEES

Sections:

12.03.010 Authority and purpose.

12.03.030 Imposition of transportation impact fees.

12.03.040 Calculation of impact fees.

12.03.065 Latecomer agreements.

12.03.080 Time of payment of impact fees.

12.03.085 Deferral of impact fee payment.

12.03.100 Establishment of impact fee account.

12.03.130 City use of collected funds.

12.03.140 Plan and fee update.

12.03.160 Existing authority unimpaired.

12.03.170 Relationship to SEPA.

12.03.180 Relationship to concurrency.

12.03.200 Options for implementation.

12.03.010 Authority and purpose.

The Richland transportation impact fee program has been developed pursuant to the city of Richland police powers, the Growth Management Act as codified in Chapter 36.70A RCW, the enabling authority in Chapter 82.02 RCW, Chapter 58.17 RCW relating to platting and subdivisions and the State Environmental Policy Act (SEPA), Chapter 43.21C RCW.

The purpose of the transportation impact fee program is to:

A. Develop a program consistent with Richland’s comprehensive plan, the six-year transportation improvement program (TIP) and the capital improvement plan (CIP), for joint public and private financing of transportation improvements necessitated in whole or in part by development within the program boundary;

B. Ensure adequate levels of transportation and traffic service consistent with the level of transportation service identified in the comprehensive plan and this title;

C. Create a mechanism to charge and collect fees to ensure that all new development bears its proportionate share of the capital costs of off-site transportation facilities directly necessitated by new development; and

D. Ensure fair collection and administration of such transportation impact fees.

The provisions of the Richland transportation impact fee program shall be liberally construed to effectively carry out its purpose in the interests of the public health, safety and welfare. [Ord. 39-04; Ord. 03-09; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.020 Definitions.

For the purposes of this chapter the following terms, phrases and words shall have the meaning given herein:

“Developer” means an individual, group of individuals, partnership, corporation, association, municipal corporation, state agency, or other person undertaking development and their successors and assigns.

“Development” means the subdivision or short platting of land or the new construction, redevelopment, or expansion of commercial, industrial, public, or any other nonresidential building, building space, or land that generates additional net new vehicular trips above the previous use.

“Development permit” means a building permit, special use or other city-issued permit required to develop property that will generate additional net new vehicular trips above the previous use.

“Equivalent single-family residential unit” means a unit of development that generates one p.m. peak hour vehicle trip per day as defined by the latest edition of the ITE Trip Generation Manual.

“Fair market value” means the price that a property will bring in a competitive and open market under all conditions of a fair sale, the buyer and seller each prudently knowledgeable, and assuming the price is not affected by undue stimulus, measured at the time of the dedication to local government of land or improved transportation facilities.

“Off-site transportation improvements” means those transportation capital improvements designated in the comprehensive plan or capital improvement plan adopted by the city that serve the transportation needs of more than one development and that are located outside the boundary of the permitted project.

“Public facilities” means the following capital facilities owned or operated by government entities: public streets, roads, and bicycle and pedestrian facilities that were designed with multimodal commuting as an intended use.

“Transportation impact fee” means a monetary charge imposed on new development for the purpose of mitigating off-site transportation impacts that are a direct result of the proposed development.

“Transportation impact zone” means an identified transportation shed boundary as depicted on the official plan map with similar travel patterns that will benefit from a group of planned improvement projects. [Ord. 39-04; Ord. 03-09; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.030 Imposition of transportation impact fees.

Transportation impact fees imposed in this program:

A. Shall only be imposed for system improvements that are reasonably related to the new development;

B. Shall not exceed a proportionate share of the costs of system improvements that are reasonably related to the new development;

C. May be collected and spent only for system improvements, which are provided for in the transportation element of the capital improvement plan and comprehensive land use plan;

D. Shall not be imposed to mitigate the same off-site transportation facility impacts that are mitigated pursuant to the State Environmental Policy Act (SEPA) or any other law;

E. Shall not be used to correct existing transportation system deficiencies as of the date of adoption of this plan; and

F. Shall be collected only once for each development, unless changes or modifications to the development are proposed which result in greater direct impacts on transportation facilities than were considered when the development was first approved. [Ord. 39-04; Ord. 03-09; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.040 Calculation of impact fees.

A. The method of calculating the transportation impact fees in this program incorporates, among other things, the following:

1. The cost of public streets and roads necessitated by new development;

2. An adjustment to the costs of the public streets and roadways for past or future SEPA mitigation payments made by previous development to pay for particular system improvements that were prorated to the particular system improvement;

3. The availability of other means of funding public street and roadway improvements; and

4. The methods by which public street and roadway improvements were financed.

B. The fee per trip shall be as follows:

|

|

Effective January 1, 2024 |

|---|---|

|

Zone 1 |

$2,647.13 |

|

Zone 2 |

$2,453.84 |

|

Zone 3 |

$4,951.56 |

|

Zone 4 |

$1,815.63 |

Beginning January 1, 2025, and every year thereafter, the transportation impact fees for all zones from the preceding year shall be adjusted based on the fourth quarter National Highway Construction Cost Index as published by the Federal Highway Administration and published in the city of Richland’s fee schedule.

