Chapter 3.27

PROPERTY TAX EXEMPTION

Sections:

3.27.030 Designation of residential targeted areas.

3.27.040 Eligibility standards and guidelines.

3.27.050 Application procedures for conditional certificate.

3.27.060 Application review and issuance of conditional certificate.

3.27.070 Application procedures for final certificate.

3.27.080 Application review and issuance of final certificate.

3.27.090 Annual compliance review.

3.27.100 Cancellation of tax exemption.

3.27.010 Purpose.

The purpose of this chapter providing for an exemption from ad valorem property taxation for multifamily housing in the residential targeted areas is to:

A. Encourage increased residential opportunities within the residential targeted area;

B. Stimulate new construction or rehabilitation or conversion of existing vacant, underutilized, or substandard buildings to multifamily housing for revitalization of the designated targeted areas;

C. Assist in directing future population growth to the residential targeted area, thereby reducing development pressure on single-family residential neighborhoods; and

D. Achieve development densities that stimulate a healthy economic base and are more conducive to transit use in the designated residential targeted area. [Ord. 944 § 1 (Exh. A), 2021; Ord. 694 § 5 (Exh. A), 2015]

3.27.020 Definitions.

A. “Affordable housing” means residential housing that is rented or sold to a person or household whose annual household income does not exceed 70 percent of the median household income adjusted for family size for King County, determined annually by the U.S. Department of Housing and Urban Development, for studio and one-bedroom units and not exceeding 80 percent of the area median household income adjusted for family size for two-bedroom or larger units.

B. “Department” means the city of Shoreline department of community and economic development.

C. “High-capacity transit” means public transit providing a substantially higher level of passenger capacity and operates with at least 15-minute scheduled frequency during the hours of 6:00 a.m. to 8:00 p.m. each weekday.

D. “Household annual income” means the aggregate annual income of all persons over 18 years of age residing in the same household.

E. “Multifamily housing” means a building or a group of buildings having four or more dwelling units designed for permanent residential occupancy.

F. “Owner” or “property owner” means the property owner of record.

G. “Permanent residential occupancy” means multifamily housing that provides either rental or owner-occupancy for a period of at least one month, excluding hotels, motels, or other types of temporary housing that predominately offer rental accommodation on a daily or weekly basis. [Ord. 944 § 1 (Exh. A), 2021; Ord. 694 § 5 (Exh. A), 2015]

