Chapter 3.38

MULTIFAMILY HOUSING PROPERTY TAX EXEMPTION

Sections:

3.38.040 Director’s authority.

3.38.050 Residential targeted areas – Criteria – Designation – Rescission.

3.38.070 Application requirements, procedure, and fee.

3.38.080 Application review – Issuance of conditional certificate – Denial – Appeal.

3.38.090 Amendment of MFTE contract.

3.38.100 Extension of conditional certificate.

3.38.110 Final certificate – Application – Issuance – Denial and appeal.

3.38.120 Annual certification.

3.38.130 Cancellation of exemption.

3.38.140 Appeals to Hearings Examiner.

3.38.010 Purpose.

A. The purposes of this chapter are:

1. To increase the supply of multifamily housing opportunities within the City’s core;

2. To promote community development and affordable housing in the City’s core, within residential targeted areas;

3. To encourage additional housing in certain areas that will support investment in public transit projects;

4. To improve the overall vitality of the City’s core; and

5. To accomplish the planning goals required under the Growth Management Act, Chapter 36.70A RCW, as implemented by the City’s comprehensive plan.

B. Any one or a combination of these purposes may be furthered by the designation of a residential targeted area under this chapter. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.020 Authority.

A. Purpose. This chapter is adopted under the authority of Chapter 84.14 RCW, which provides for special valuations for eligible improvements associated with multifamily housing in designated residential targeted areas to improve residential opportunities, including affordable housing. Specifically, Chapter 84.14 RCW authorizes jurisdictions to waive property tax associated with eligible multifamily residential development for a period of eight years, or up to 12 years for certain affordable housing developments. The City of Ferndale has adopted an eight-year waiver period and does not require an affordable housing component as a prerequisite for eligibility.

The purpose of this section is to define the responsibilities, rules, procedures, and requirements for the interpretation of this chapter. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.030 Definitions.

The following definitions are specific to this chapter and shall have the following meanings:

“Assessor” means the Whatcom County Assessor.

“Director” means the director of the City’s Community Development Department, or his or her authorized designee.

“MFTE” means multifamily housing property tax exemption.

“MFTE contract” means the agreement between the property owner and the City regarding the terms and conditions of the project and eligibility for exemption under this chapter.

“Multifamily housing” means a structure per FMC 18.08.575, Dwelling, multifamily, designed for permanent residential occupancy resulting from new construction and having no less than four residential units. Townhouse developments with a minimum of four units may be considered multifamily housing within the context of this chapter.

“Owner” means the property owner of record.

“Permanent residential occupancy” means multifamily housing that provides occupancy for a period of at least one month, and excludes transient lodging.

“Project” means the multifamily housing or portion of the multifamily housing that is to receive the tax exemption.

“Residential targeted area” means an area within an urban center as defined by Chapter 84.14 RCW that the City has so designated by the City Council pursuant to this chapter. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.040 Director’s authority.

A. General Authority. The Community Development Director is charged with the administration and enforcement of the provisions of this chapter in the manner described by FMC 18.12.020. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.050 Residential targeted areas – Criteria – Designation – Rescission.