The fee is established based on the calculated trips generated. For example, a single-family residence produces one unit. The fees for most common uses will be as depicted in Exhibit A – Transportation Impact Fee Schedule. Fees for uses not accurately represented in Exhibit A will be calculated based on their p.m. peak hour trip generation rates as determined by the city engineer applying the latest edition of the ITE Trip Generation Manual. Pass-by and internally captured trips will be deducted from the total trip generation in determining new development trips. As an example, a commercial building generating 150 trips with 50 being pass-by and/or internally captured trips resulting in 100 new peak hour trips will have an impact fee of 100 times the applicable zone fee.

|

Land Use Category – ITE Trip Generation, 11th Edition* |

Notes |

ITE Land Use Code |

ITE Average PM Peak Hour Trip Rate (1) |

New Trip % ** (2) |

Net New PM Peak Hour Trip Rate (3) |

Unit of Development*** |

Formula for TIF Fee per Unit of Development |

|---|---|---|---|---|---|---|---|

|

RESIDENTIAL |

|||||||

|

Single-Family Detached Housing |

2 |

210 |

0.99 |

100% |

0.99 |

Dwelling Unit |

0.99 x # of Units x Zone # TIF |

|

Single-Family Attached Housing |

2 |

215 |

0.57 |

100% |

0.57 |

Dwelling Unit |

0.57 x # of Units x Zone # TIF |

|

Multifamily Housing (Low-Rise) – 3 or less floors |

2 |

220 |

0.51 |

100% |

0.51 |

Dwelling Unit |

0.51 x # of Units x Zone # TIF |

|

Multifamily Housing (Mid-Rise) – 4 to 10 floors |

2 |

221 |

0.39 |

100% |

0.39 |

Dwelling Unit |

0.39 x # of Units x Zone # TIF |

|

Mobile Home Park |

2 |

240 |

0.65 |

100% |

0.65 |

Dwelling Unit |

0.65 x # of Units x Zone # TIF |

|

Senior (55+) Adult Housing – Single-Family |

2 |

251 |

0.30 |

100% |

0.30 |

Dwelling Unit |

0.3 x # of Units x Zone # TIF |

|

Senior (55+) Adult Housing – Multifamily |

2 |

252 |

0.25 |

100% |

0.25 |

Dwelling Unit |

0.25 x # of Units x Zone # TIF |

|

Congregate Care Facility |

2 |

253 |

0.18 |

100% |

0.18 |

Dwelling Unit |

0.18 x # of Units x Zone # TIF |

|

Assisted Living |

|

254 |

0.24 |

100% |

0.24 |

Bed |

0.24 x # of Units x Zone # TIF |

|

INSTITUTIONAL |

|||||||

|

Animal Hospital/Veterinary Clinic |

2 |

640 |

3.53 |

100% |

3.53 |

1,000 sf GFA |

3.53 x # of Units x Zone # TIF |

|

Movie Theater |

|

445 |

13.96 |

100% |

13.96 |

Movie Screens |

13.96 x # of Units x Zone # TIF |

|

Casino |

2 |

473 |

22.61 |

100% |

22.61 |

1,000 sf GFA |

22.61 x # of Units x Zone # TIF |

|

Health/Fitness Club |

3(a) |

492 |

3.45 |

75% |

2.59 |

1,000 sf GFA |

2.59 x # of Units x Zone # TIF |

|

Church |

2 |

560 |

0.49 |

100% |

0.49 |

1,000 sf GFA |

0.49 x # of Units x Zone # TIF |

|

Day Care Center |

3 |

565 |

11.12 |

56% |

6.23 |

1,000 sf GFA |

6.23 x # of Units x Zone # TIF |

|

Elementary School |

3(a) |

520 |

0.16 |

75% |

0.12 |

Student |

0.12 x # of Units x Zone # TIF |

|

Middle School/Junior High School |

3(a) |

522 |

0.15 |

75% |

0.11 |

Student |

0.11 x # of Units x Zone # TIF |

|

High School |

3(a) |

525 |

0.14 |

75% |

0.11 |

1,000 sf GFA |

0.11 x # of Units x Zone # TIF |

|

BUSINESS AND COMMERCIAL |

|||||||

|

Fast Casual |

3(e) |

930 |

12.55 |

57% |

7.15 |

1,000 sf GFA |

7.15 x # of Units x Zone # TIF |

|

Fine Dining Restaurant |

3 |

931 |