3.27.030 Designation of residential targeted areas.

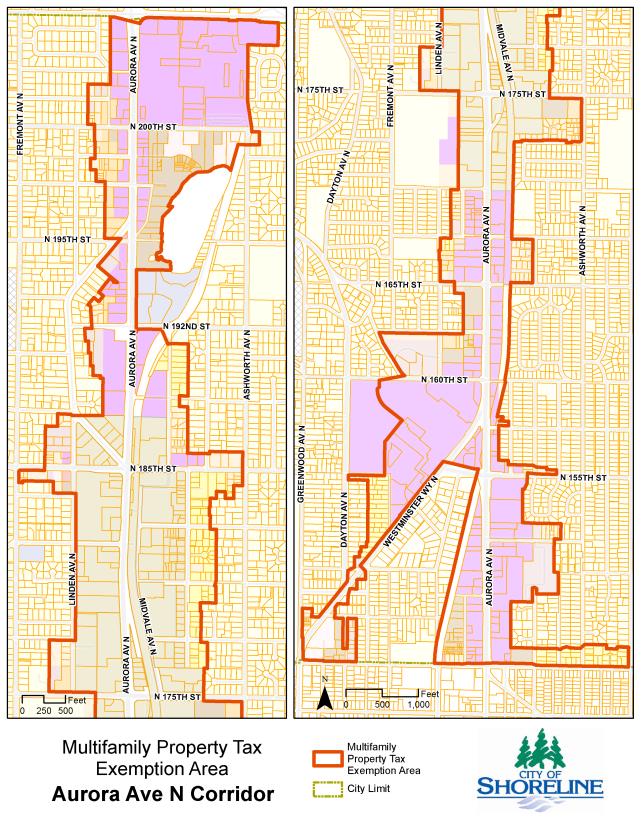

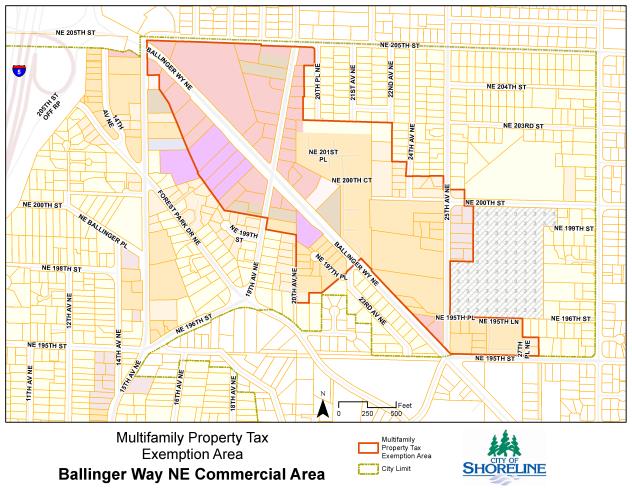

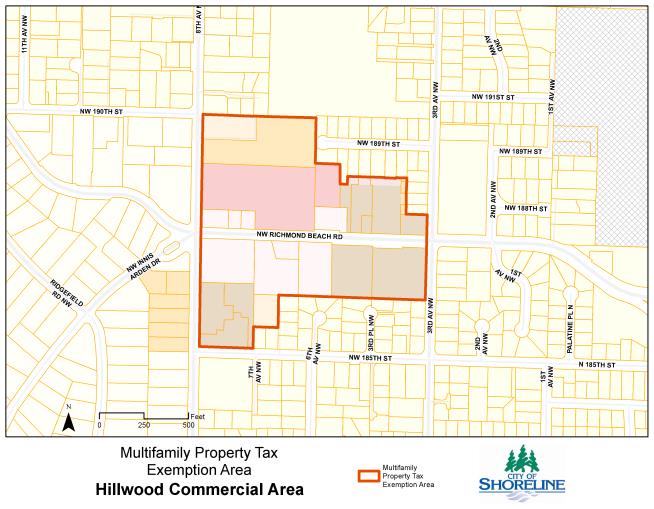

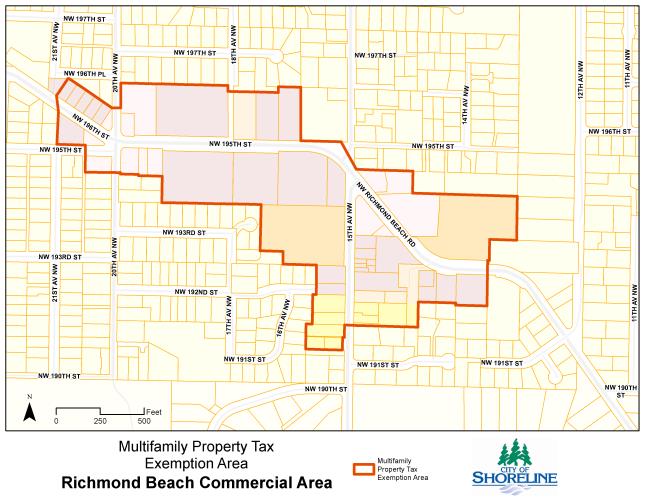

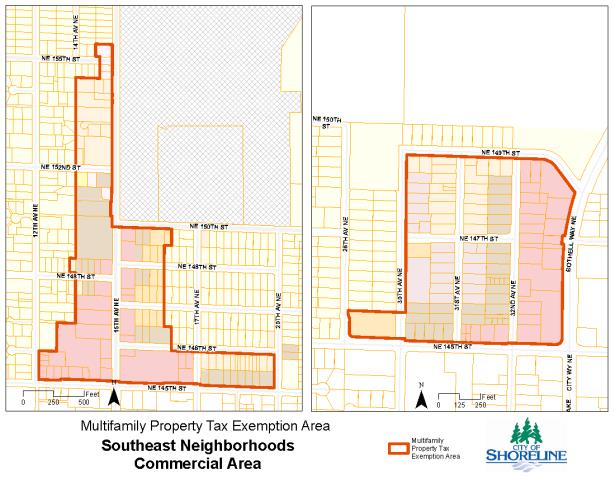

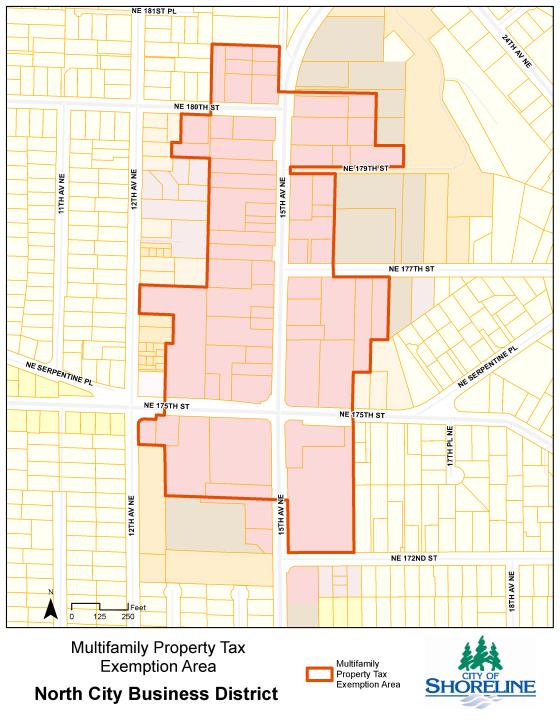

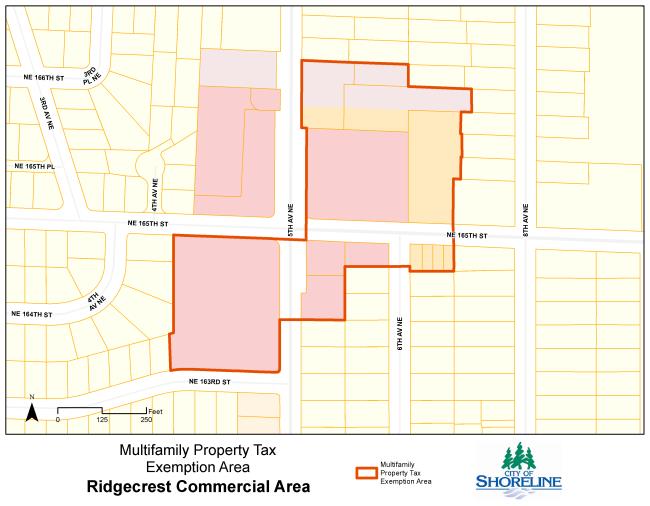