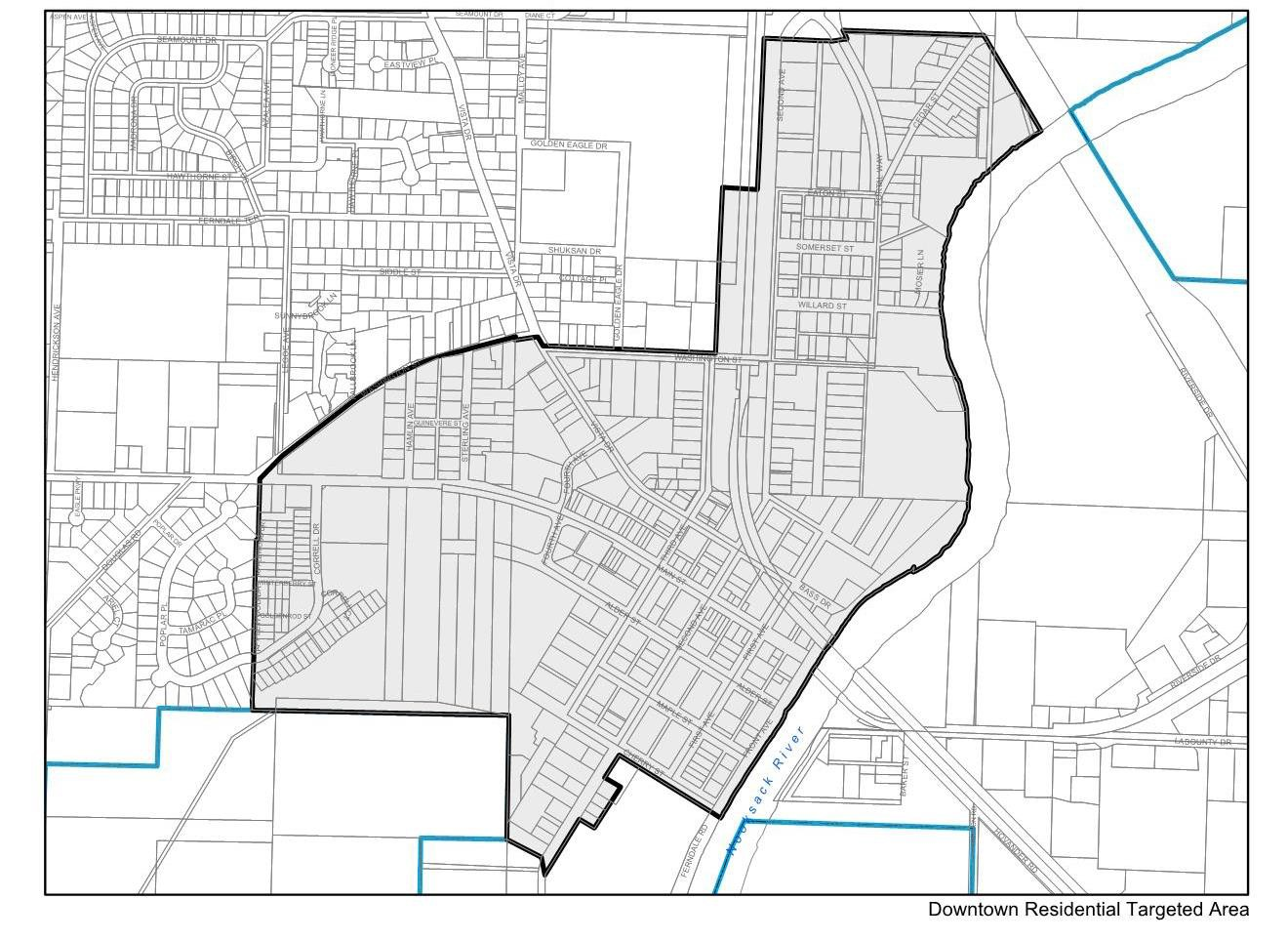

A. The following area, as shown in Map 1 of this section, meets the criteria of this chapter and RCW 84.14.040 for residential targeted areas, and is designated as such:

1. Downtown.

Map 1: Downtown

B. If a part of any legal lot is within a residential targeted area as shown on Map 1 in this section, then the entire lot shall be deemed to lie within such residential targeted area.

C. In addition to the residential targeted areas described in subsection (A) of this section, the City Council may designate additional areas as per RCW 84.14.040 (now or as hereafter amended).

D. In designating a residential targeted area, the City Council may also consider other factors, including:

1. Whether additional housing in the residential targeted area will attract and maintain an increase in the number of permanent residents;

2. Whether providing additional housing opportunities for low and moderate income households would meet the needs of individuals likely to live in the area if affordable residences were available;

3. Whether an increased permanent residential population in the residential targeted area will help to achieve the planning goals mandated by the Growth Management Act under Chapter 36.70A RCW, as implemented through the City’s Comprehensive Plan; or

4. Whether encouraging additional housing in the residential targeted area supports plans for significant public investment in public transit, infrastructure, recreation, schools, or a better jobs and housing balance.

E. The City Council may, by ordinance, in its sole discretion, amend or rescind the designation of a residential targeted area pursuant to the same procedural requirements as set forth in this chapter for the original designation. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.060 Project eligibility.

A. To be eligible for exemption from property taxation under this chapter, the property shall satisfy all of the following requirements:

1. The property must be located in a residential targeted area.

2. The project must be construction of new multifamily housing within a residential structure or as part of a mixed use development, in which at least 50 percent of the space within such residential structure or mixed use development is intended for permanent residential occupancy.

3. Within the City Center and Urban Residential Zones, a minimum of 15 residential units per gross acre shall be achieved.

4. Within the Residential Multifamily and Residential Office Zones, a minimum density of 10 units per gross acre shall be achieved.

5. The project shall comply with all applicable provisions of the Ferndale Municipal Code.

6. Construction of new multifamily housing must be completed within three years from the date of approval of the application, as described in FMC 3.38.080, or within an extension authorized under this chapter.