7.80 |

56% |

4.37 |

1,000 sf GFA |

4.37 x # of Units x Zone # TIF |

|

High Turnover Restaurant (Sit-Down, typically a chain) |

3 |

932 |

9.05 |

57% |

5.16 |

1,000 sf GFA |

5.16 x # of Units x Zone # TIF |

|

Fast Food Restaurant w/ Drive-Through |

3 |

934 |

33.03 |

45% |

14.86 |

1,000 sf GFA |

14.86 x # of Units x Zone # TIF |

|

Coffee/Donut Shop w/ Drive-Through Window |

3(b) |

936, 937, 938 |

38.99 |

20% |

7.80 |

1,000 sf GFA |

7.8 x # of Units x Zone # TIF |

|

Wine Tasting Room |

1, 3(a) |

970 |

7.31 |

75% |

5.48 |

1,000 sf GFA |

5.48 x # of Units x Zone # TIF |

|

Brewery Tap Room |

1, 3(a) |

971 |

9.83 |

75% |

7.37 |

1,000 sf GFA |

7.37 x # of Units x Zone # TIF |

|

Drinking Place (Pub) |

3(a) |

975 |

11.36 |

75% |

8.52 |

1,000 sf GFA |

8.52 x # of Units x Zone # TIF |

|

Shopping Center (>150K GFA) |

3 |

820 |

3.40 |

78% |

2.65 |

1,000 sf GLA |

2.65 x # of Units x Zone # TIF |

|

Shopping Plaza (40 – 150K GFA), No Supermarket |

3 |

821 |

5.19 |

60% |

3.11 |

1,000 sf GFA |

3.11 x # of Units x Zone # TIF |

|

Shopping Plaza (40 – 150K GFA), Includes Supermarket |

3 |

821 |

9.03 |

60% |

5.42 |

1,000 sf GFA |

5.42 x # of Units x Zone # TIF |

|

Strip Retail Plaza (<40K GFA) |

2, 3(d) |

822 |

6.59 |

60% |

3.95 |

1,000 sf GFA |

3.95 x # of Units x Zone # TIF |

|

Freestanding Discount Store |

3 |

815 |

4.86 |

80% |

3.89 |

1,000 sf GFA |

3.89 x # of Units x Zone # TIF |

|

Freestanding Discount Superstore (includes grocery) |

3 |

813 |

4.33 |

71% |

3.07 |

1,000 sf GFA |

3.07 x # of Units x Zone # TIF |

|

Variety Store (“Dollar Stores”) |

3 |

814 |

6.70 |

66% |

4.42 |

1,000 sf GFA |

4.42 x # of Units x Zone # TIF |

|

Discount Club |

3 |

857 |

4.19 |

66% |

2.77 |

1,000 sf GFA |

2.77 x # of Units x Zone # TIF |

|

Supermarket |

2, 3 |

854 |

8.95 |

76% |

6.80 |

1,000 sf GFA |

6.8 x # of Units x Zone # TIF |

|

Pharmacy/Drug Store with Drive-Through |

3 |

881 |

10.25 |

51% |

5.23 |

1,000 sf GFA |

5.23 x # of Units x Zone # TIF |

|

Drive-in Bank |

3 |

912 |

21.01 |

65% |

13.66 |

1,000 sf GFA |

13.66 x # of Units x Zone # TIF |

|

Convenience Store and Gas Station (based upon 4 – 5.5K GFA Store) |

3 |

945 |

22.76 |

31% |

7.06 |

Vehicle Fueling Positions |

7.06 x # of Units x Zone # TIF |

|

Automobile Sales (New) |

3(a) |

840 |

2.42 |

75% |

1.82 |

1,000 sf GFA |

1.82 x # of Units x Zone # TIF |

|

Automobile Sales (Used) |

3(a) |

841 |

3.75 |

75% |

2.81 |

1,000 sf GFA |

2.81 x # of Units x Zone # TIF |

|

Automobile Parts Sales |

3 |

843 |

4.90 |

57% |

2.79 |

1,000 sf GFA |

2.79 x # of Units x Zone # TIF |

|

Tire Store |

3 |

848 |

3.75 |

75% |

2.81 |

1,000 sf GFA |

2.81 x # of Units x Zone # TIF |

|

Quick Lubrication Vehicle Shop |

3(a) |

941 |

4.85 |

75% |

3.64 |

Servicing Positions |

3.64 x # of Units x Zone # TIF |

|

Automobile Care Center |

3(a) |

942 |

3.11 |

75% |

2.33 |

1,000 sf GLA |

2.33 x # of Units x Zone # TIF |

|

Self-Service Car Wash |

3(c) |

947 |

5.54 |

31% |

1.72 |

Wash Stalls |

1.72 x # of Units x Zone # TIF |

|

Automated Car Wash |

1, 3(c) |

948 |

77.50 |

31% |

24.03 |

Car Wash Tunnels |

24.03 x # of Units x Zone # TIF |

|

Construction Equipment Rental Store |

3(a) |

811 |

0.99 |

75% |

0.74 |

1,000 sf GFA |

0.74 x # of Units x Zone # TIF |

|