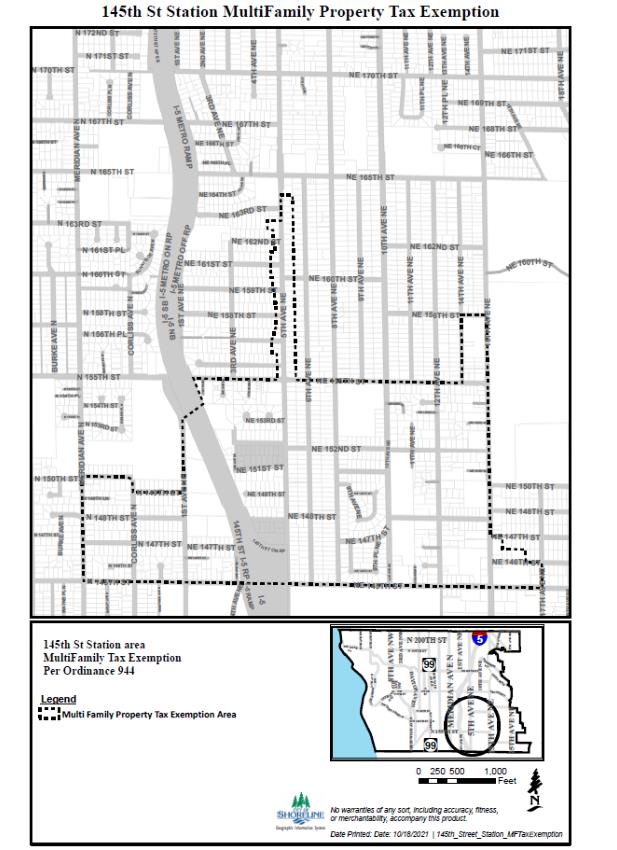

A. The following areas, as shown in Attachments A through I, are designated as residential targeted areas:

Attachment A: Aurora Avenue North Corridor, including a portion of Westminster Way N:

Attachment B: Ballinger Way NE commercial area:

Attachment C: Hillwood commercial area:

Attachment D: Richmond Beach commercial area:

Attachment E: Southeast Neighborhood commercial area:

Attachment F: North City Business District:

Attachment G: Ridgecrest commercial area:

Attachment H: 145th Street Station Subarea:

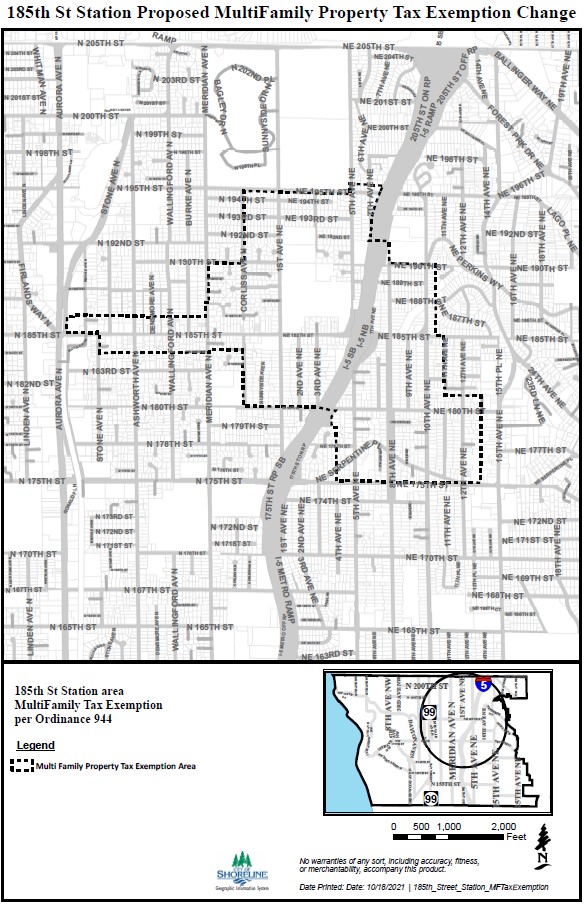

Attachment I: 185th Street Station Subarea:

B. If a part of any legal lot is within a residential targeted area, then the entire lot shall be deemed to lie within such residential targeted area.

C. Additional residential targeted areas may be designated if the city council determines that an area meets the criteria set forth in RCW 84.14.040(1), as amended. [Ord. 944 § 1 (Exh. A), 2021; Ord. 776 § 1 (Exhs. A, B), 2017; Ord. 694 § 5 (Exh. A), 2015]

3.27.040 Eligibility standards and guidelines.

A. Eligibility Requirements. To be eligible for exemption from property tax under this chapter, the property must satisfy all of the following requirements:

1. The project must be located within one of the residential targeted areas designated in SMC 3.27.030;

2. The project must be multifamily housing consisting of at least four dwelling units within a residential structure or as part of a mixed used development, in which at least 50 percent of the space must provide for permanent residential occupancy;

3. The project must be designed to comply with the city’s comprehensive plan, applicable development regulations, and applicable building and housing code requirements;

4. At least 20 percent of the housing units must be affordable housing as defined in SMC 3.27.020, except for housing units within the 145th Street Station subarea and the 185th Street Station subarea which must meet the median income requirements of the 20 percent affordability option as set forth in SMC 20.40.235;

5. For the rehabilitation of existing occupied multifamily projects, at least four additional residential units must be added except when the project has been vacant for 12 consecutive months or more;

6. The project must be scheduled for completion within three years from the date of issuance of the conditional certificate;

7. Property proposed to be rehabilitated must fail to comply with one or more standards of the applicable state or local building or housing codes. If the property proposed to be rehabilitated is not vacant, an applicant must provide each existing tenant housing of comparable size, quality, and price and a reasonable opportunity to relocate;

8. The mix and configuration of housing units used to meet the requirement for affordable units under this chapter shall be substantially proportional to the mix and configuration of the total housing units in the project; and

9. The applicant must enter into a contract with the city, approved by the city council, under which the applicant has agreed to the implementation of the project on terms and conditions satisfactory to the city.