7. No new applications may be accepted for inclusion into this program after December 31, 2031. (Ord. 2187 § 1 (Exh. 1), 2021; Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.070 Application requirements, procedure, and fee.

A. Application Procedure. The owner of property applying for exemption under this chapter shall submit an application to the Director, on a form established by the Director, and consistent with RCW 84.14.050. The owner shall verify the application by oath or affirmation.

B. Application Requirements. The application shall contain such information as the Director may deem necessary or useful, and shall include but not be limited to:

1. A brief written description of the project, including phasing if applicable, and preliminary schematic site and floor plans of the multifamily units and the structure(s) in which they are proposed to be located;

2. A statement from the owner acknowledging the potential tax liability when the property ceases to be eligible for exemption under this chapter; and

3. Information attesting to the eligibility requirements of RCW 84.14.030 and this chapter.

C. Fee. At the time of application under this section, the owner shall pay to the City an initial application fee as established by the Unified Fee Schedule.

D. Deadline. The deadline for application generally shall be any time before the date the first building permit is issued for the multifamily housing structure. The Director may determine if a project’s circumstances warrant allowing flexibility in the timing of application submittal. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.080 Application review – Issuance of conditional certificate – Denial – Appeal.

A. The Director shall approve an application for tax exemption if the Director determines the project meets the eligibility requirements in FMC 3.38.060. If the application fails to meet the requirements of FMC 3.38.060 the Director must deny the application. If the application is approved, the owner shall enter into a MFTE contract with the City regarding the terms and conditions of the project and eligibility for exemption under this chapter. The Director’s approval or denial shall take place within 90 days of the Director’s receipt of the completed application, and shall include written findings. Following execution of the MFTE contract by the owner and the City, the Director shall issue a conditional certificate of acceptance of tax exemption. The conditional certificate shall expire three years from the date of approval unless an extension is granted as provided in this chapter.

1. The Director’s written findings justifying approval or denial shall include, but may not be limited to:

a. A determination that the application meets the application requirements of this chapter; and

b. A determination that the proposed development is within a residential targeted area, and meets the minimum development threshold of the MFTE program; and

c. A determination that the applicant has provided sufficient information for the Director to have a reasonable expectation that the proposed development will be completed within the timeframes provided by the chapter.

B. If the application is denied, the Director shall state in writing the reasons for the denial and send notice of denial to the owner’s last known address within 10 calendar days of the denial.

C. An owner may appeal the Director’s denial in accordance with the provisions of FMC 14.11.070. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.090 Amendment of MFTE contract.

A. An owner may seek amendment(s) to the MFTE contract between the owner and the City by submitting a request in writing to the Director at any time prior to receiving the final certificate of tax exemption (“final certificate”).

B. The Director shall have authority to approve amendments to the MFTE contract between the owner and the City that are reasonably within the scope and intent of the MFTE contract.

C. Any owner seeking amendments to the approved MFTE contract shall pay to the City an amendment application fee as established by the Unified Fee Schedule.

D. The date for expiration of the conditional certificate shall not be extended by contract amendment unless all the conditions for extension set forth in FMC 3.38.100 are met. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.100 Extension of conditional certificate.

A. The Director may extend the conditional certificate for a period not to exceed 24 consecutive months. The owner shall submit a written request stating the grounds for the extension together with a fee as established by the Director. The Director may grant an extension if the Director determines that:

1. The anticipated failure to complete construction within the required time period is due to circumstances beyond the control of the owner;

2. The owner has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

3. All the conditions of the original MFTE contract between the owner and the City will be satisfied upon completion of the project. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.110 Final certificate – Application – Issuance – Denial and appeal.

A. Upon completion of construction as provided in the MFTE contract between the owner and the City, and upon issuance of a certificate of occupancy, the owner may request a final certificate of tax exemption. The owner shall file with the Director such information as the Director may deem necessary or useful to evaluate eligibility for the final certificate, and:

1. A description of the completed work and a statement of qualification for the exemption;

2. A statement that the work was completed within the required three-year period or any approved extension; and

3. A statement of the amount of rehabilitation and construction expenditures made with respect to each housing unit and the composite expenditures made in the rehabilitation or construction of the entire property.

B. Within 30 days of receipt of all materials required for a final certificate, the Director shall determine whether the completed work is consistent with the application and MFTE contract and is qualified for limited exemption under RCW 84.14.060, and which specific improvements completed meet the requirements of this chapter and the required findings of RCW 84.14.060, now or hereafter amended.

C. If the Director determines that the project has been completed in accordance with the MFTE contract between the City and owner, and with subsection (A) of this section, the City shall file a final certificate of tax exemption with the Assessor within 10 days of the expiration of the 30-day period provided under subsection (B) of this section.