Sporting Goods Superstore |

3(d) |

861 |

2.14 |

60% |

1.28 |

1,000 sf GFA |

1.28 x # of Units x Zone # TIF |

|

Pet Supply Superstore |

1, 3(a) |

866 |

3.55 |

75% |

2.66 |

1,000 sf GFA |

2.66 x # of Units x Zone # TIF |

|

Home Improvement Superstore |

3 |

862 |

2.29 |

58% |

1.33 |

1,000 sf GFA |

1.33 x # of Units x Zone # TIF |

|

Building Materials and Lumber Store |

3(a) |

812 |

2.25 |

75% |

1.69 |

1,000 sf GFA |

1.69 x # of Units x Zone # TIF |

|

Hardware/Paint Store |

3 |

816 |

2.98 |

74% |

2.21 |

1,000 sf GFA |

2.21 x # of Units x Zone # TIF |

|

Nursery (Garden Center) |

3(a) |

817 |

6.94 |

75% |

5.21 |

1,000 sf GFA |

5.21 x # of Units x Zone # TIF |

|

Electronic Superstore |

3 |

863 |

4.25 |

60% |

2.55 |

1,000 sf GFA |

2.55 x # of Units x Zone # TIF |

|

Office Supply Superstore |

1, 3(d) |

867 |

2.77 |

60% |

1.66 |

1,000 sf GFA |

1.66 x # of Units x Zone # TIF |

|

Discount Home Furnishings Superstore |

3(a) |

869 |

1.57 |

75% |

1.18 |

1,000 sf GFA |

1.18 x # of Units x Zone # TIF |

|

Apparel Store |

3(d) |

876 |

4.12 |

66% |

2.72 |

1,000 sf GFA |

2.72 x # of Units x Zone # TIF |

|

Hotel |

3(a) |

310 |

0.59 |

100% |

0.59 |

Rooms |

0.59 x # of Units x Zone # TIF |

|

Motel |

3(a) |

320 |

0.36 |

100% |

0.36 |

Rooms |

0.36 x # of Units x Zone # TIF |

|

OFFICE |

|||||||

|

General Office |

|

710, 714, 715 |

1.50 |

100% |

1.50 |

1,000 sf GFA |

1.5 x # of Units x Zone # TIF |

|

Small Office Building (<=10K GFA) |

|

712 |

2.16 |

100% |

2.16 |

1,000 sf GFA |

2.16 x # of Units x Zone # TIF |

|

Medical-Dental Office Building (Not Adjacent to Hospital Campus) |

2 |

720 |

3.93 |

100% |

3.93 |

1,000 sf GFA |

3.93 x # of Units x Zone # TIF |

|

Business Park |

2 |

770 |

1.22 |

100% |

1.22 |

1,000 sf GFA |

1.22 x # of Units x Zone # TIF |

|

INDUSTRIAL |

|||||||

|

Industrial |

2 |

110 |

0.65 |

100% |

0.65 |

1,000 sf GFA |

0.65 x # of Units x Zone # TIF |

|

Industrial Park |

|

130 |

0.34 |

100% |

0.34 |

1,000 sf GFA |

0.34 x # of Units x Zone # TIF |

|

Manufacturing |

2 |

140 |

0.74 |

100% |

0.74 |

1,000 sf GFA |

0.74 x # of Units x Zone # TIF |

|

Warehousing/Storage |

|

150, 151 |

0.16 |

100% |

0.16 |

1,000 sf GFA |

0.16 x # of Units x Zone # TIF |

|

Industrial Suites (Flex Space) |

4 |

Weighted Average |

0.97 |

N/A |

0.97 |

1,000 sf GFA |

0.97 x # of Units x Zone # TIF |

*ITE Trip Generation Manual, Institute of Transportation Engineers, 11th Edition.

**The New Trip % reflects that not all trips are new to the transportation network. The New Trip % factor reduces the average trip rate based on average pass-by trip percentages.

***Abbreviations include: GFA = gross floor area, sf = square feet, and GLA = gross leasable area.

NOTES:

(1) ITE Trip Generation Manual (11th Edition) has less than six studies supporting this average rate. Applicants are encouraged to conduct independent trip generation studies in support of their application.

(2) The ITE Trip Generation Manual contains a regression equation which may match a proposed site better than the average rate. Typically the average rate will be used from the table above, but the traffic engineer reserves the right to consider use of the average rate if the equation clearly represents a more realistic estimate based on specific project size and scope.