B. Duration of Tax Exemption. The following property tax exemptions are available for qualified properties in designated residential targeted areas:

1. Twelve-year tax exemption: If the property otherwise qualifies for the exemption under this chapter and meets the conditions in subsection A of this section, an exemption for 12 successive years beginning January 1st of the year immediately following the calendar year of issuance of the final certificate of tax exemption; or

2. Twenty-year tax exemption: If the property otherwise qualifies for the exemption under this chapter, meets the conditions in subsection A of this section, and the conditions set forth below, an exemption for 20 successive years beginning January 1st of the year immediately following the calendar year of issuance of the final certificate of tax exemption:

a. The property is located within one mile of high-capacity transit of at least 15-minute scheduled frequency measured in a straight line from the property line at which access from the property to a public street is provided to the nearest existing or planned high-capacity transit stop or station; and

b. The owner must record a covenant or deed restriction acceptable to the city ensuring continued rental of units for at least 99 years and sets forth criteria to maintain public benefit if the property is converted to a use other than permanent affordable low-income housing.

C. Extension of Tax Exemption. The owner of property that received a tax exemption pursuant to subsection (B)(1) of this section, may apply for an extension for an additional 12 successive years. No extension will be granted for property that received a 20-year tax exemption pursuant to subsection (B)(2) of this section.

1. Only one extension may be granted.

2. Failure to timely apply for an extension shall be deemed a waiver of the extension.

3. For the property to qualify for an extension:

a. The property must have qualified for, satisfied the conditions of, and utilized the 12-year exemption sought to be extended;

b. The owner must timely apply for the extension on forms provided by the city within 18 months of expiration of the original exemption;

c. The property must meet the requirements of this chapter for the property to qualify for an exemption under subsection A of this section as applicable at the time of the extension application; and

d. The property must continue to rent or sell at least 20 percent of the multifamily housing units as affordable housing units for low-income households for the extension period.

4. If an extension is granted by the city, at the end of both the tenth and eleventh years of a 12-year extension, the applicant or the property owner at that time, must provide tenants of affordable units with notification of the applicant’s or property owner’s intent to provide the tenant with relocation assistance in an amount equal to one month as provided in RCW 84.14.020, as amended.

D. Limitation on Tax Exemption Value.

1. The exemption provided for in this chapter does not include the value of land or nonhousing-related improvements not qualifying under this chapter.

2. In the case of rehabilitation of existing buildings, the exemption does not include the value of improvements constructed prior to the submission of the application for conditional certificate required by this chapter.

3. The exemption does not apply to increases in the assessed value made by the county assessor on nonqualifying portions of the building and value of land.

E. Residential Targeted Areas – Specific Requirements.

1. Units within the 145th and 185th Street Station subareas must meet the median income requirements of the 20 percent affordability option as set forth in SMC 20.40.235. [Ord. 944 § 1 (Exh. A), 2021; Ord. 879 § 1, 2020; Ord. 776 § 1, 2017; Ord. 694 § 5 (Exh. A), 2015]

3.27.050 Application procedures for conditional certificate.

A. A property owner who wishes to propose a project for a tax exemption shall file an application with the department of planning and community development upon a form provided by that department.

B. The application for exemption must be filed prior to issuance of the project’s first certificate of occupancy, temporary or final.

C. The application shall include:

1. Information setting forth the grounds for the exemption;

2. A description of the project and a site plan, including the floor plan of units;

3. A statement that the applicant is aware of the potential tax liability when the project ceases to be eligible under this chapter;

4. Information describing how the applicant shall comply with the affordability requirements of this chapter;

5. In the case of rehabilitation or where demolition or new construction is required, verification from the department of the property’s noncompliance with applicable building and housing codes; and

6. Verification by oath or affirmation of the information submitted by the applicant.

D. Fees. At the time of application under this section, the applicant shall pay a minimum fee deposit of three times the current hourly rate for processing land use permits as provided in Chapter 3.01 SMC, Fee Schedules. Total city fees will be calculated using the adopted hourly rates for land use permits in effect during processing of the tax exemption and any excess will be refunded to the applicant upon approval or denial of the application. [Ord. 771 § 1, 2017; Ord. 694 § 5 (Exh. A), 2015]

3.27.060 Application review and issuance of conditional certificate.

A. Conditional Certificate.

1. The city manager may approve or deny an application for tax exemption.

2. The city manager may only approve the application if the requirements of RCW 84.14.060 and this chapter have been met.

3. A decision to approve or deny certification of an application shall be made within 90 days of receipt of a complete application for tax exemption.

a. If approved, the applicant must enter into a contract with the city setting forth the terms and conditions of the project and eligibility for exemption under this chapter.

b. This contract is subject to approval by the city council.

c. The applicant shall record, at the applicant’s expense, the contract with the county assessor within 10 days of contract execution and provide the city with the recording number.