D. The Director is authorized to cause to be recorded, or to require the owner to record, in the real property records of the Whatcom County Auditor, the contract with the City required under subsection (A) of this section, and such other document(s) as will identify such terms and conditions of eligibility for exemption under this chapter as the Director deems appropriate for recording, including requirements under this chapter relating to affordability of units.

E. The Director shall notify the owner in writing that the City will not file a final certificate if the Director determines that the project was not completed within the required three-year period or any approved extension or was not completed in accordance with subsection (B) of this section; or if the Director determines that the owner’s property is not otherwise qualified under this chapter; or if the owner and the Director cannot agree on the allocation of the value of the improvements allocated to the exempt portion of new construction and multiuse new construction.

F. Within 30 days of the date of notice of denial of final certificate, the owner may file a notice of appeal with the Director along with the appeal fee, pursuant to FMC 14.11.070. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.120 Annual certification.

A. A property that receives a tax exemption under this chapter shall continue to comply with the contract and the requirements of this chapter in order to retain its property tax exemption.

B. Within 30 days after the first anniversary of the date the City filed the final certificate of tax exemption and each year for the tax exemption period, the property owner shall file a certification with the Director, verified upon oath or affirmation, which shall contain such information as the Director may deem necessary or useful, and shall include the following information:

1. A statement of occupancy and vacancy of the multifamily units during the previous year;

2. A certification that the property has not changed use since the date of filing of the final certificate of tax exemption, and continues to be in compliance with the MFTE contract with the City and the requirements of this chapter;

3. A description of any improvements or changes to the property made after the filing of the final certificate or last declaration, as applicable;

4. The value of the tax exemption for the project; and

5. Any additional information requested by the City in regard to the units receiving a tax exemption (pursuant to meeting any reporting requirements under Chapter 84.14 RCW). (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.130 Cancellation of exemption.

A. The Director may cancel the tax exemption if the property owner breaches any term of the MFTE contract or any part of this chapter. Reasons for cancellation include but are not limited to the following:

1. Failure to file the annual certification or filing a defective certification.

2. Violation of any applicable zoning requirements, land use regulations, or building and housing code requirements contained in FMC Titles 15 and 18. Timely and cooperative resolution of the violation(s) may serve as a mitigating factor in the Director’s decision of whether to cancel the exemption.

3. Conversion of the multifamily housing to another use. The owner shall notify the Director and the County Assessor within no less than 60 days of the intended change in use. Upon such change in use, the tax exemption shall be canceled pursuant to this section.

B. Upon cancellation of the exemption for any reason, the property owner shall be immediately liable for all taxes, interest and penalties pursuant to law. Upon determining that a tax exemption shall be canceled, the Director shall notify the property owner by certified mail, return receipt requested. Pursuant to FMC 14.11.070, the property owner may appeal the determination by filing a notice of appeal with the Director along with the appeal fee established by the Unified Fee Schedule within 30 days of the date of notice of cancellation, specifying the factual and legal basis for the appeal in writing. The appeal shall be heard by the Hearings Examiner pursuant to FMC 3.38.140.

C. Failure to submit the annual declaration may result in cancellation of the tax exemption pursuant to this section. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.140 Appeals to Hearings Examiner.

Any appeals of decisions made pursuant to this chapter shall follow the appeal process described by FMC 14.11.070. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.150 Annual reporting.

A. If the City issues tax exemption certificates pursuant to this chapter, the Director shall submit the report required by RCW 84.14.100 to the Department of Commerce by December 31st of each year.

B. Annually, beginning in 2020, the Director or designee shall review the program established by this chapter and provide a report to the City Council describing development activity, types and numbers of units produced and their locations, rent (if applicable), and other appropriate factors. These reports may include recommendations on whether any residential targeted areas should be added or removed and shall provide feedback from owners who have MFTE contracts with the City. The annual report shall be submitted to the City Council no later than March 30th of each year the program is in effect, starting in 2020; each report shall include information for the previous year. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.160 Conflicts.

If a conflict exists between the provisions of this chapter or between this chapter and the laws, regulations, codes or rules promulgated by other authority having jurisdiction within the City, the requirement that best advances the purposes set forth in FMC 3.38.010 shall be applied, except when constrained by federal or state law, or where specifically provided otherwise in this chapter. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)

3.38.170 Severability.

The provisions of this chapter are severable. If any provision of this chapter or its application to any person or circumstance is held invalid, the remainder of this chapter and its application are not affected and will remain in full force and effect. (Ord. 2103 § 1 (Exh. 1), 2019; Ord. 2064 § 2 (Exh. 1), 2018)