(3) Uses pass-by data from ITE Trip Generation Manual Appendix for pass-by data. Notes below indicate estimates based on similar land uses.

|

Code |

Land Use |

New Trip Percentage |

|---|---|---|

|

3(a) |

No Data Available. 25% Estimated Pass-by |

75% |

|

3(b) |

No Data Available. 80% Estimated Pass-by |

20% |

|

3(c) |

Convenience Store and Gas Station |

31% |

|

3(d) |

Shopping Plaza (821) |

60% |

|

3(e) |

High Turnover Restaurant (932) |

57% |

|

Net New PM Peak Hour Trip Rate Calculation: |

ITE Average PM Peak Hour Trip Rate (1) |

X |

New Trip % (2) |

= |

Net New PM Peak Hour Trip Rate (3) |

Transportation Impact Fee Calculation: |

Net New PM Peak Hour Trip Rate (3) |

X |

Zone # TIF Per New PM Peak Hour Trip |

= |

Impact Fee/Unit of Development (4) |

X |

# of Units |

= |

Total Impact Fee |

(4) Weighted rate for industrial suites is made up of General Office (25%), Business Park (25%), Industrial Park (25%), Warehousing and Storage (25%).

(5) Some land uses may not fit this table in which case the full ITE Trip Generation Manual will be considered to determine the proper land use.

[Ord. 39-04; Ord. 03-09; Ord. 41-12 § 1; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.060 Credits.

A credit, not to exceed the impact fee otherwise payable, shall be provided for the fair market value of any dedication of land for, improvement to, or new construction of any system improvements provided by the developer, to facilities that are identified in the project list in RMC 12.03.190. The determination of “value” shall be consistent with the assumptions and methodology used by the city in estimating the capital improvement costs. For land dedications, the value of land dedicated after January 1, 2018, shall be $4.50 per square foot in residential zones. For land dedications in commercial or industrial zones, and for all dedications before January 1, 2018, the value shall be established based on a determination of fair market value at the time of dedication. [Ord. 39-04; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.065 Latecomer agreements.

Latecomer agreements may be used to recover costs of right-of-way dedications and improvements for projects included in this chapter. The developer may be eligible for a latecomer agreement if the cost of dedicated land and improvements exceed the impact fees collected from or credited to the development project. The procedure for entering into such an agreement is administered by the city and provided in Chapter 3.10 RMC. [Ord. 2023-09 § 1].

12.03.070 Applicability.

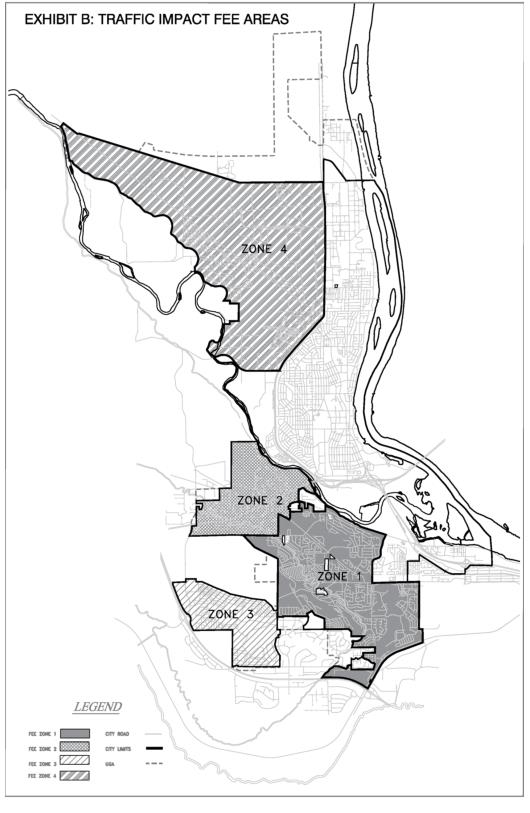

The requirements of this chapter apply to all development activity located within the boundaries of an identified transportation impact fee zone as depicted on the map titled Exhibit B. The requirements of this chapter do not apply outside the boundaries of the city or within unincorporated properties within the exterior boundary of the city. Unincorporated areas located inside of a transportation impact fee zone as depicted in Exhibit B are not considered to establish the fee levels. An unincorporated area that is annexed into the city will be assigned to the appropriate fee area and shall participate in the program prior to approval of any development proposal.

[Ord. 39-04; Ord. 03-09; Ord. 41-12 § 2; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.080 Time of payment of impact fees.

All new development within the program boundary shall pay a transportation impact fee in accordance with the provisions of this plan at the time that the applicable development permit is ready for issuance; except that permit applications for detached or attached single-family residences may defer impact fee payment, as authorized under RMC 12.03.085. The fee paid shall be the amount in effect as of the date of the permit issuance.