4. Once the city council has approved the contract and it is fully executed and recorded, the city manager will issue the property owner a conditional certificate of acceptance of tax exemption.

a. The certificate must contain a statement by the city manager that the property has complied with the required findings indicated in RCW 84.14.060.

b. The conditional certificate expires three years from the date of issuance unless an extension is granted as provided for in this section.

5. If denied, the city manager must state in writing the reasons for denial and send notice to the applicant at the applicant’s last known address within 10 days of the denial by U.S. mail, return receipt requested.

6. The applicant may appeal the denial to the city council within 30 days of the date of issuance of the denial by filing an appeal statement with the city clerk and paying any applicable fee. The appeal before the city council will be based upon the record made before the city manager with the burden of proof on the applicant to show there was no substantial evidence to support the city manager’s decision. The city council’s decision on appeal shall be final.

B. Extension of Conditional Certificate. The conditional certificate may be extended by the city manager for a period not to exceed 24 consecutive months. The applicant must submit a written request stating the grounds for the extension, accompanied by a nonrefundable processing fee equal to two times the current hourly rate for processing land use permits as provided in Chapter 3.01 SMC, Fee Schedules. An extension may be granted if the city manager determines that:

1. The anticipated failure to complete construction or rehabilitation within the required time period is due to circumstances beyond the control of the applicant;

2. The applicant has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

3. All conditions of the original contract between the applicant and the city will be satisfied upon completion of the project.

The applicant may appeal a denial of the extension to the city council within 30 days of the issuance date of the denial by filing an appeal statement with the city clerk and paying any applicable fee. The city council’s decision on appeal shall be final. [Ord. 694 § 5 (Exh. A), 2015]

3.27.070 Application procedures for final certificate.

A. Application. Upon completion of the improvements provided in the contract between the applicant and the city, the applicant may request a final certificate of tax exemption. The applicant must file with the city manager such information as the city manager may deem necessary or useful to evaluate eligibility for the final certificate and shall include:

1. A statement of expenditures made with respect to each multifamily housing unit and the total expenditures made with respect to the entire property;

2. A description of the completed work and a statement that the improvements qualify for the exemption;

3. A statement that the work was completed within the required three-year period or any authorized extension; and

4. A statement that the project meets affordable housing requirements of this chapter.

B. Fees. At the time of application under this section, the applicant must submit a check made payable to the county assessor in an amount equal to the assessor’s fee for administering the tax exemption program in effect at the time of final application. [Ord. 694 § 5 (Exh. A), 2015]

3.27.080 Application review and issuance of final certificate.

A. Within 30 days of receipt of all materials required for an application for final certificate, the city manager shall determine whether a final certificate should be issued. The city manager’s determination shall be based on whether the improvements and the affordability of units satisfy the requirements of this chapter, the requirements and findings of RCW 84.14.060, and are consistent with the approved contract.

B. Approval. If the city manager determines that the project qualifies for the exemption, the city manager shall issue to the property owner a final certificate of tax exemption and file the final certificate with the county assessor within 10 days of the expiration of the 30-day period provided in this section.

C. Denial. The city manager shall notify the applicant in writing within 10 days of the expiration of the 30-day period provided in this section that the final certificate will not be issued if it is determined that:

1. The improvements were not completed within three years of issuance of the conditional certificate, or any authorized extension of the time limit;

2. The improvements were not completed in accordance with the contract between the applicant and the city;

3. The owner’s property is otherwise not qualified under this chapter;

4. If applicable, the affordable housing requirements of this chapter have not been met; or

5. The owner and the city manager cannot come to an agreement on the allocation of the value of improvements allocated to the exempt portion of the rehabilitation improvements, new construction and multi-use new construction.

D. Appeal. The applicant may appeal the denial to the city council within 30 days of the date of issuance of the denial by filing an appeal statement with the city clerk and paying any applicable fee. The appeal before the city council will be based upon the record made before the city manager with the burden of proof on the applicant to show there was no substantial evidence to support the city manager’s decision. The city council’s decision on appeal shall be final. [Ord. 694 § 5 (Exh. A), 2015]

3.27.090 Annual compliance review.

A. Annual Report – Property Owner. Thirty days after the anniversary of the date of the final certificate of tax exemption and each year for the tax exemption period, the property owner shall file an annual report with the city manager indicating the following:

1. A statement of occupancy and vacancy of the rehabilitated or newly constructed property during the 12 months ending with the anniversary date;

2. A certification by the owner that the property has not changed use and, if applicable, that the property has been in compliance with affordable housing requirements for the property, since the date of the final certificate approved by the city;

3. A description of any subsequent changes or improvements constructed after issuance of the final certificate of tax exemption.