The impact fee amount shall be set as of the date of the development permit application. No development permit shall be issued until the impact fee is paid, except as authorized under RMC 12.03.085.

A developer may obtain a preliminary determination of the impact fee before application for a development permit.

Impact fees may be paid under protest in order to obtain a permit or other approval of development activity. [Ord. 39-04; Ord. 03-09; Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.085 Deferral of impact fee payment.

Impact fees required for a detached or attached single-family residence shall be paid either prior to the issuance of a building permit for a single-family residence or, if the applicant chooses, the impact fee can be deferred until the time that the city approves the final building inspection for the single-family residence. If an applicant chooses to defer payment of an impact fee, the following process shall be followed:

A. The amount of the impact fee shall be determined at the time the applicant applies for deferral of the impact fee.

B. The applicant shall grant a deferred impact fee lien against the property in favor of the city of Richland in the amount of the deferred impact fee. The deferred impact fee lien shall include the legal description of the property, the county assessor tax parcel number, and the property address on a form approved by the city and containing the signatures of all owners of the property.

C. The deferred impact fee lien shall be recorded by the city. The applicant shall be responsible for providing all recording fees for the deferred impact fee lien.

D. Once the impact fee has been paid, the city shall execute a release of deferred impact fee lien. The applicant shall be responsible for recording the release of deferred impact fee lien.

The city shall not approve the final inspection or issue a certificate of occupancy for any building until the impact fee has been paid in full. [Ord. 41-16 § 1; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.090 Adjustments.

The amount of fee to be imposed on a particular development may be adjusted by the public works director giving consideration to studies and other data available to the director or submitted by the developer demonstrating to the satisfaction of the director that an adjustment should be made in order to carry out the purposes of this chapter. [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.095 Exemptions.

An exemption for low-income housing in the form of a waiver of up to 80 percent of the calculated transportation impact fee may be given with the approval of the public works director or designee, provided the following conditions are met:

A. The developer is required to record a covenant or deed restriction that prohibits using the property for any purpose other than for low-income housing; and

B. The terms of the covenant or deed restriction must be reviewed and approved by the city and must, at a minimum, address price restrictions and household income limits for the low-income housing, and terms for removing the deed restriction or covenant as provided in subsection (D) of this section; and

C. The covenant must be recorded with the Benton County auditor against the development property; and

D. If the property is converted to a use other than low-income housing, the property owner must obtain permission from the city to remove the deed restriction or covenant, which permission shall be granted upon payment of the full applicable impact fee in effect at the time of the conversion.

For the purposes of this subsection, “low-income housing” is defined as housing with monthly costs, including utilities other than telephone, that do not exceed 30 percent of a household’s monthly income for a household with a family income not exceeding 80 percent of the city of Richland’s median family income. [Ord. 2023-09 § 1].

12.03.100 Establishment of impact fee account.

Impact fee receipts for the Richland transportation impact fee program shall be earmarked specifically and retained in special interest-bearing accounts. Separate accounts shall be established and maintained for each transportation impact zone. All interest shall be retained in the account and expended for the purpose or purposes for which the impact fees were imposed. [Ord. 39-04; Ord. 03-09; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.120 Refunds.

A developer may request and shall receive a refund when the developer does not proceed with the development activity for which transportation impact fees were paid, and the developer shows that no impact has resulted.

The owner must submit a request for a refund to the city in writing within one year of the date the right to claim the refund arises. Any transportation impact fees that are not expended or encumbered within the time limitations established, and for which no application for a refund has been made within this one-year period, shall be retained and expended on any project identified in the Richland transportation impact fee program.

In the event that transportation impact fees must be refunded for any reason, they shall be refunded with interest earned to the owners as they appear of record with the Benton County assessor at the time of refund.

When the city seeks to terminate any or all impact fee requirements, all unexpended or unencumbered funds shall be refunded pursuant to this section. Upon the finding that any or all fee requirements are to be terminated, the city shall place notice of such termination and the availability of refunds in a newspaper of general circulation at least two times and shall notify all potential claimants by first class mail to the last known address of claimants. Claimants shall request refunds as in this section. All funds available for refund shall be retained for a period of one year. At the end of one year, any remaining funds shall be retained by the city, but must be expended on projects identified within the Richland transportation impact fee program. This notice requirement shall not apply if there are no unexpended or unencumbered balances within an account or accounts being terminated. [Ord. 39-04; Ord. 03-09; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.130 City use of collected funds.

The city will establish a separate account for each transportation impact zone in the Richland transportation impact fee program into which developer contributions will be deposited. The only eligible costs that would be allowed to draw upon these funds would be for right-of-way acquisition, design engineering, construction, construction management and inspection, or reimbursement of funds expended on approved improvements within the plan area boundaries. Eligible expenditures would be prioritized based on:

A. Right-of-way acquisition for a project to reduce the traffic congestion on a street at or over the adopted LOS standard vehicle capacity as defined in the municipal code or comprehensive plan, as amended.

B. Construction costs for a project to reduce the traffic congestion on a street at or over the adopted LOS standard vehicle capacity as defined in the municipal code or comprehensive plan, as amended.

C. Right-of-way acquisition for a project projected to reduce the traffic congestion on a street projected to exceed the adopted LOS standard vehicle capacity based on approved preliminary plats.

D. Construction costs for an approved improvement that will reduce the traffic congestion on a collector street projected to exceed the adopted LOS standard vehicle capacity based on approved preliminary plats.

E. Bicycle and pedestrian facilities that were designed with multimodal commuting as an intended use.

F. Reimbursement of private developer construction costs for an approved street improvement included in an approved latecomer agreement.

G. Reimbursement of private developer right-of-way acquisition costs for an approved street improvement included in an approved latecomer agreement.

Transportation impact fees shall be expended or encumbered for a permissible use within 10 years of receipt, unless there exists an extraordinary or compelling reason for fees to be held longer than 10 years. The public works director may recommend to the council that the city hold fees beyond 10 years in cases where extraordinary or compelling reasons exist. Such reasons shall be identified in written findings by the council.

The finance director shall prepare an annual report on the transportation impact fee account showing the source and amount of all monies collected, earned or received and projects that were financed in whole or in part by transportation impact fees.

The city council will approve expenditures of Richland transportation impact fee program funds in accordance with the above priorities. [Ord. 39-04; Ord. 03-09; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.140 Plan and fee update.

This plan may be updated annually to evaluate the consistency of development density assumption, estimated project costs and adjust for awarded grant funding, if any. Plan updates that result in a change in impact fees will be reviewed by city council. Impact fee changes will only occur through an ordinance requiring council action. [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.150 Appeals.

A developer may appeal the amount of an impact fee determined by the city. The appeal shall be submitted in writing to the public works director. No appeal shall be permitted until the impact fees at issue have been paid.

A. The developer shall bear the burden of proving:

1. That the city committed an error in calculating the developer’s proportionate share, as determined by an individual fee calculation; or

2. That the fee was based upon incorrect data.

Appeals regarding the impact fees imposed on any development activity shall only be filed by the fee payer of the property where such development activity will occur.

B. The fee payer must first file the appeal and request a review regarding impact fees as provided herein:

1. The request shall be in writing stating the specific reasons for the appeal;

2. The appeal and request for review shall be filed no later than 14 calendar days after the fee payer pays the impact fees at issue;

3. The public works director shall issue a determination in writing within 14 calendar days after the receipt of the appeal;

4. The developer may appeal the public works director’s determination to the city council. [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.160 Existing authority unimpaired.

Nothing in this chapter shall preclude the city from requiring the applicant for a building permit, or certificate of occupancy if no building permit is required, to mitigate adverse environmental impacts of a specific development pursuant to the State Environmental Policy Act, Chapter 43.21C RCW, based on the environmental documents accompanying the underlying development approval process, and/or Chapter 58.17 RCW, governing plats and subdivisions; provided, that the exercise of this authority is consistent with the provisions of RCW 82.02.050(1)(c). [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.170 Relationship to SEPA.

All development shall be subject to environmental review pursuant to SEPA and other applicable city ordinances and regulations.

Payment of the impact fee shall constitute satisfactory mitigation of those transportation impacts related to the specific improvements identified on the project list.

Further mitigation in addition to the impact fee shall be required for identified adverse impacts appropriate for mitigation pursuant to SEPA that are not mitigated by an impact fee.

Nothing in this chapter shall be construed to limit the city’s authority to deny development permits when a proposal would result in significant adverse transportation impacts identified in an environmental impact statement and reasonable mitigation measures are insufficient to mitigate the identified impact. [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.180 Relationship to concurrency.

Development proposals that are submitted in general conformance with the assumptions made for land uses and scale/density will be deemed to meet the concurrency requirements of the Growth Management Act by paying the appropriate transportation impact fee. A development proposal not meeting such may require additional review and studies to determine concurrency. [Ord. 39-04; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.190 Project list.