B. Additional Reporting Requirement – Property Owner. By December 15th of each year, beginning with the first year in which the final certificate of tax exemption is issued and each year thereafter for the tax exemption period, the property owner shall provide city staff with a written report that contains information sufficient to complete the city’s report to the Department of Commerce described in subsection D of this section.

C. Audits. City staff may conduct audits or on-site verification of any statements of information provided by the property owner. Failure to submit the annual report and/or the additional written report may result in cancellation of the tax exemption.

D. Annual Report – City. By December 31st of each year, the city shall file a report to the Department of Commerce which must include the following:

1. The number of tax exemption certificates granted;

2. The total number and type of units produced or to be produced;

3. The number and type of units produced or to be produced meeting affordable housing requirements;

4. The actual development cost of each unit produced, specifically:

a. Development cost average per unit including all costs;

b. Development cost average per unit, excluding land and parking;

c. Development cost average per structured parking stall;

d. Land cost;

e. Other costs;

f. Net rentable square footage;

g. Gross square footage, including common spaces, surface parking and garage;

5. The total monthly rent or total sale amount of each unit produced;

6. The income of each renter household at the time of initial occupancy and the income of each initial purchaser of owner-occupied units at the time of purchase for each of the units receiving a tax exemption and a summary of these figures for the city; and

7. The value of the tax exemption for each project receiving a tax exemption and the total value of tax exemptions granted. [Ord. 694 § 5 (Exh. A), 2015]

3.27.100 Cancellation of tax exemption.

A. Cancellation – Upon City Determination.

1. If at any time during the exemption period, the city manager determines the property owner has not complied with or the project no longer complies with the terms and requirements of this chapter or the contract required by SMC 3.27.040(A)(9), or for any reason no longer qualifies for the tax exemption, the tax exemption shall be canceled and additional taxes, interest and penalties may be imposed pursuant to RCW 84.14.110, as amended.

2. Cancellation may occur in conjunction with the annual review or at any other time when noncompliance has been determined.

3. Upon a determination that a tax exemption is to be cancelled for a reason stated in this section, the city manager shall notify in writing the property owner as shown by the tax rolls by U.S. mail, return receipt requested, of the determination to cancel exemption.

4. If the cancellation determination has not been appealed as provided in this section, the city manager shall send written notification to the county tax assessor of the cancellation within 30 days so that additional taxes, interest, and penalties may be imposed pursuant to RCW 84.14.110.

B. Cancellation – Conversion of Use by Property Owner.

1. If the property owner intends to convert the multifamily housing to another use or to discontinue compliance with the affordable housing requirements described in this chapter, the owner must notify, in writing, the city manager and the county assessor within 60 days of the change in use or intended discontinuance. Upon such change in use or intended discontinuance, the tax exemption shall be cancelled and additional taxes, interest, and penalties imposed pursuant to RCW 84.14.110.

C. Appeal.

1. The property owner may appeal the cancellation determination to the city council by filing an appeal with the city clerk within 30 days of the issuance date of the notice of cancellation and paying any applicable fee.

2. The appeal must specify the factual and legal basis on which the cancellation determination is alleged to be erroneous.

3. At the hearing, all affected parties must be heard and all competent evidence received.

4. The city council must affirm, modify, or repeal the cancellation determination based on the evidence presented. If the city council affirms the cancellation determination, the city manager shall send written notification to the county tax assessor of the cancellation within 30 days of the city council’s decision so that additional taxes, interest, and penalties may be imposed pursuant to RCW 84.14.110.

5. An aggrieved party may appeal the city council’s decision to the superior court under RCW 34.05.510 through 34.05.598. [Ord. 776* § 1, 2017; Ord. 694 § 5 (Exh. A), 2015]

*Code reviser’s note: Pursuant to Section 4 of Ord. 776, the ordinance shall automatically expire and be of no further effect at 11:59 p.m. December 31, 2021, unless otherwise extended by the city council.