The improvements included in the transportation impact fee program are:

A. Transportation Impact Zone 1.

1. Queensgate Drive (Phase 1) – Keene Road to Shockley.

2. Queensgate Drive/Keene Road intersection improvements.

3. Shockley Road – Keene Road to Columbia Park Trail.

4. Center Parkway/Leslie Road intersection improvements.

5. Leslie Road/Columbia Park Trail intersection improvements.

6. Leslie Road/Reata Road intersection improvements.

7. Gage Boulevard – Corvina Street to Queensgate.

8. Gage Boulevard – Morency Drive to Queensgate.

9. Gage Boulevard/Queensgate Boulevard intersection improvements.

10. Gage Boulevard/Leslie Road intersection improvements.

11. Leslie Road/Clearwater Avenue intersection improvements.

B. Transportation Impact Zone 2.

1. Queensgate and Westbound I-182 ramps improvements.

2. Queensgate and Duportail intersection improvements.

3. Duportail/Kennedy intersection improvements.

4. Duportail/driveway intersection improvements.

5. Queensgate Drive – Truman Avenue to city limits.

6. Kingsgate Way – Keene Road to north city limits.

7. Kingsgate/Keene intersection improvements.

8. Kingsgate/Kennedy intersection improvements.

9. Kingsgate/Queensgate intersection improvements.

10. Duportail Street/City View Drive intersection improvements.

C. Transportation Impact Zone 3.

1. Trowbridge Boulevard – Sol Duc Avenue to Gage Boulevard.

2. Dallas Road widening (four lanes).

3. Bella Coola Lane – Copper Mountain Apartments to Gage Boulevard.

4. Gage Boulevard – Reata Road to Trowbridge Boulevard.

5. Gage Boulevard – Trowbridge Boulevard to Corvina Street.

6. Gage Boulevard/Trowbridge intersection improvements.

7. Dallas Road/Trowbridge Boulevard intersection improvements.

8. Dallas Road/Ava Way intersection improvements.

9. Dallas Road/I-82 EB ramps intersection improvements.

10. Dallas Road/I-82 WB ramps intersection improvements.

11. Reata Road/Bermuda Road intersection improvements.

12. Reata Road/Morningside Parkway intersection improvements.

13. Trowbridge Boulevard/Southgate Way intersection improvements.

14. Gage Boulevard/Morningside Parkway intersection improvements.

15. Bella Coola Lane/Southgate Way intersection improvements.

16. Dallas Road/Arena Road intersection improvements.

17. Bombing Range Road/Dallas Road/Kennedy Road intersection improvements.

18. Bombing Range Road/Keene Road intersection improvements.

19. Keene Road/Kennedy Road intersection improvements.

D. Transportation Impact Zone 4.

1. SR-240/Logston Road intersection improvements.

2. SR-240/Village Parkway intersection improvements.

3. SR-240/Twin Bridges Road intersection improvements.

4. SR-240/Beardsley Road intersection improvements.

5. SR-240 widening – West of Stevens Drive to 1,000 feet west of Hagen Road.

6. SR-240 widening – 1,000 feet west of Hagen Road to 1,000 feet west of Kingsgate Way.

7. SR-240 widening – 1,000 feet west of Kingsgate Way to Village Parkway.

8. SR-240 widening – Village Parkway to Beardsley Road.

9. SR-240 widening – Beardsley Road to Vantage Properties western access.

10. Kingsgate Way – Clubhouse Lane to Van Giesen Avenue. [Ord. 39-04; Ord. 03-09; Ord. 41-12 § 3; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.200 Options for implementation.

A. As defined in the Richland transportation impact fee program, the impact fee will be designed to accomplish the following scope of work:

1. Right-of-way acquisition, not to exceed widths for the functional classification defined in RMC 24.16.110, except additional width needed for intersection improvements.

2. Traffic signal, roundabout, and intersection improvements.

3. Street improvements including asphalt pavement, bikeways, curb, gutter, sidewalk, street lighting, and storm drainage. Roadside landscaping is excluded from the impact fee scope of work. In Zone 1, pavement width beyond 32 feet, curb, gutter, bikeways, sidewalk, street lighting and storm drainage are excluded from the fee-covered scope of work and remain the responsibility of the underlying property owner.

B. Improvement costs are divided into two elements:

1. Right-of-way acquisition; and

2. Design and construction of city standard collector street section, including storm drain system, street lights, curb, gutter, bikeways, sidewalks, and listed intersection improvements. Roadside landscaping is excluded from the impact fee scope of work. In Zone 1, pavement width beyond 32 feet, curb, gutter, bikeways, sidewalk, street lighting and storm drainage are excluded from the fee-covered scope of work and remain the responsibility of the underlying property owner. [Ord. 39-04; Ord. 03-09; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].

12.03.220 Grant funds.

Grant funds acquired for identified improvements in the program will be applied to the public share of the project, if any, and then to the new development share and may result in a reassessment of required plan funding, with properties developing after the grant was acquired benefiting from lower per-trip costs. [Ord. 39-04; Ord. 03-09; Ord. 36-18 § 1; Ord. 43-21 § 1; Ord. 2023-09 § 1].